Question

Planet Corporation acquired 90 percent of Saturn Company?s voting shares of stock in 20X1. During 20X4, Planet purchased 40,000 Playday doghouses for $24 each and

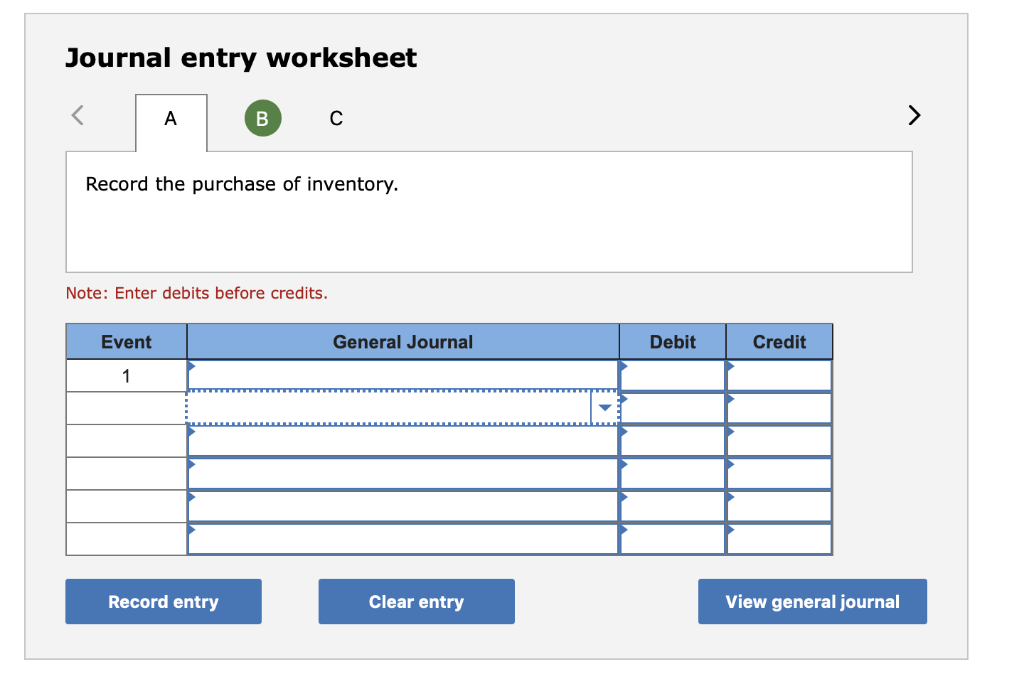

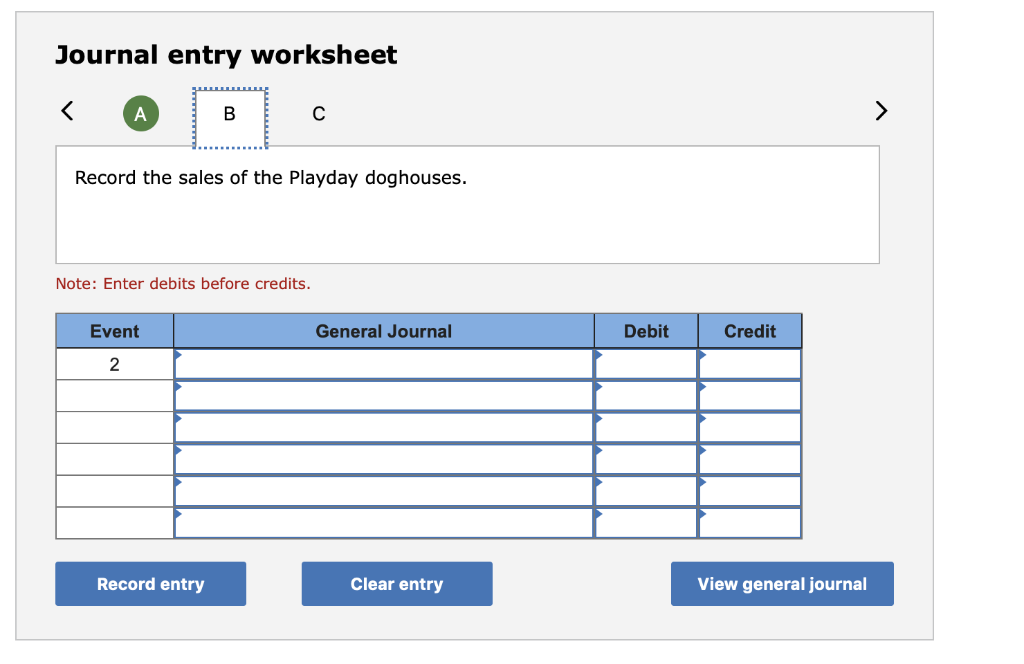

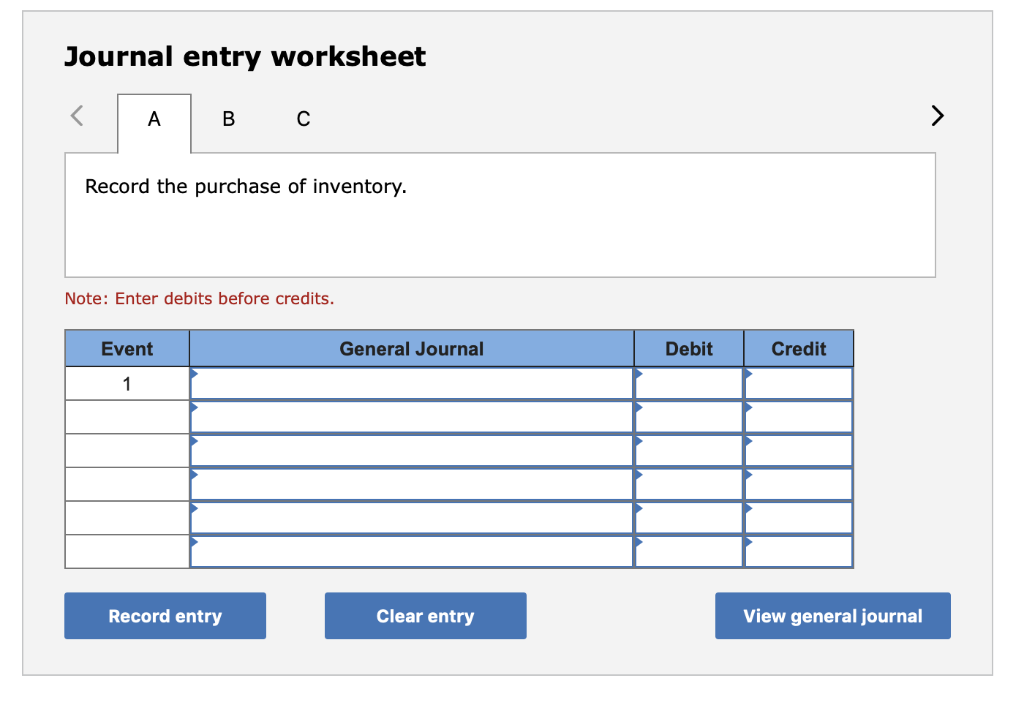

Planet Corporation acquired 90 percent of Saturn Company?s voting shares of stock in 20X1. During 20X4, Planet purchased 40,000 Playday doghouses for $24 each and sold 25,000 of them to Saturn for $30 each. Saturn sold 18,000 of the doghouses to retail establishments prior to December 31, 20X4, for $45 each. Both companies use perpetual inventory systems.Required: a. Prepare all journal entries Planet recorded for the purchase of inventory and resale to Saturn Company in 20X4.

