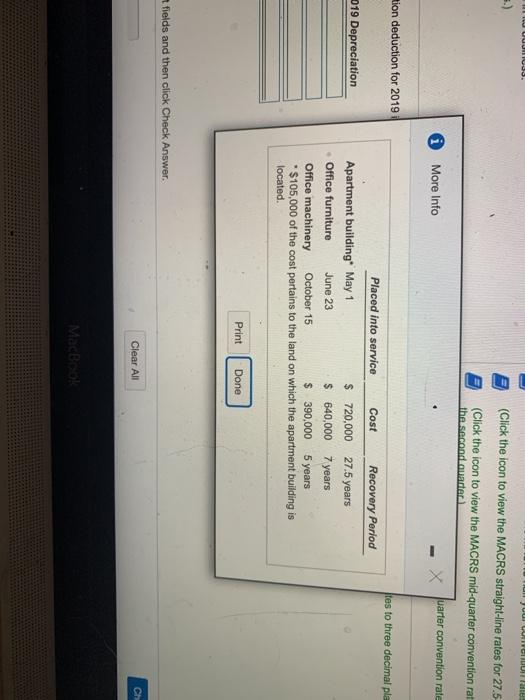

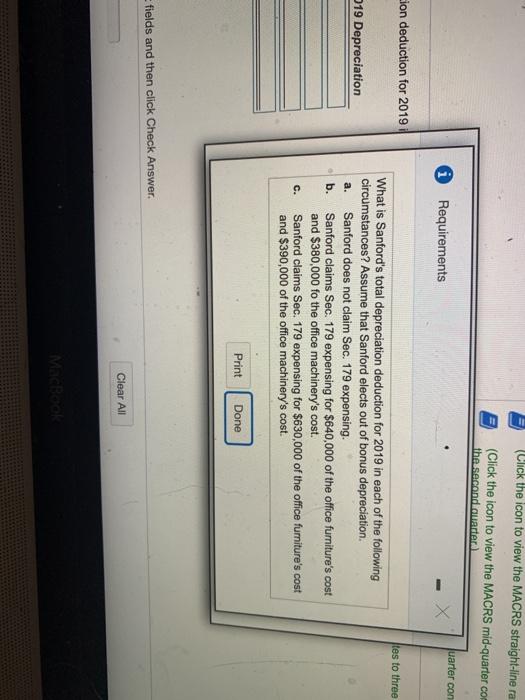

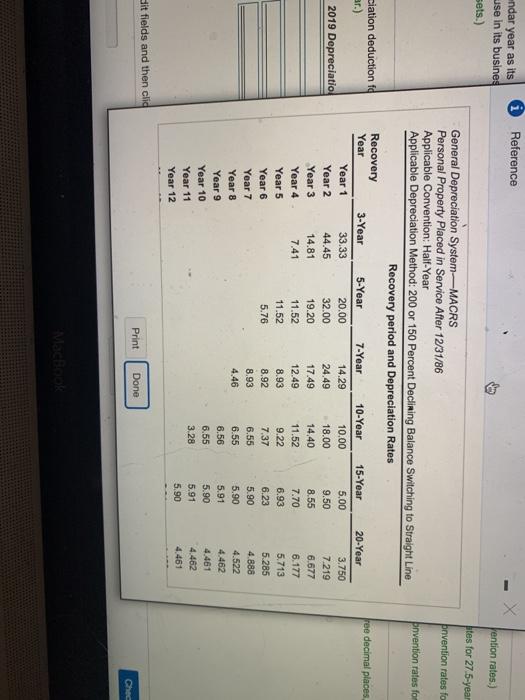

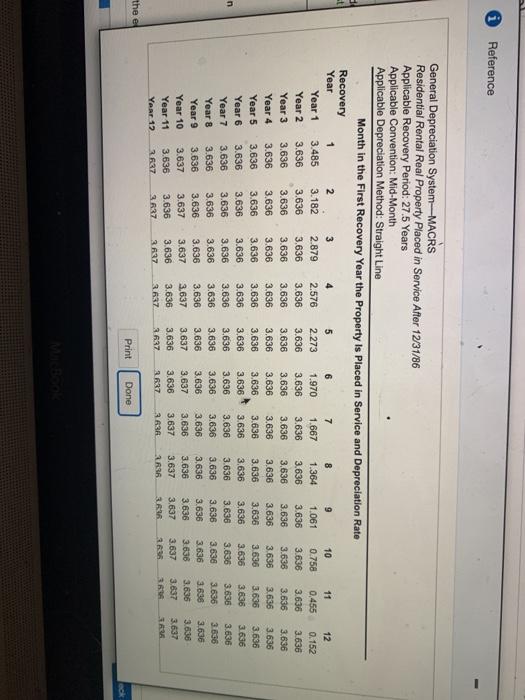

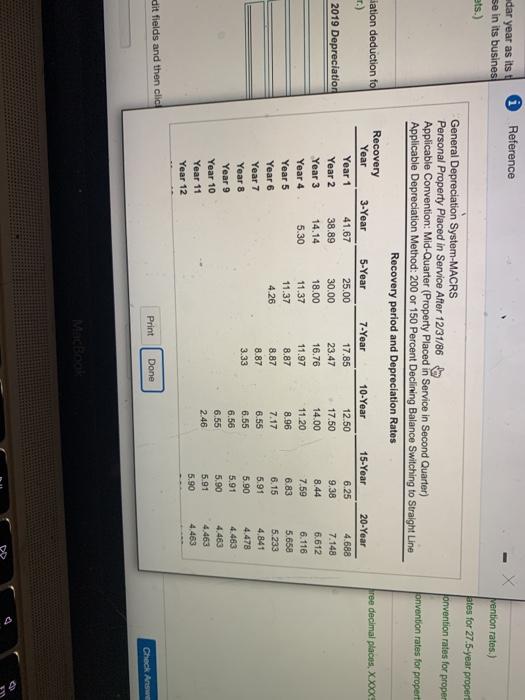

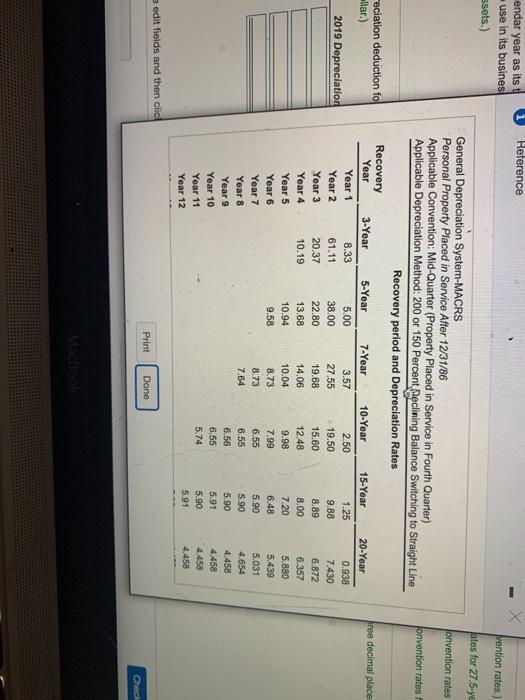

Pl:10-29 (similar to) Sanford Corporation uses the calendar year as tax year it purchases and places into service 51.75 mation of property during 2019 to use in its business (Click the icon to view the MACRS ar continues (Click the icon to view the Click the tow MACRS ir 27. Syarnporty (Click then to view the MACR midower convention to pred the second (che ne con www MACRO Quarter contrast to procedih the fourth water What a Santors to depreciation deduction for 2018 Sanford lects out of bonus deprecimien und docham soc 17 pering? (Use MAC ou ducim. X. Houd www depreciation or are doar 2010 Depreciation Office Furniture Office Machinery Questione Building Total 2019 depreciation Enter any number in the edit fields and then click Check Antwer Dear A Check parts romania ILU UUUUUU you tellulity (Click the icon to view the MACRS straight-line rates for 27.5 (Click the icon to view the MACRS mid-quarter convention rat the second quarter uarter convention rate More Info tion deduction for 2019 tes to three decimal pla Placed into service Cost Recovery Period 019 Depreciation Apartment building May 1 $ 720,000 27.5 years Office furniture June 23 $ 640,000 7 years Office machinery October 15 $ 390,000 5 years $105,000 of the cost pertains to the land on which the apartment building is located. Print Done fields and then click Check Answer Clear All CH MacBook (Click the icon to view the MACRS straight-line ra (Click the icon to view the MACRS mid-quarter CO the second quarter uarter con X i Requirements cion deduction for 2019 tes to three 19 Depreciation a. What is Sanford's total depreciation deduction for 2019 in each of the following circumstances? Assume that Sanford elects out of bonus depreciation. Sanford does not claim Sec. 179 expensing. b. Sanford claims Sec. 179 expensing for $640,000 of the office furniture's cost and $380,000 fo the office machinery's cost. Sanford claims Sec. 179 expensing for $630,000 of the office furniture's cost and $390,000 of the office machinery's cost. c. Print Done Done fields and then click Check Answer. Clear All MACROOR Reference ndar year as its use in its busines sets.) vention rates.) bites for 27.5-year nvention rates fo bnvention rates for ciation deduction fd free decimal places 2019 Depreciatio General