Answered step by step

Verified Expert Solution

Question

1 Approved Answer

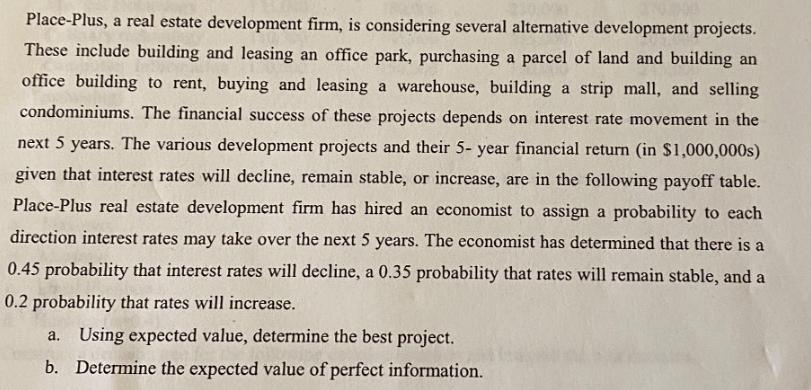

Place-Plus, a real estate development firm, is considering several alternative development projects. These include building and leasing an office park, purchasing a parcel of

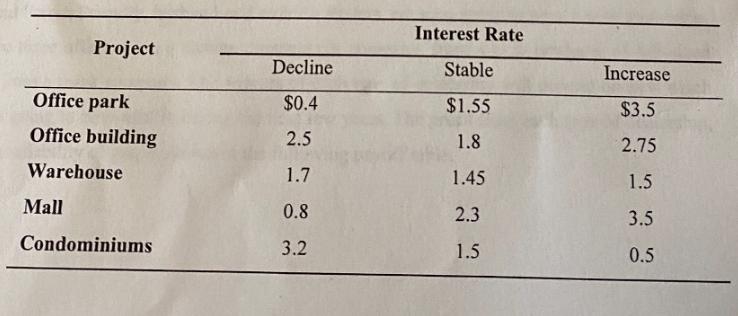

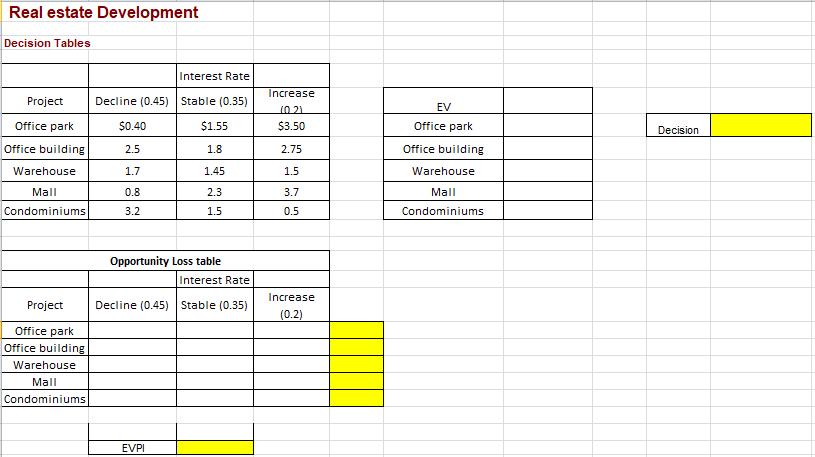

Place-Plus, a real estate development firm, is considering several alternative development projects. These include building and leasing an office park, purchasing a parcel of land and building an office building to rent, buying and leasing a warehouse, building a strip mall, and selling condominiums. The financial success of these projects depends on interest rate movement in the next 5 years. The various development projects and their 5- year financial return (in $1,000,000s) given that interest rates will decline, remain stable, or increase, are in the following payoff table. Place-Plus real estate development firm has hired an economist to assign a probability to each direction interest rates may take over the next 5 years. The economist has determined that there is a 0.45 probability that interest rates will decline, a 0.35 probability that rates will remain stable, and a 0.2 probability that rates will increase. a. Using expected value, determine the best project. b. Determine the expected value of perfect information. Interest Rate Project Decline Stable Increase Office park $0.4 $1.55 $3.5 Office building 2.5 1.8 2.75 Warehouse 1.7 1.45 1.5 Mall 0.8 2.3 3.5 Condominiums 3.2 1.5 0.5 Real estate Development Decision Tables Interest Rate Increase Project Decline (0.45) Stable (0.35) (0 21 EV Office park $0.40 $1.55 $3.50 Office park Decision Office building 2.5 1.8 2.75 Office building Warehouse 1.7 1.45 1.5 Warehouse Mall 0.8 2.3 3.7 Mall Condominiums 3.2 1.5 0.5 Condominiums Opportunity Loss table Interest Rate Increase Project Decline (0.45) Stable (0.35) (0.2) Office park Office building Warehouse Mall Condominiums EVPI

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Document Format ( 1 attachment)

60ae4f499e83b_707752.xlsx

300 KBs Excel File

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started