Answered step by step

Verified Expert Solution

Question

1 Approved Answer

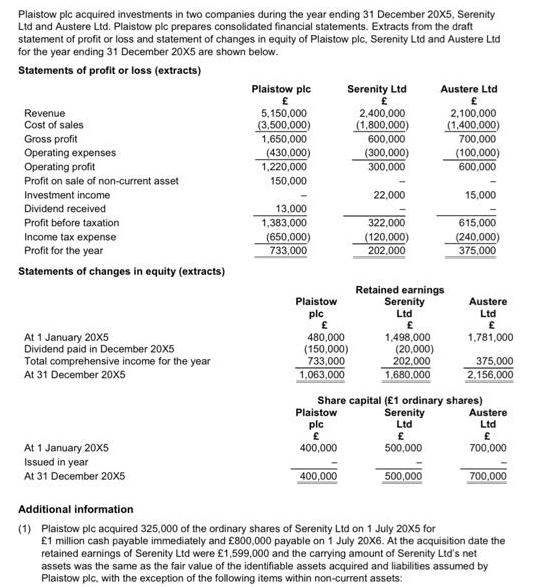

Plaistow plc acquired investments in two companies during the year ending 31 December 20X5, Serenity Ltd and Austere Ltd. Plaistow plc prepares consolidated financial

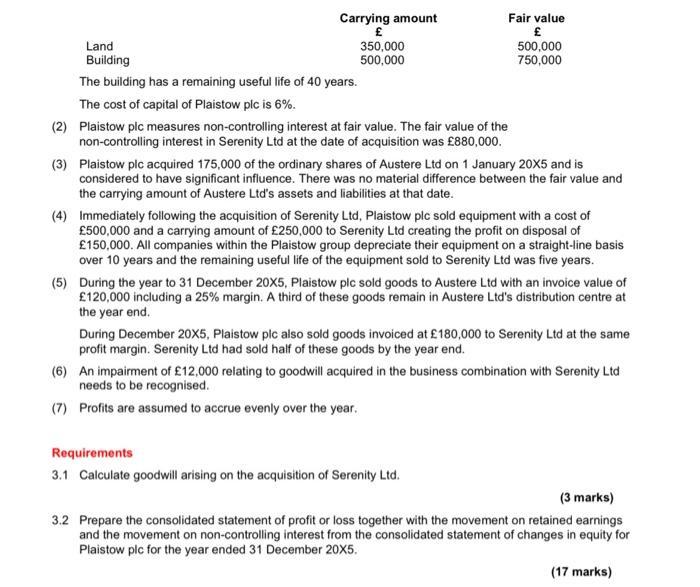

Plaistow plc acquired investments in two companies during the year ending 31 December 20X5, Serenity Ltd and Austere Ltd. Plaistow plc prepares consolidated financial statements. Extracts from the draft statement of profit or loss and statement of changes in equity of Plaistow plc, Serenity Ltd and Austere Ltd for the year ending 31 December 20X5 are shown below. Statements of profit or loss (extracts) Revenue Cost of sales Gross profit Operating expenses Operating profit Profit on sale of non-current asset Investment income Dividend received Profit before taxation Income tax expense Profit for the year Statements of changes in equity (extracts) At 1 January 20X5 Dividend paid in December 20X5 Total comprehensive income for the year At 31 December 20X5 At 1 January 20X5 Issued in year At 31 December 20X5 Plaistow plc 5,150,000 (3,500,000) 1,650,000 (430,000) 1,220,000 150,000 13,000 1,383,000 (650,000) 733,000 Plaistow plc 480,000 (150,000) 733,000 1.063.000 Serenity Ltd 2,400,000 (1,800,000) 600,000 Plaistow plc 400,000 400,000 (300,000) 300,000 22,000 322,000 (120,000) 202.000 Retained earnings Serenity Ltd 1,498,000 (20,000) 202,000 1.680.000 Austere Ltd 2,100,000 (1,400,000) 500,000 700,000 (100,000) 600,000 15,000 615,000 (240,000) 375,000 Share capital (1 ordinary shares) Serenity Ltd 500,000 Austere Ltd 1,781,000 375,000 2.156,000 Austere Ltd 700,000 700.000 Additional information (1) Plaistow plc acquired 325,000 of the ordinary shares of Serenity Ltd on 1 July 20X5 for 1 million cash payable immediately and 800,000 payable on 1 July 20X6. At the acquisition date the retained earnings of Serenity Ltd were 1,599,000 and the carrying amount of Serenity Ltd's net assets was the same as the fair value of the identifiable assets acquired and liabilities assumed by Plaistow plc, with the exception of the following items within non-current assets: Land Building Carrying amount 350,000 500,000 Fair value 500,000 750,000 The building has a remaining useful life of 40 years. The cost of capital of Plaistow plc is 6%. (2) Plaistow plc measures non-controlling interest at fair value. The fair value of the non-controlling interest in Serenity Ltd at the date of acquisition was 880,000. (3) Plaistow plc acquired 175,000 of the ordinary shares of Austere Ltd on 1 January 20X5 and is considered to have significant influence. There was no material difference between the fair value and the carrying amount of Austere Ltd's assets and liabilities at that date. (4) Immediately following the acquisition of Serenity Ltd, Plaistow plc sold equipment with a cost of 500,000 and a carrying amount of 250,000 to Serenity Ltd creating the profit on disposal of 150,000. All companies within the Plaistow group depreciate their equipment on a straight-line basis over 10 years and the remaining useful life of the equipment sold to Serenity Ltd was five years. (5) During the year to 31 December 20X5, Plaistow plc sold goods to Austere Ltd with an invoice value of 120,000 including a 25% margin. A third of these goods remain in Austere Ltd's distribution centre at the year end. During December 20X5, Plaistow plc also sold goods invoiced at 180,000 to Serenity Ltd at the same profit margin. Serenity Ltd had sold half of these goods by the year end. (6) An impairment of 12,000 relating to goodwill acquired in the business combination with Serenity Ltd needs to be recognised. (7) Profits are assumed to accrue evenly over the year. Requirements 3.1 Calculate goodwill arising on the acquisition of Serenity Ltd. (3 marks) 3.2 Prepare the consolidated statement of profit or loss together with the movement on retained earnings and the movement on non-controlling interest from the consolidated statement of changes in equity for Plaistow plc for the year ended 31 December 20X5. (17 marks)

Step by Step Solution

★★★★★

3.42 Rating (165 Votes )

There are 3 Steps involved in it

Step: 1

31 Calculate goodwill arising on the acquisition of Serenity Ltd Goodwill is calculated as the excess of the consideration transferred which is the cash paid and the fair value of any noncontrolling i...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started