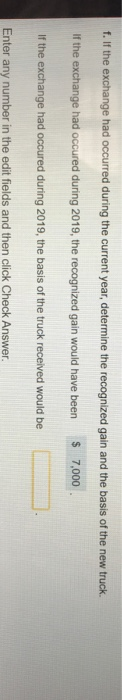

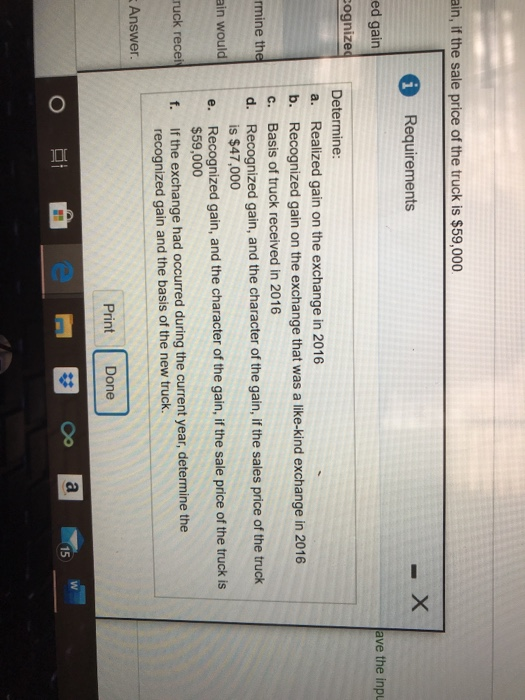

%PL:13-45 (similar to) Liam owned a truck used in his trade or business that com 550.000 and had an new truck in 2019. Liam was allowed depreciation of $6,000 for the new truck d basis of $43.000 in 2016 when the truck was exchanged for a new truck that was and property with a FMV of $50,000. Prior to selling the Read the requirements f. If the exchange had occurred during the current year, determine the recognized gain and the basis of the new truck. If the exchange had occured during 2019, the recognized gain would have been $ 7,000 If the exchange had occured during 2019, the basis of the truck received would be Enter any number in the edit fields and then click Check Answer. ain, if the sale price of the truck is $59,000 Requirements - X ave the inpu ed gain cognized rmine the Determine: a. Realized gain on the exchange in 2016 Recognized gain on the exchange that was a like-kind exchange in 2016 c. Basis of truck received in 2016 d. Recognized gain, and the character of the gain, if the sales price of the truck is $47,000 Recognized gain, and the character of the gain, if the sale price of the truck is $59,000 If the exchange had occurred during the current year, determine the recognized gain and the basis of the new truck ain would e. ruck recei Answer. Print Done %PL:13-45 (similar to) Liam owned a truck used in his trade or business that com 550.000 and had an new truck in 2019. Liam was allowed depreciation of $6,000 for the new truck d basis of $43.000 in 2016 when the truck was exchanged for a new truck that was and property with a FMV of $50,000. Prior to selling the Read the requirements f. If the exchange had occurred during the current year, determine the recognized gain and the basis of the new truck. If the exchange had occured during 2019, the recognized gain would have been $ 7,000 If the exchange had occured during 2019, the basis of the truck received would be Enter any number in the edit fields and then click Check Answer. ain, if the sale price of the truck is $59,000 Requirements - X ave the inpu ed gain cognized rmine the Determine: a. Realized gain on the exchange in 2016 Recognized gain on the exchange that was a like-kind exchange in 2016 c. Basis of truck received in 2016 d. Recognized gain, and the character of the gain, if the sales price of the truck is $47,000 Recognized gain, and the character of the gain, if the sale price of the truck is $59,000 If the exchange had occurred during the current year, determine the recognized gain and the basis of the new truck ain would e. ruck recei Answer. Print Done