Answered step by step

Verified Expert Solution

Question

1 Approved Answer

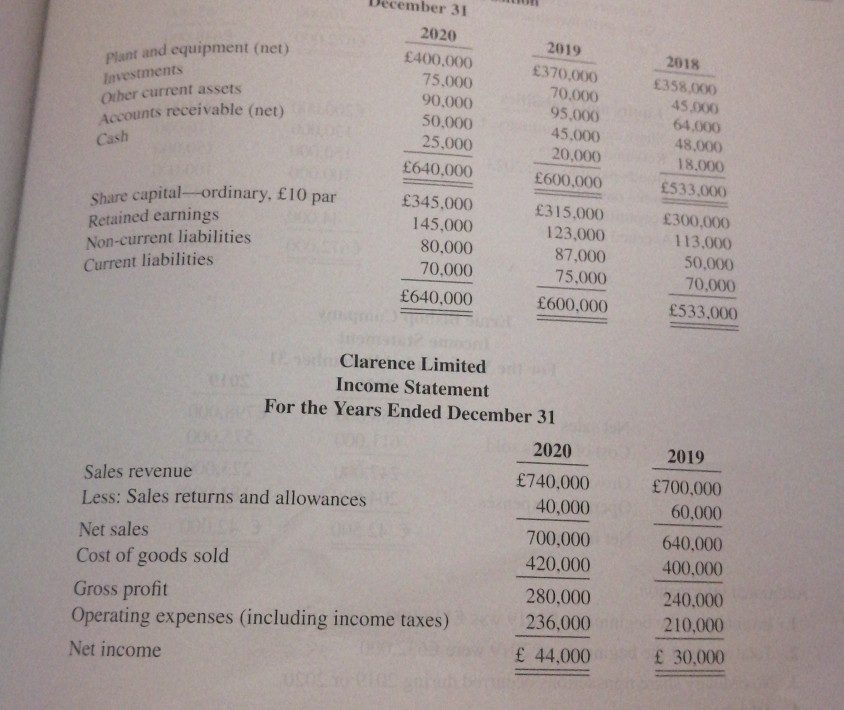

Plant and equipment (net) 2019 2018 Investments 370,000 Other current assets Accounts receivable (net) December 31 2020 400,000 75.000 90.000 50,000 25,000 640,000 70,000 95.000

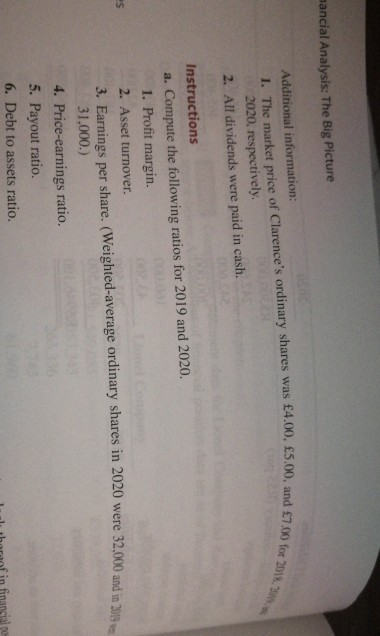

Plant and equipment (net) 2019 2018 Investments 370,000 Other current assets Accounts receivable (net) December 31 2020 400,000 75.000 90.000 50,000 25,000 640,000 70,000 95.000 45.000 20,000 600,000 Share capital-ordinary, 10 par Retained earnings Non-current liabilities Current liabilities 345.000 145.000 80,000 70,000 640,000 358.000 45.000 64.000 48.000 18.000 533.000 300.000 113,000 50.000 70,000 533.000 315,000 123.000 87,000 75.000 600,000 2019 700,000 Clarence Limited Income Statement For the Years Ended December 31 2020 Sales revenue 740.000 Less: Sales returns and allowances 40,000 Net sales 700,000 Cost of goods sold 420.000 Gross profit 280,000 Operating expenses (including income taxes) 236,000 Net income 44.000 60,000 640,000 400,000 240.000 210,000 30.000 mancial Analysis: The Big Picture 0)and 7.00 for 2018. Additional information: 1. The market price of Clarence's ordinary shares was 4.00, 5.00, and 2020, respectively. 2. All dividends were paid in cash. Instructions a. Compute the following ratios for 2019 and 2020. 1. Profit margin. 2. Asset turnover. 3. Earnings per share. (Weighted-average ordinary shares in 2020 were 32,000 and in 2010 31.000.) 4. Price-earnings ratio. 5. Payout ratio. 6. Debt to assets ratio. Jual thoreof in financial

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started