Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pl. Coyote Co. purchased a car for $40,000 and paid $2,400 to California DMV for the registration of the car on 1/1, 2020. Coyote

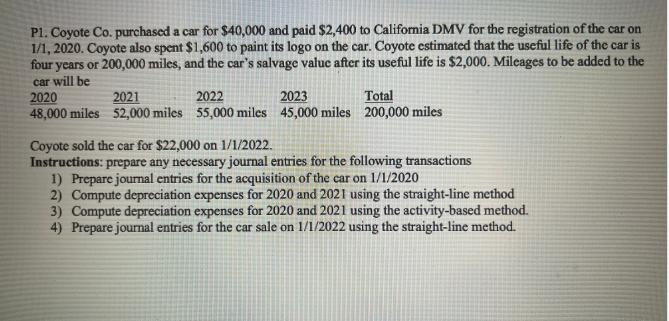

Pl. Coyote Co. purchased a car for $40,000 and paid $2,400 to California DMV for the registration of the car on 1/1, 2020. Coyote also spent $1,600 to paint its logo on the car. Coyote estimated that the useful life of the car is four years or 200,000 miles, and the car's salvage value after its useful life is $2,000. Mileages to be added to the car will be 2020 48,000 miles 2021 2022 2023 Total 52,000 miles 55,000 miles 45,000 miles 200,000 miles Coyote sold the car for $22,000 on 1/1/2022. Instructions: prepare any necessary journal entries for the following transactions 1) Prepare journal entries for the acquisition of the car on 1/1/2020 2) Compute depreciation expenses for 2020 and 2021 using the straight-line method 3) Compute depreciation expenses for 2020 and 2021 using the activity-based method. 4) Prepare journal entries for the car sale on 1/1/2022 using the straight-line method.

Step by Step Solution

★★★★★

3.39 Rating (155 Votes )

There are 3 Steps involved in it

Step: 1

1 Date 112020 Car ac 2 Car registration charges Logo painting charges Cash To record the purchse of ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started