Answered step by step

Verified Expert Solution

Question

1 Approved Answer

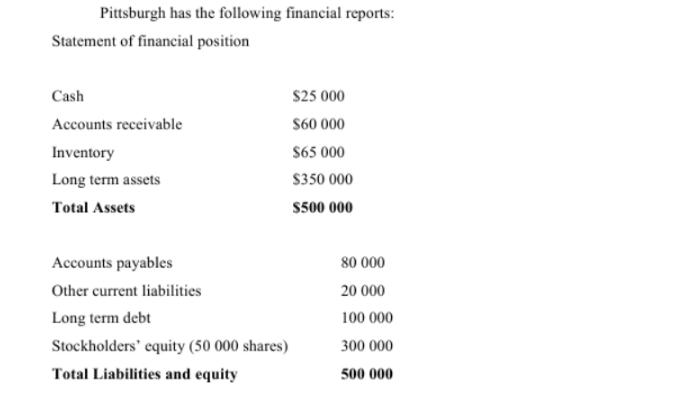

Pittsburgh has the following financial reports: Statement of financial position Cash Accounts receivable Inventory Long term assets Total Assets Accounts payables Other current liabilities

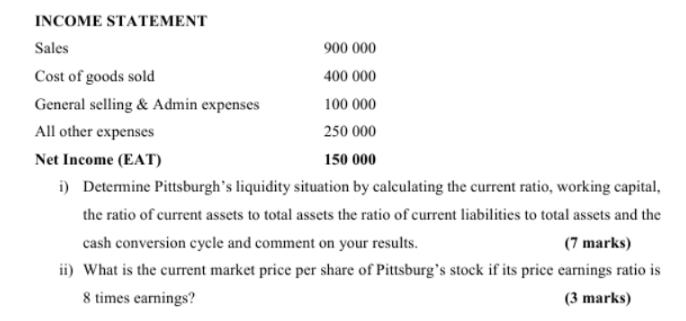

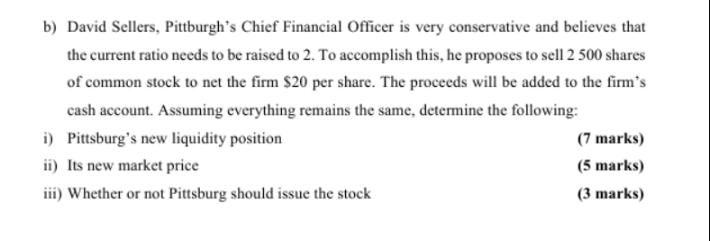

Pittsburgh has the following financial reports: Statement of financial position Cash Accounts receivable Inventory Long term assets Total Assets Accounts payables Other current liabilities Long term debt Stockholders' equity (50 000 shares) Total Liabilities and equity $25 000 $60 000 $65 000 $350 000 $500 000 80 000 20 000 100 000 300 000 500 000 INCOME STATEMENT Sales Cost of goods sold General selling & Admin expenses 900 000 400 000 100 000 250 000 150 000 i) Determine Pittsburgh's liquidity situation by calculating the current ratio, working capital, the ratio of current assets to total assets the ratio of current liabilities to total assets and the cash conversion cycle and comment on your results. (7 marks) ii) What is the current market price per share of Pittsburg's stock if its price earnings ratio is 8 times earnings? (3 marks) All other expenses Net Income (EAT) b) David Sellers, Pittburgh's Chief Financial Officer is very conservative and believes that the current ratio needs to be raised to 2. To accomplish this, he proposes to sell 2 500 shares of common stock to net the firm $20 per share. The proceeds will be added to the firm's cash account. Assuming everything remains the same, determine the following: i) Pittsburg's new liquidity position ii) Its new market price iii) Whether or not Pittsburg should issue the stock (7 marks) (5 marks) (3 marks)

Step by Step Solution

★★★★★

3.40 Rating (163 Votes )

There are 3 Steps involved in it

Step: 1

To solve the given problem lets calculate the required financial ratios and values step by step i Liquidity Situation a Current Ratio Current Ratio Cu...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started