Answered step by step

Verified Expert Solution

Question

1 Approved Answer

PKC Ltd is considering raising $120 million from the markets, In its recent management meeting, Winnie Poon, the CFO, suggested PKC to issue perpetual

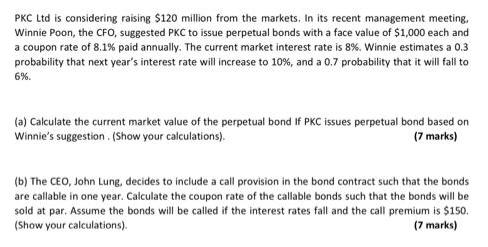

PKC Ltd is considering raising $120 million from the markets, In its recent management meeting, Winnie Poon, the CFO, suggested PKC to issue perpetual bonds with a face value of $1,000 each and a coupon rate of 8.1% paid annually. The current market interest rate is 8%. Winnie estimates a 0.3 probability that next year's interest rate will increase to 10%, and a 0.7 probability that it will fall to 6%. (a) Calculate the current market value of the perpetual bond If PKC issues perpetual bond based on Winnie's suggestion . (Show your calculations). (7 marks) (b) The CEO, John Lung, decides to include a call provision in the bond contract such that the bonds are callable in one year. Calculate the coupon rate of the callable bonds such that the bonds will be sold at par. Assume the bonds will be called if the interest rates fall and the call premium is $150. (Show your calculations). (7 marks)

Step by Step Solution

★★★★★

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Answer a The annual coupon on a perpetual bond having a face value of 1000 and a coupon rate of 81 i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started