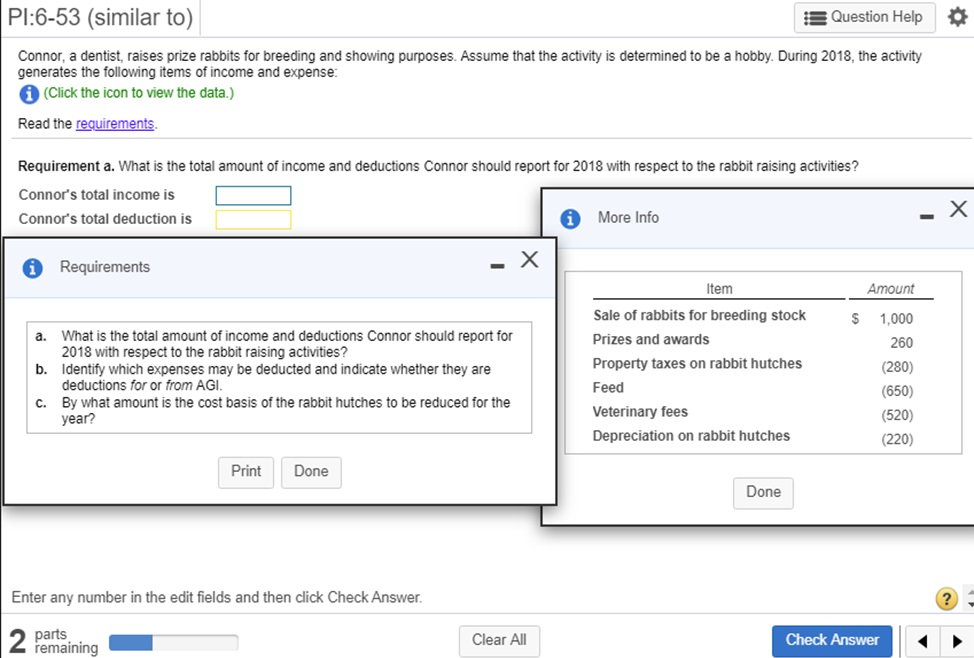

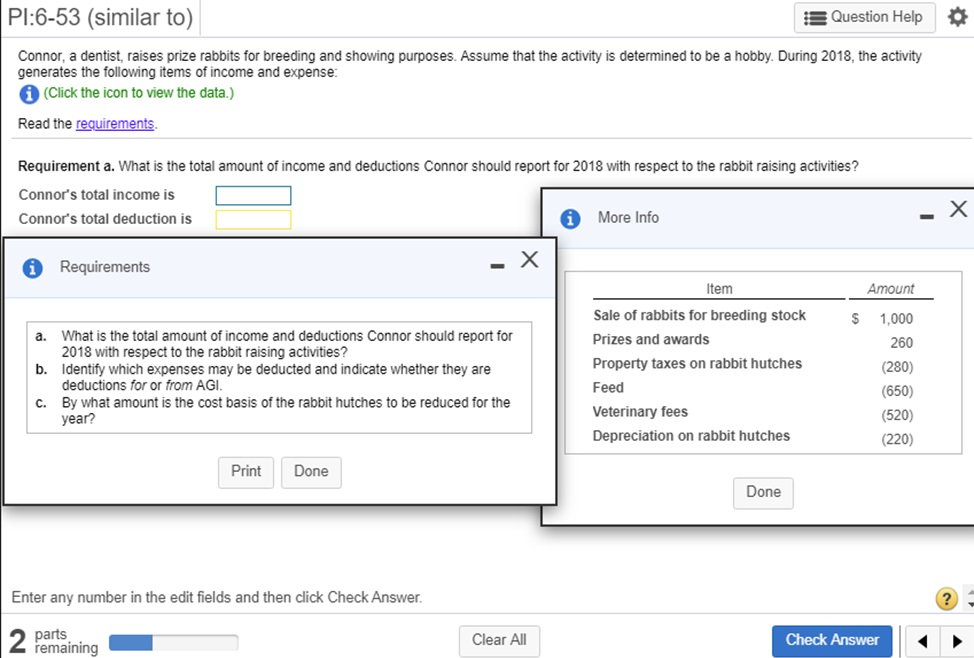

Pl:6-53 (similar to) Question Help Connor, a dentist, raises prize rabbits for breeding and showing purposes. Assume that the activity is determined to be a hobby. During 2018, the activity generates the following items of income and expense: (Click the icon to view the data.) Read the requirements. Requirement a. What is the total amount of income and deductions Connor should report for 2018 with respect to the rabbit raising activities? Connor's total income is X iMore Info Connor's total deduction is Requirements Item Amount Sale of rabbits for breeding stock 1,000 What is the total amount of income and deductions Connor should report for 2018 with respect to the rabbit rais ing activities? b. a. Prizes and awards 260 Property taxes on rabbit hutches (280) Identify which expenses may be deducted and indicate whether they are deductions for or from AGI Feed (650) By what amount is the cost basis of the rabbit hutches to be reduced for the year? c. Veterinary fees (520) Depreciation on rabbit hutches (220) Print Done Done Enter any number in the edit fields and then click Check Answer. ? 2 parts remaining Clear All Check Answer Pl:6-53 (similar to) Question Help Connor, a dentist, raises prize rabbits for breeding and showing purposes. Assume that the activity is determined to be a hobby. During 2018, the activity generates the following items of income and expense: (Click the icon to view the data.) Read the requirements. Requirement a. What is the total amount of income and deductions Connor should report for 2018 with respect to the rabbit raising activities? Connor's total income is X iMore Info Connor's total deduction is Requirements Item Amount Sale of rabbits for breeding stock 1,000 What is the total amount of income and deductions Connor should report for 2018 with respect to the rabbit rais ing activities? b. a. Prizes and awards 260 Property taxes on rabbit hutches (280) Identify which expenses may be deducted and indicate whether they are deductions for or from AGI Feed (650) By what amount is the cost basis of the rabbit hutches to be reduced for the year? c. Veterinary fees (520) Depreciation on rabbit hutches (220) Print Done Done Enter any number in the edit fields and then click Check Answer. ? 2 parts remaining Clear All Check