Answered step by step

Verified Expert Solution

Question

1 Approved Answer

plase check if answers are correct You are willing to pay $640 monthly for a car loan and currently have $3,000 that can be used

plase check if answers are correct

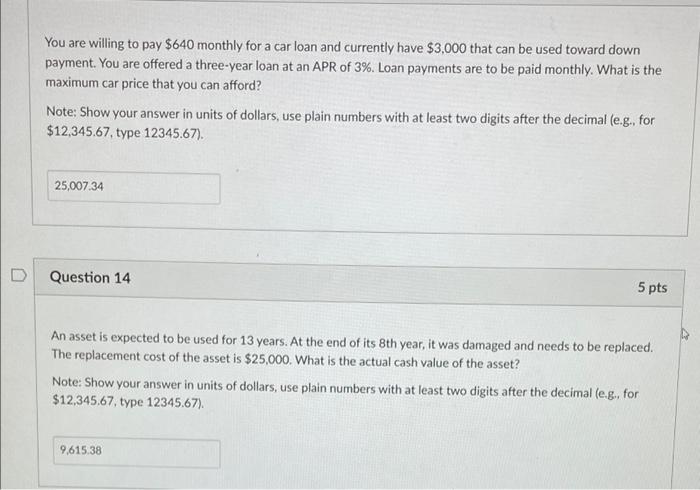

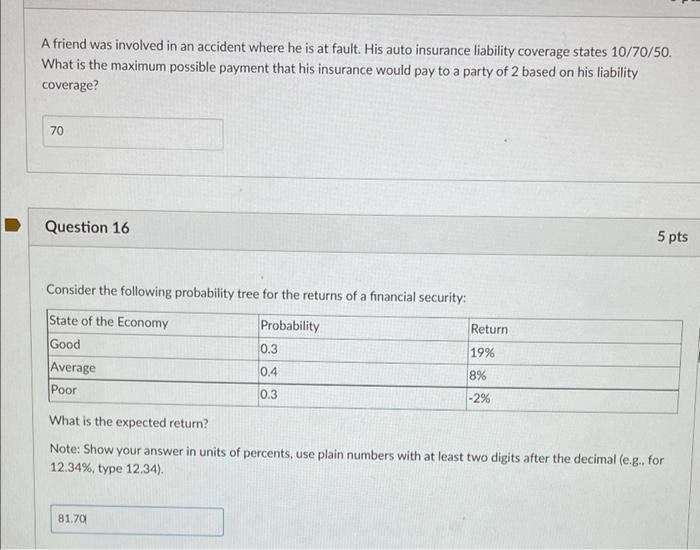

You are willing to pay $640 monthly for a car loan and currently have $3,000 that can be used toward down payment. You are offered a three-year loan at an APR of 3%. Loan payments are to be paid monthly. What is the maximum car price that you can afford? Note: Show your answer in units of dollars, use plain numbers with at least two digits after the decimal (e.g., for $12,345.67 type 12345.67). 25,007.34 Question 14 5 pts An asset is expected to be used for 13 years. At the end of its 8th year, it was damaged and needs to be replaced. The replacement cost of the asset is $25,000. What is the actual cash value of the asset? Note: Show your answer in units of dollars, use plain numbers with at least two digits after the decimal (eg, for $12,345.67, type 12345.67) 9,615.38 A friend was involved in an accident where he is at fault. His auto insurance liability coverage states 10/70/50. What is the maximum possible payment that his insurance would pay to a party of 2 based on his liability coverage? 70 Question 16 5 pts Consider the following probability tree for the returns of a financial security: Return State of the Economy Good Average Poor Probability 0.3 0.4 19% 8% -2% 0.3 What is the expected return? Note: Show your answer in units of percents, use plain numbers with at least two digits after the decimal (e.g., for 12.34%, type 12.34). 81.70

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started