Depreciation System--MACRS Personal Property Placed in Service After 12/31/86 Applicable Convention: Half-Year Applicable Depreciation Method: 200 or 150 Percent Declining Balance Switching to Straight Line Recovery period and Depreciation Rates Recovery Year 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year Year 1 33.33 20.00 14.29 10.00 5.00 3.750 Year 2 44.45 32.00 24.49 18.00 9.50 7.219 Year 3 14.81 19.20 17.49 14.40 8.55 6.677 Year 4 7.41 11.52 12.49 11.52 7.70 6.177 Year 5 11.52 8.93 9.22 6.93 5.713 Year 6 5.76 8.92 7.37 6.23 5.285 8.93 Year 7 6.55 5.90 4.888 Year 8 4.46 6.55 5.90 4.522 5.91 4.462 Year 9 Year 10 6.55 5.90 4.461 Year 11 3.28 4.462 5.90 4.461 Year 12 6.56 5.91 Sit fields and then clig Print Done Chec Reference General Depreciation System--MACRS Residential Rental Real Property Placed in Service After 12/31/86 Applicable Recovery Period: 27.5 Years Applicable Convention: Mid-Month Applicable Depreciation Method: Straight Line Month in the First Recovery Year the Property Is Placed in Service and Depreciation Rate Recovery Year 1 2 3 4 5 6 7 8 9 10 11 12 Year 1 3.485 3.182 2.879 2.576 2.273 1.970 1.667 1.364 1.061 0.758 0.455 0.152 Year 2 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 Year 3 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.638 3.636 3.636 Year 4 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 Year 5 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 Year 6 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3,636 3.636 3.636 3.636 3.636 Year 7 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 Year 8 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3636 Year 9 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 Year 10 3.637 3.637 3.637 3.637 3.637 3.637 3.636 3.636 3.636 3.636 3.636 3.638 Year 11 3.636 3.636 3.636 3.636 3.636 3.636 3.637 3.637 3.637 3.637 3.637 3.637 3637 Year 12 337 2637 3.637 337 3627 33 3.63 3 2036 n the el Print Dono i Reference dar year as its se in its busines ets.) vention rates.) ates for 27.5-year proper Jonvention rates for proper onvention rates for propert lation deduction to free decimal places, XXX 2019 Depreciation General Depreciation System-MACRS Personal Property Placed in Service After 12/31/86 Applicable Convention: Mid-Quarter (Property Placed in Service in Second Quarter) Applicable Depreciation Method: 200 or 150 Percent Declining Balance Switching to Straight Line Recovery period and Depreciation Rates Recovery Year 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year Year 1 41.67 