Answered step by step

Verified Expert Solution

Question

1 Approved Answer

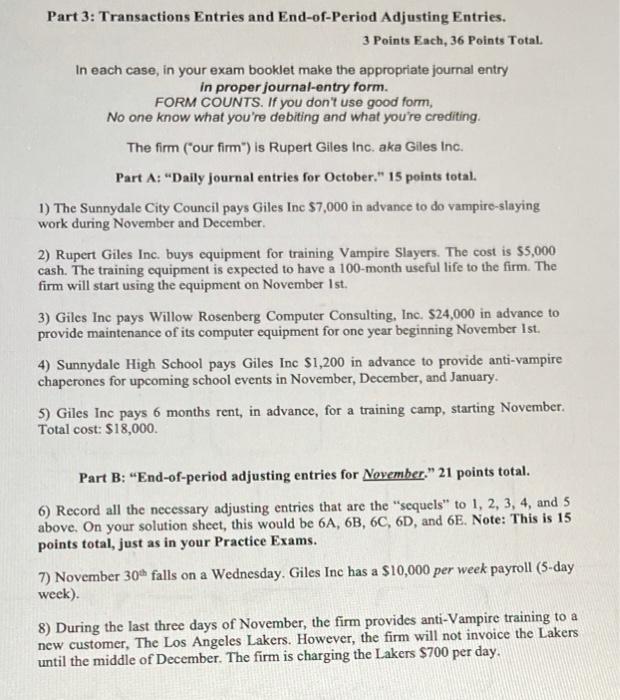

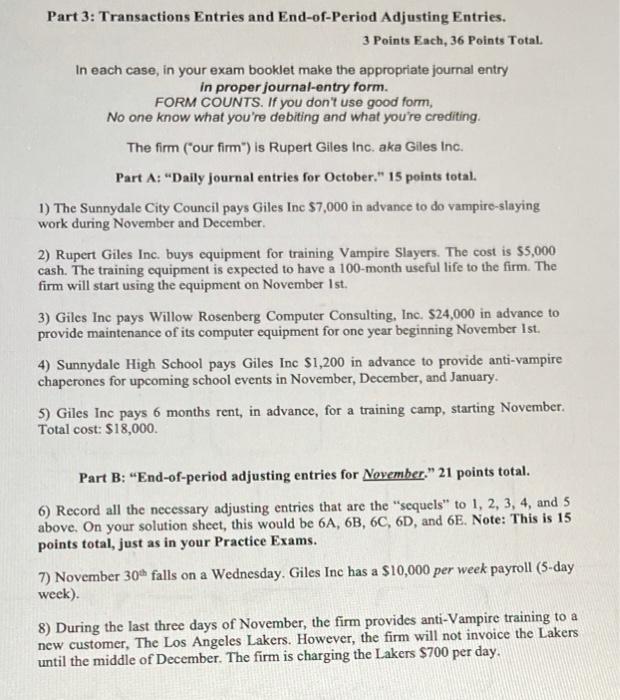

pkease need answer urgently Part 3: Transactions Entries and End-of-Period Adjusting Entries. 3 Points Each, 36 Points Total. In each case, in your exam booklet

pkease need answer urgently

Part 3: Transactions Entries and End-of-Period Adjusting Entries. 3 Points Each, 36 Points Total. In each case, in your exam booklet make the appropriate journal entry in proper journal-entry form. FORM COUNTS. If you don't use good form, No one know what you're debiting and what you're crediting. The firm ('our firm") is Rupert Giles Inc. aka Giles Inc. Part A: "Daily journal entries for October." 15 points total. 1) The Sunnydale City Council pays Giles Ine $7,000 in advance to do vampire-slaying work during November and December. 2) Rupert Giles Inc. buys equipment for training Vampire Slayers. The cost is $5,000 cash. The training equipment is expected to have a 100-month useful life to the firm. The firm will start using the equipment on November 1st. 3) Giles Inc pays Willow Rosenberg Computer Consulting, Inc. $24,000 in advance to provide maintenance of its computer equipment for one year beginning November Ist. 4) Sunnydale High School pays Giles Inc $1,200 in advance to provide anti-vampire chaperones for upcoming school events in November, December, and January. 5) Giles Inc pays 6 months rent, in advance, for a training camp, starting November. Total cost: $18,000. Part B: "End-of-period adjusting entries for November." 21 points total. 6) Record all the necessary adjusting entries that are the "sequels" to 1, 2, 3,4, and 5 above. On your solution sheet, this would be 6A,6B,6C,6D, and 6E. Note: This is 15 points total, just as in your Practice Exams. 7) November 30th falls on a Wednesday. Giles Inc has a $10,000 per week payroll (5-day week). 8) During the last three days of November, the firm provides anti-Vampire training to a new customer, The Los Angeles Lakers. However, the firm will not invoice the Lakers until the middle of December. The firm is charging the Lakers $700 per day

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started