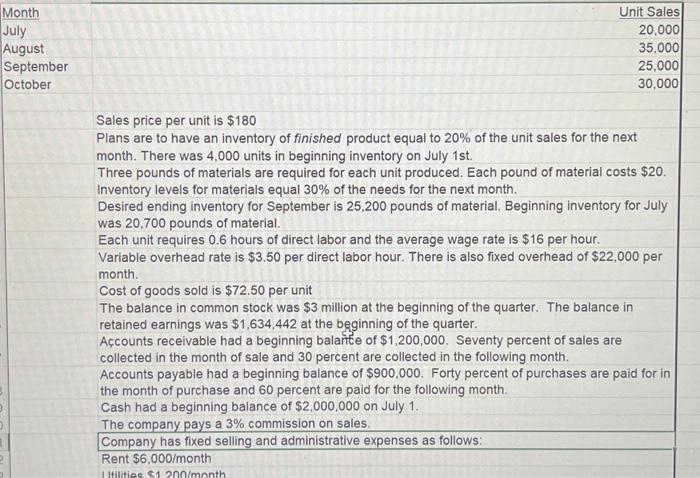

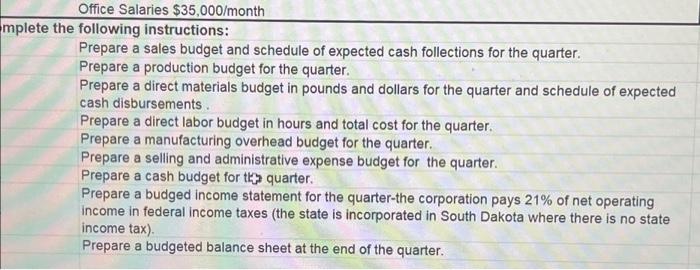

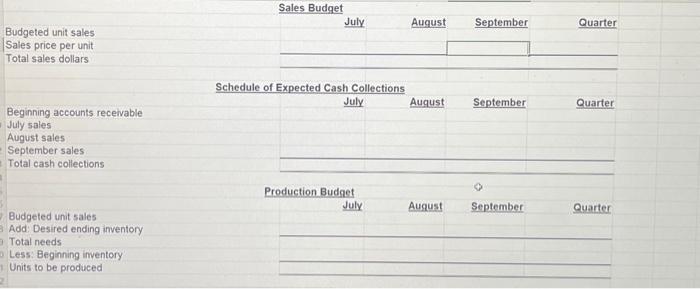

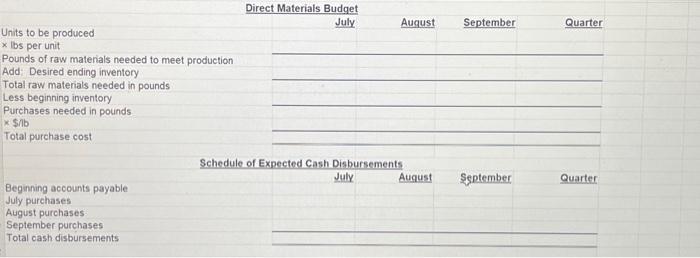

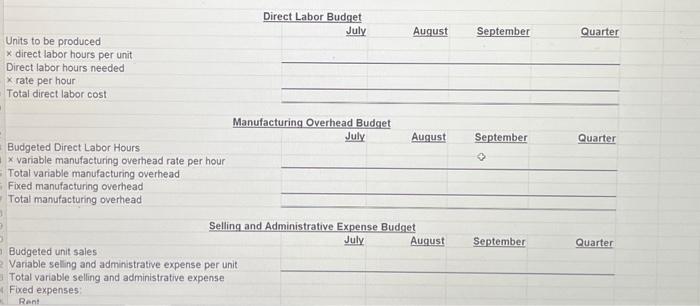

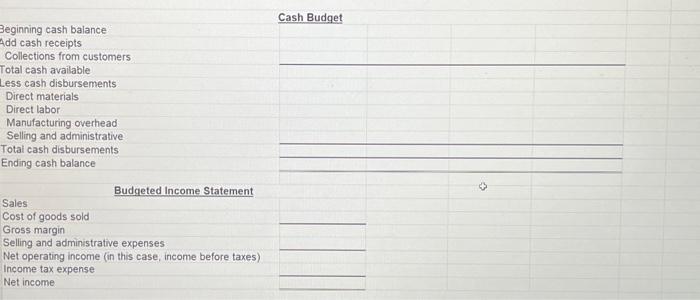

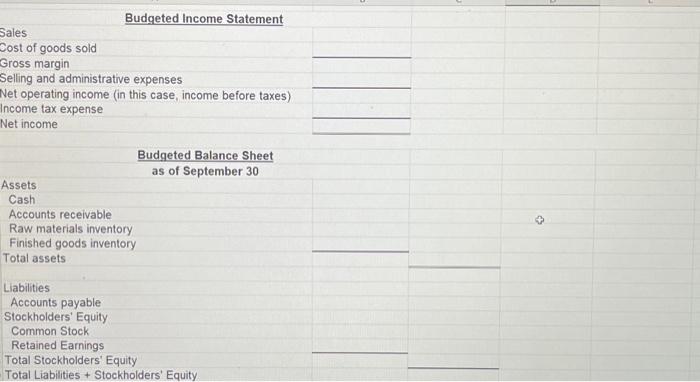

Plans are to have an inventory of finished product equal to 20% of the unit sales for the next month. There was 4,000 units in beginning inventory on July 1 st. Three pounds of materials are required for each unit produced. Each pound of material costs $20. Inventory levels for materials equal 30% of the needs for the next month. Desired ending inventory for September is 25,200 pounds of material. Beginning inventory for July was 20.700 pounds of material. Each unit requires 0.6 hours of direct labor and the average wage rate is $16 per hour. Variable overhead rate is $3.50 per direct labor hour. There is also fixed overhead of $22,000 per month. Cost of goods sold is $72.50 per unit The balance in common stock was $3 million at the beginning of the quarter. The balance in retained earnings was $1,634,442 at the beginning of the quarter. Accounts receivable had a beginning balartce of $1,200,000. Seventy percent of sales are collected in the month of sale and 30 percent are collected in the following month. Accounts payable had a beginning balance of $900,000. Forty percent of purchases are paid for in the month of purchase and 60 percent are paid for the following month. Cash had a beginning balance of $2,000,000 on July 1 . The company pays a 3% commission on sales. Company has fixed selling and administrative expenses as follows: Rent $6,000/ month Office Salaries $35,000/ month mplete the following instructions: Prepare a sales budget and schedule of expected cash follections for the quarter. Prepare a production budget for the quarter. Prepare a direct materials budget in pounds and dollars for the quarter and schedule of expected cash disbursements. Prepare a direct labor budget in hours and total cost for the quarter. Prepare a manufacturing overhead budget for the quarter. Prepare a selling and administrative expense budget for the quarter. Prepare a cash budget for thes quarter. Prepare a budged income statement for the quarter-the corporation pays 21% of net operating income in federal income taxes (the