25.00 17.85 12.50 6.25 4.688 Year 2 38.89 30.00 23.47 17.50 9.38 7-148 Year 3 14.14 18.00 16.76 14.00 8.44 6.612 Year 4 11.37 11.97 11.20 7.59 6.116 Year 5 11.37 8.87 8.96 6.83 5.658 Year 6 4.26 8.87 7.17 6.15 5.233 Year 7 8.87 6.55 5.91 4,841 Year 8 3.33 6.55 5.90 4.478 Year 9 6.56 5.91 4.463 Year 10 6.55 5.90 4 483 Year 11 2.46 5.91 4.463 5.90 Year 12 5.30 dit fields and then clic Print Done Check And @ 1 Reference endar year as its use in its busines ssets.) vention rates) ates for 27.5-ye Jonvention rates Jonvention rates reciation deduction fo llar.) hree decimal place 1.25 2019 Depreciation General Depreciation System-MACRS Personal Property Placed in Service After 12/31/86 Applicable Convention: Mid-Quarter (Property Placed in Service in Fourth Quarter) Applicable Depreciation Method: 200 or 150 Percent Declining Balance Switching to Straight Line Recovery period and Depreciation Rates Recovery Year 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year Year 1 8.33 5.00 3.57 2.50 0.938 Year 2 61.11 38.00 27.55 19.50 9.88 7.430 Year 3 20.37 22.80 19.68 15.60 8.89 6.872 Year 4 10.19 13.68 14.06 12.48 8.00 6.357 Year 5 10.94 10.04 9.98 7.20 5.880 Year 6 9.58 8.73 7.99 6.48 5.439 Year 7 8.73 6.55 5.90 5.031 Year 8 7.64 6.55 5.90 4.654 Year 9 5.90 4.458 Year 10 6.55 5.91 4.458 Year 11 5.74 5.90 4458 4.458 5.91 Year 12 6.56 edit fields and then clic Print Done Check MacBook Pl:10-29 (similar to) Sanford Corporation uses the calendar year as tax year it purchases and places into service 51.75 mation of property during 2019 to use in its business (Click the icon to view the MACRS ar continues (Click the icon to view the Click the tow MACRS ir 27. Syarnporty (Click then to view the MACR midower convention to pred the second (che ne con www MACRO Quarter contrast to procedih the fourth water What a Santors to depreciation deduction for 2018 Sanford lects out of bonus deprecimien und docham soc 17 pering? (Use MAC ou ducim. X. Houd www depreciation or are doar 2010 Depreciation Office Furniture Office Machinery Questione Building Total 2019 depreciation Enter any number in the edit fields and then click Check Antwer Dear A Check parts romania ILU UUUUUU you tellulity (Click the icon to view the MACRS straight-line rates for 27.5 (Click the icon to view the MACRS mid-quarter convention rat the second quarter uarter convention rate More Info tion deduction for 2019 tes to three decimal pla Placed into service Cost Recovery Period 019 Depreciation Apartment building May 1 $ 720,000 27.5 years Office