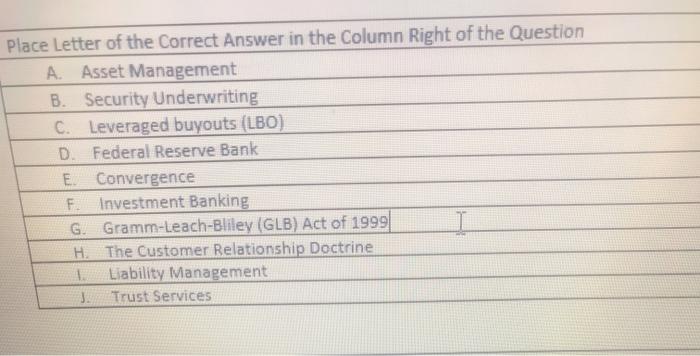

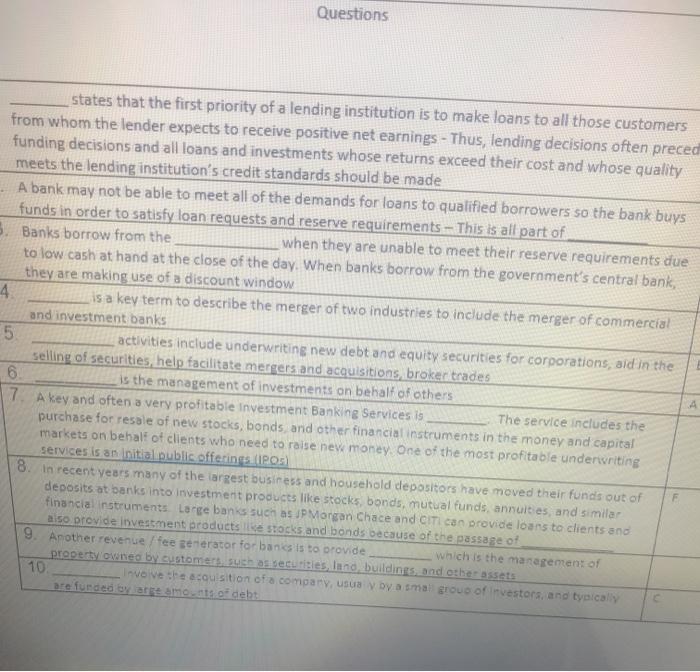

Place Letter of the Correct Answer in the Column Right of the Question A Asset Management B. Security Underwriting C. Leveraged buyouts (LBO) D. Federal Reserve Bank E Convergence F. Investment Banking G.Gramm-Leach-Bliley (GLB) Act of 1999 1 H The Customer Relationship Doctrine 1. Liability Management J. Trust Services Questions states that the first priority of a lending institution is to make loans to all those customers from whom the lender expects to receive positive net earnings - Thus, lending decisions often preced funding decisions and all loans and investments whose returns exceed their cost and whose quality meets the lending institution's credit standards should be made A bank may not be able to meet all of the demands for loans to qualified borrowers so the bank buys funds in order to satisfy loan requests and reserve requirements - This is all part of 5. Banks borrow from the when they are unable to meet their reserve requirements due to low cash at hand at the close of the day. When banks borrow from the government's central bank, they are making use of a discount window 4. is a key term to describe the merger of two industries to include the merger of commercial and investment banks 5 activities include underwriting new debt and equity securities for corporations, aid in the selling of securities, help facilitate mergers and acquisitions, broker trades 6 is the management of investments on behalf of others 7. A key and often a very profitable Investment Banking Services is The service includes the purchase for resale of new stocks, bonds and other financial instruments in the money and capital markets on behalf of clients who need to raise new money. One of the most profitable underwriting services is an initial public offerings (IPO) 8. In recent years many of the largest business and household depositors have moved their funds out of deposits at banks into investment products like stocks, bonds, mutual funds, annuities, and similar financial instruments Large banks such as JPMorgan Chace and CITI can provide loans to clients and also provide investment products se stocks and bonds because of the passage of 9. Another revenue fee generator for bancs is to provide which is the management of property owned by customers, such as securities, and buildings, and other assets 10 nove the acquisition of a company, usua v by a smal grous of restors and typically Brefunded by are amets of debt A F