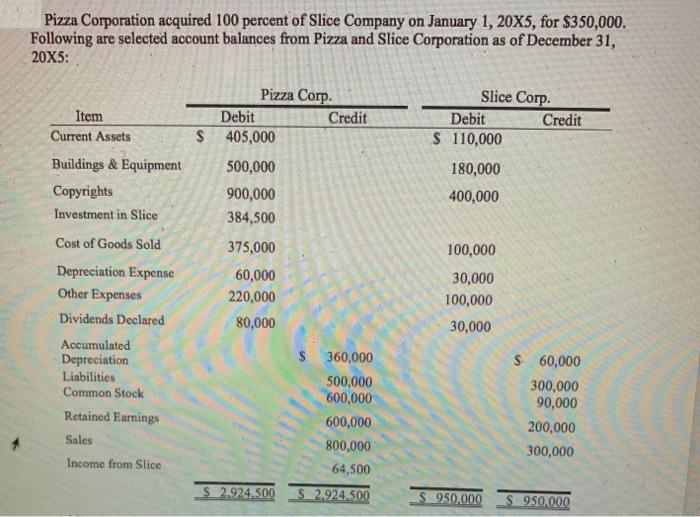

Pizza Corporation acquired 100 percent of Slice Company on January 1, 20X5, for $350,000. Following are selected account balances from Pizza and Slice Corporation

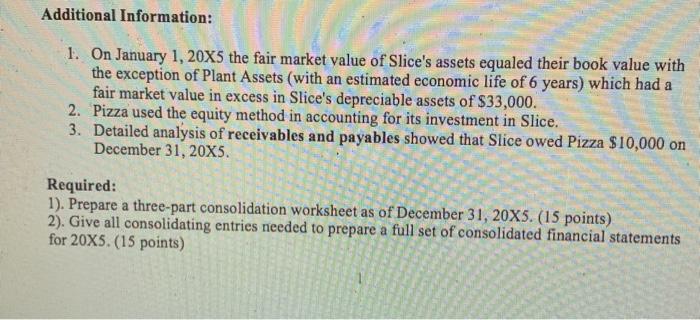

Pizza Corporation acquired 100 percent of Slice Company on January 1, 20X5, for $350,000. Following are selected account balances from Pizza and Slice Corporation as of December 31, 20X5: Item Current Assets Buildings & Equipment Copyrights Investment in Slice Cost of Goods Sold Depreciation Expense Other Expenses Dividends Declared Accumulated Depreciation Liabilities Common Stock Retained Earnings Sales Income from Slice $ Pizza Corp. Debit 405,000 500,000 900,000 384,500 375,000 60,000 220,000 80,000 Credit 360,000 500,000 600,000 600,000 800,000 64,500 S 2.924,500 S 2.924,500 Slice Corp. Debit 110,000 180,000 400,000 100,000 30,000 100,000 30,000 S950,000 Credit $ 60,000 300,000 90,000 200,000 300,000 950,000 Additional Information: 1. On January 1, 20X5 the fair market value of Slice's assets equaled their book value with the exception of Plant Assets (with an estimated economic life of 6 years) which had a fair market value in excess in Slice's depreciable assets of $33,000. 2. Pizza used the equity method in accounting for its investment in Slice. 3. Detailed analysis of receivables and payables showed that Slice owed Pizza $10,000 on December 31, 20X5. Required: 1). Prepare a three-part consolidation worksheet as of December 31, 20X5. (15 points) 2). Give all consolidating entries needed to prepare a full set of consolidated financial statements for 20X5. (15 points)

Step by Step Solution

3.47 Rating (167 Votes )

There are 3 Steps involved in it

Step: 1

Answ...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started