Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Bernard Blanger has been working full-time for the last 4 years. Last year, a close family friend, Aunt Maria, suddenly passed away and left

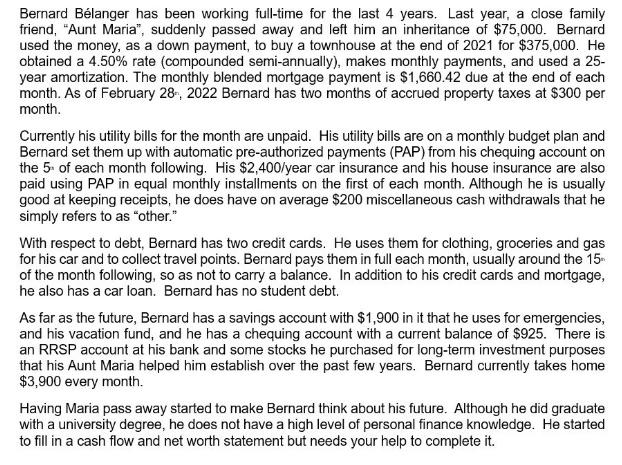

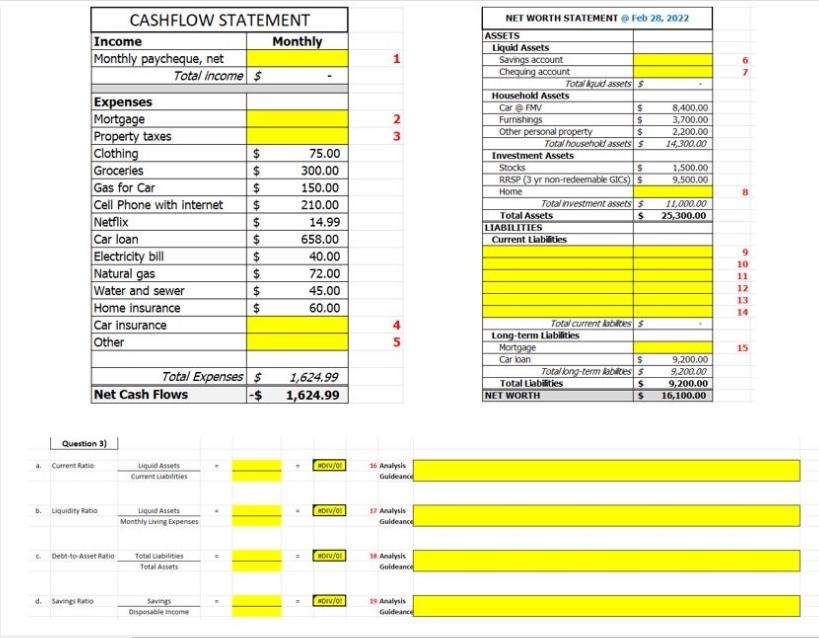

Bernard Blanger has been working full-time for the last 4 years. Last year, a close family friend, "Aunt Maria", suddenly passed away and left him an inheritance of $75,000. Bernard used the money, as a down payment, to buy a townhouse at the end of 2021 for $375,000. He obtained a 4.50% rate (compounded semi-annually), makes monthly payments, and used a 25- year amortization. The monthly blended mortgage payment is $1,660.42 due at the end of each month. As of February 28, 2022 Bernard has two months of accrued property taxes at $300 per month. Currently his utility bills for the month are unpaid. His utility bills are on a monthly budget plan and Bernard set them up with automatic pre-authorized payments (PAP) from his chequing account on the 5 of each month following. His $2,400/year car insurance and his house insurance are also paid using PAP in equal monthly installments on the first of each month. Although he is usually good at keeping receipts, he does have on average $200 miscellaneous cash withdrawals that he simply refers to as "other." With respect to debt, Bernard has two credit cards. He uses them for clothing, groceries and gas for his car and to collect travel points. Bernard pays them in full each month, usually around the 15- of the month following, so as not to carry a balance. In addition to his credit cards and mortgage, he also has a car loan. Bernard has no student debt. As far as the future, Bernard has a savings account with $1,900 in it that he uses for emergencies, and his vacation fund, and he has a chequing account with a current balance of $925. There is an RRSP account at his bank and some stocks he purchased for long-term investment purposes that his Aunt Maria helped him establish over the past few years. Bernard currently takes home $3,900 every month. Having Maria pass away started to make Bernard think about his future. Although he did graduate with a university degree, he does not have a high level of personal finance knowledge. He started to fill in a cash flow and net worth statement but needs your help to complete it. a. b. Income Monthly paycheque, net Expenses Mortgage Property taxes Clothing Groceries Question 3) Current Ratio d. Savings Ratio CASHFLOW STATEMENT Gas for Car Cell Phone with internet Netflix Car loan Electricity bill Natural gas Water and sewer Home insurance Car insurance Other Liquidity Ratio Debt-to-Asset Ratio Total income Net Cash Flows Liquid Assets Current Liabilities Liquid Assets Monthly Living Expenses Total Liabilities Total Assets $ $ $ $ $ $ Savings Disposable income SSSS Total Expenses $ -$ $ $ $ $ Monthly 75.00 300.00 150.00 210.00 14.99 658.00 40.00 72.00 45.00 60.00 1,624.99 1,624.99 worv/0 DIV/0! #DIV/0! DIV/0! 1 23 3 4 5 16 Analysis Guideance 17 Analysis Guideance 16 Analysis Guideance 19 Analysis Guideance NET WORTH STATEMENT @ Feb 28, 2022 ASSETS Liquid Assets Savings account Chequing account Household Assets Car FMV Total quid assets $ $ $ $ Total household assets $ Furnishings Other personal property Investment Assets Stocks $ RRSP (3 yr non-redeemable GICS) S Home Total investment assets $ S Total Assets LIABILITIES Current Liabilities Mortgage Car iban Total current abilities S Long-term Liabilities $ Total long-term labilities $ Total Liabilities NET WORTH $ $ 8,400.00 3,700.00 2,200.00 14,300.00 1,500.00 9,500.00 11,000.00 25,300.00 9,200.00 9,200.00 9,200.00 16,100.00 6 7 9 10 11 12 13 14 15

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started