furniture June 23 $ 640,000 7 years Office machinery October 15 $ 390,000 5 years $105,000 of the cost pertains to the land on which the apartment building is located. Print Done fields and then click Check Answer Clear All CH MacBook (Click the icon to view the MACRS straight-line ra (Click the icon to view the MACRS mid-quarter CO the second quarter uarter con X i Requirements cion deduction for 2019 tes to three 19 Depreciation a. What is Sanford's total depreciation deduction for 2019 in each of the following circumstances? Assume that Sanford elects out of bonus depreciation. Sanford does not claim Sec. 179 expensing. b. Sanford claims Sec. 179 expensing for $640,000 of the office furniture's cost and $380,000 fo the office machinery's cost. Sanford claims Sec. 179 expensing for $630,000 of the office furniture's cost and $390,000 of the office machinery's cost. c. Print Done Done fields and then click Check Answer. Clear All MACROOR Reference ndar year as its use in its busines sets.) vention rates.) bites for 27.5-year nvention rates fo bnvention rates for ciation deduction fd free decimal places 2019 Depreciatio General Depreciation System--MACRS Personal Property Placed in Service After 12/31/86 Applicable Convention: Half-Year Applicable Depreciation Method: 200 or 150 Percent Declining Balance Switching to Straight Line Recovery period and Depreciation Rates Recovery Year 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year Year 1 33.33 20.00 14.29 10.00 5.00 3.750 Year 2 44.45 32.00 24.49 18.00 9.50 7.219 Year 3 14.81 19.20 17.49 14.40 8.55 6.677 Year 4 7.41 11.52 12.49 11.52 7.70 6.177 Year 5 11.52 8.93 9.22 6.93 5.713 Year 6 5.76 8.92 7.37 6.23 5.285 8.93 Year 7 6.55 5.90 4.888 Year 8 4.46 6.55 5.90 4.522 5.91 4.462 Year 9 Year 10 6.55 5.90 4.461 Year 11 3.28 4.462 5.90 4.461 Year 12 6.56 5.91 Sit fields and then clig Print Done Chec Reference General Depreciation System--MACRS Residential Rental Real Property Placed in Service After 12/31/86 Applicable Recovery Period: 27.5 Years Applicable Convention: Mid-Month Applicable Depreciation Method: Straight Line Month in the First Recovery Year the Property Is Placed in Service and Depreciation Rate Recovery Year 1 2 3 4 5 6 7 8 9 10 11 12 Year 1 3.485 3.182 2.879 2.576 2.273 1.970 1.667 1.364 1.061 0.758 0.455 0.152 Year 2 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 Year 3 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.638 3.636 3.636 Year 4 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 Year 5 