Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pixma Limited began operations in January 2 0 1 9 with R 9 0 0 0 0 0 obtained from selling 4 5 0 0

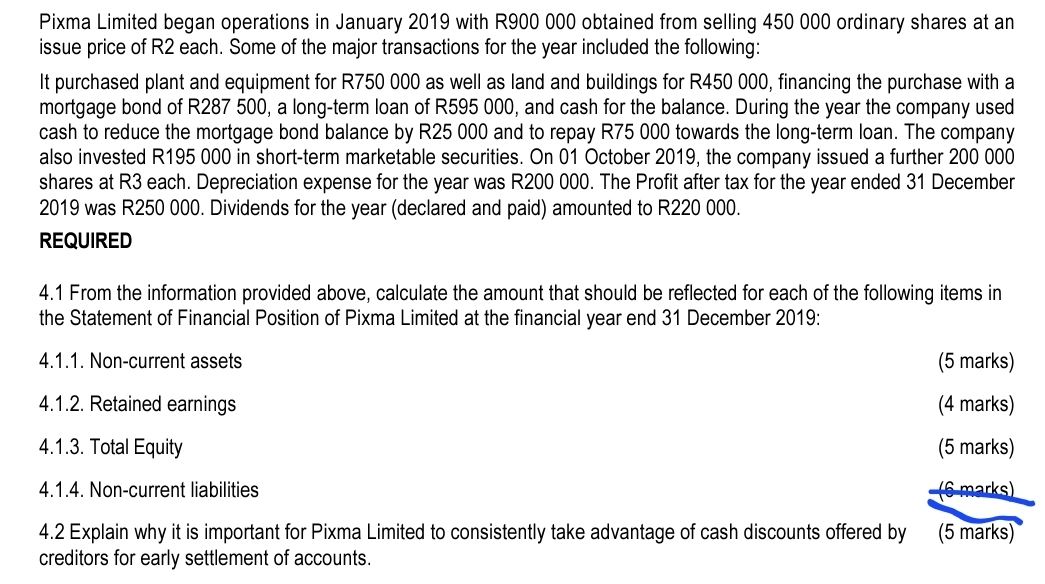

Pixma Limited began operations in January with R obtained from selling ordinary shares at an issue price of each. Some of the major transactions for the year included the following:

It purchased plant and equipment for R as well as land and buildings for financing the purchase with a mortgage bond of R a longterm loan of R and cash for the balance. During the year the company used cash to reduce the mortgage bond balance by R and to repay R towards the longterm loan. The company also invested R in shortterm marketable securities On October the company issued a further shares at R each. Depreciation expense for the year was R The Profit after tax for the year ended December was R Dividends for the year declared and paid amounted to R

REQUIRED

From the information provided above, calculate the amount that should be reflected for each of the following items in the Statement of Financial Position of Pixma Limited at the financial year end December :

Noncurrent assets

marks

Retained earnings

marks

Total Equity

marks

Noncurrent liabilities

Explain why it is important for Pixma Limited to consistently take advantage of cash discounts offered by creditors for early settlement of accounts.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started