state is incorporated in South Dakota where there is no state income tax). Prepare a budgeted balance sheet at the end of the quarter. Sales Budget Budgeted unit sales Sales price per unit Total sales dollars Schedule of Expected Cash Collections July August September Quarter Beginning accounts recelvable July sales August sales September sales Total cash collections Production Budget Budgeted unit sales Add: Desired ending inventory Total needs Less: Beginning inventory Units to be produced Direct Materials Budget July Auqust September Quarter Units to be produced x lbs per unit Pounds of raw materials needed to meet production Add: Desired ending inventory Total raw materials needed in pounds Less beginning inventory Purchases needed in pounds x \$ilb Total purchase cost Schedule of Expected Cash Disbursements July August September Quarter Beginning accounts payable July purchases August purchases September purchases Total cash disbursements Direct Labor Budget Units to be produced x direct labor hours per unit Direct labor hours needed x rate per hour Total direct labor cost Manufacturing Overhead Budget Budgeted Direct Labor Hours * variable manufacturing overhead rate per hour Total variable manufacturing overhead Fixed manufacturing overhead Total manufacturing overhead Selling and Administrative Expense Budget Budgeted unit sales Variable seling and administrative expense per unit Total variable selling and administrative expense Fixed expenses: Cash Budget Beginning cash balance Add cash receipts Collections from customers Total cash available Less cash disbursements Direct materials Direct labor Manufacturing overhead Selling and administrative Totai cash disbursements Ending cash balance Budgeted Income Statement Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income (in this case, income before taxes) Income tax expense Net income Budgeted Income Statement Sales Cost of goods sold Gross margin Selling and administrative expenses Net operating income (in this case, income before taxes) Income tax expense Net income Budgeted Balance Sheet as of September 30 Assets Cash Accounts receivable Raw materials inventory Finished goods inventory Total assets Liabilities Accounts payable Stockholders' Equity Common Stock Retained Earnings Total Stockholders' Equity Total Liabilities + Stockholders' Equity