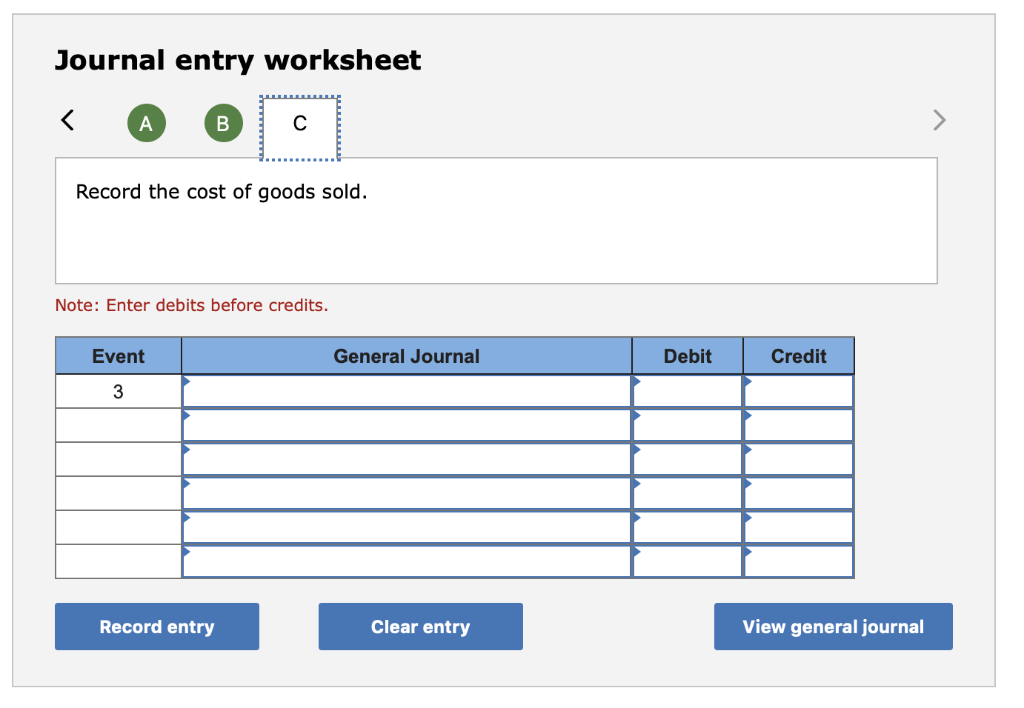

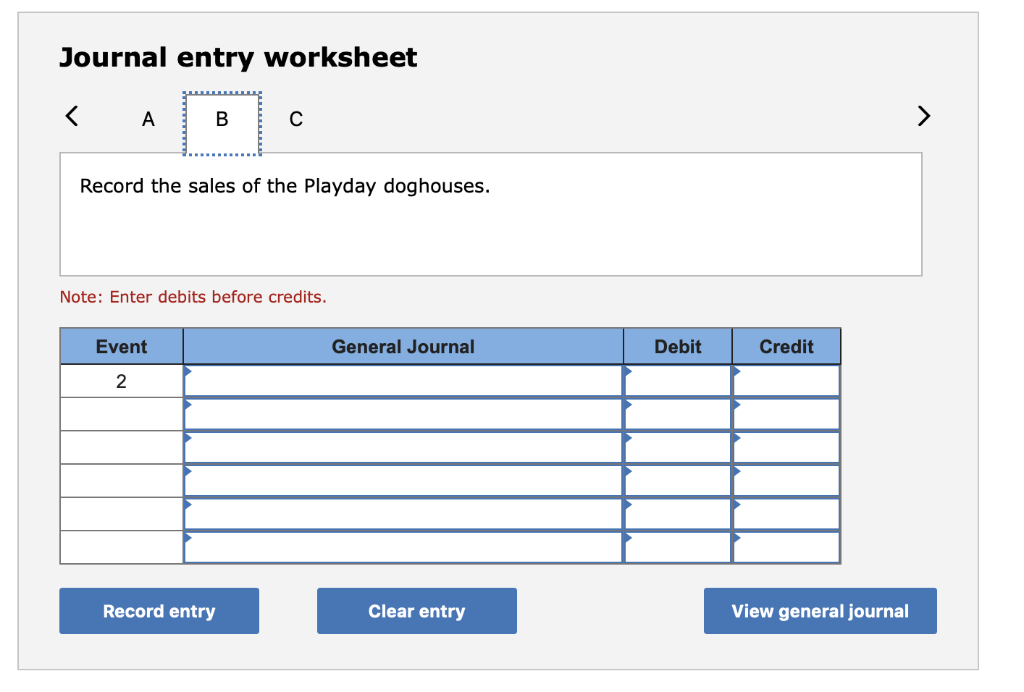

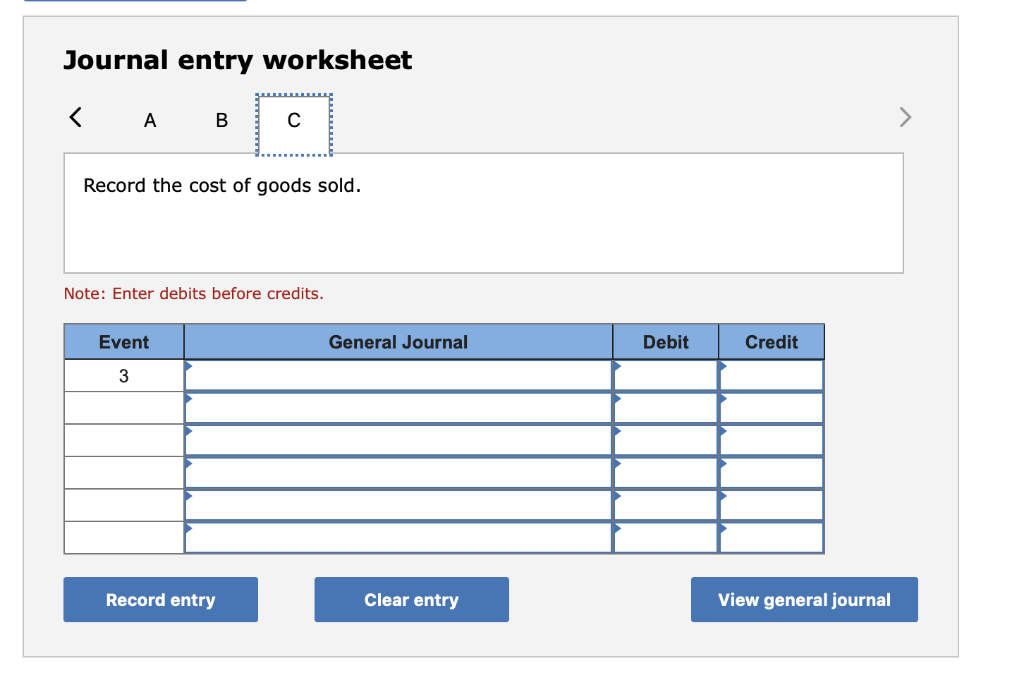

b. Prepare the journal entries Saturn recorded for the purchase of inventory and resale to retail establishments in 20X4.

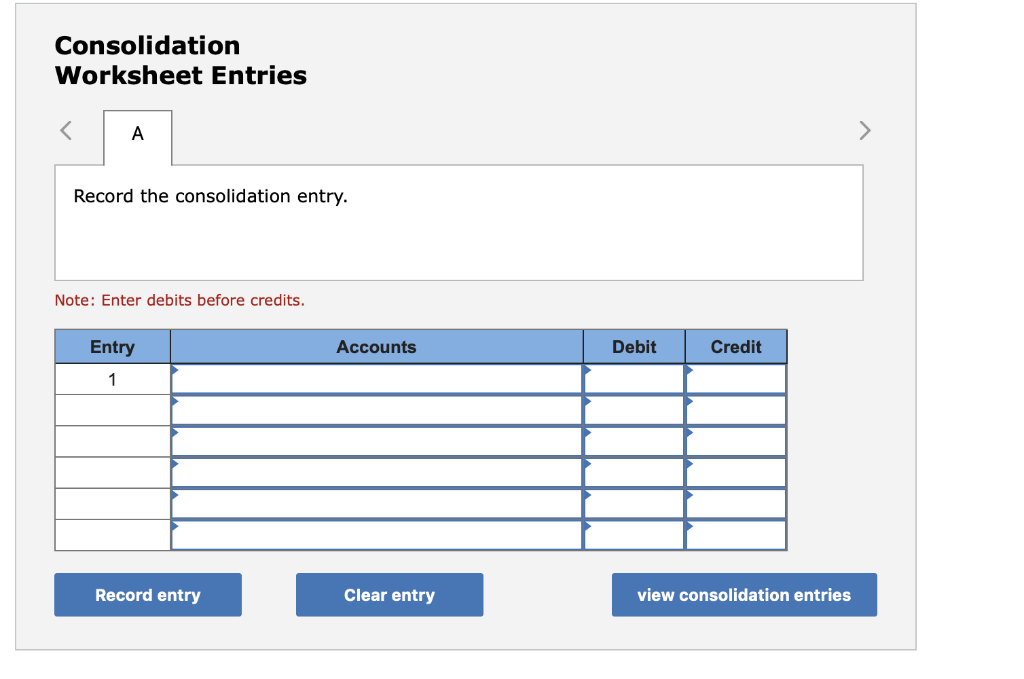

c. Prepare the worksheet consolidation entry(ies) needed in preparing consolidated financial statements for 20X4 to remove the effects of the intercompany sale.

Journal entry worksheet A Event 1 B Record the purchase of inventory. C Note: Enter debits before credits. Record entry General Journal Clear entry Debit Credit View general journal Journal entry worksheet A Event 1 B Record the purchase of inventory. C Note: Enter debits before credits. Record entry General Journal Clear entry Debit Credit View general journal

Step by Step Solution

3.48 Rating (164 Votes )

There are 3 Steps involved in it

Step: 1

a Event Particular Debit Credit 1 Inventory 40000 x 24 960000 cash 960000 To ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started