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 Year 6 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3,636 3.636 3.636 3.636 3.636 Year 7 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 Year 8 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3636 Year 9 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 3.636 Year 10 3.637 3.637 3.637 3.637 3.637 3.637 3.636 3.636 3.636 3.636 3.636 3.638 Year 11 3.636 3.636 3.636 3.636 3.636 3.636 3.637 3.637 3.637 3.637 3.637 3.637 3637 Year 12 337 2637 3.637 337 3627 33 3.63 3 2036 n the el Print Dono i Reference dar year as its se in its busines ets.) vention rates.) ates for 27.5-year proper Jonvention rates for proper onvention rates for propert lation deduction to free decimal places, XXX 2019 Depreciation General Depreciation System-MACRS Personal Property Placed in Service After 12/31/86 Applicable Convention: Mid-Quarter (Property Placed in Service in Second Quarter) Applicable Depreciation Method: 200 or 150 Percent Declining Balance Switching to Straight Line Recovery period and Depreciation Rates Recovery Year 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year Year 1 41.67 25.00 17.85 12.50 6.25 4.688 Year 2 38.89 30.00 23.47 17.50 9.38 7-148 Year 3 14.14 18.00 16.76 14.00 8.44 6.612 Year 4 11.37 11.97 11.20 7.59 6.116 Year 5 11.37 8.87 8.96 6.83 5.658 Year 6 4.26 8.87 7.17 6.15 5.233 Year 7 8.87 6.55 5.91 4,841 Year 8 3.33 6.55 5.90 4.478 Year 9 6.56 5.91 4.463 Year 10 6.55 5.90 4 483 Year 11 2.46 5.91 4.463 5.90 Year 12 5.30 dit fields and then clic Print Done Check And @ 1 Reference endar year as its use in its busines ssets.) vention rates) ates for 27.5-ye Jonvention rates Jonvention rates reciation deduction fo llar.) hree decimal place 1.25 2019 Depreciation General Depreciation System-MACRS Personal Property Placed in Service After 12/31/86 Applicable Convention: Mid-Quarter (Property Placed in Service in Fourth Quarter) Applicable Depreciation Method: 200 or 150 Percent Declining Balance Switching to Straight Line Recovery period and Depreciation Rates Recovery Year 3-Year 5-Year 7-Year 10-Year 15-Year 20-Year Year 1 8.33 5.00 3.57 2.50 0.938 Year 2 61.11 38.00 27.55 19.50 9.88 7.430 Year 3 20.37 22.80 19.68 15.60 8.89 6.872 Year 4 10.19 13.68 14.06 12.48 8.00 6.357 Year 5 10.94 10.04 9.98 7.20 5.880 Year 6 9.58 8.73 7.99 6.48 5.439 Year 7 8.73 6.55 5.90 5.031 Year 8 7.64 6.55 5.90 4.654 Year 9 5.90 4.458 Year 10 6.55 5.91 4.458 Year 11 5.74 5.90 4458 4.458 5.91 Year 12 6.56 edit fields and then clic Print Done Check MacBook