Plateau Pharmaceuticals Limited (Plateau), is a Namibian publicly listed company in the Health sector. Plateau, manufactures medical drugs for sale to various pharmacies (retail outlets)

Plateau Pharmaceuticals Limited (Plateau), is a Namibian publicly listed company in the Health sector. Plateau, manufactures medical drugs for sale to various pharmacies (retail outlets) and to medical institutions. Plateau decided to expand its operations in the health sector in Namibia and the existence of free cash flows at the end of September 2020 encouraged the decision. After comprehensive market research and financial analysis of the viability of various listed companies in the sector, Plateau decided to invest in Savanna Medical Facilities Limited (Savannah).

Savannah is listed on the Namibian Stock Exchange which manufactures the raw material required to produce medical drugs. Plateau gained control of Savanna on 1 October 2020 when all control assessment conditions were satisfied in accordance with IFRS 10: Consolidated Financial Statements. You are an intern at Plateau and you were working closely with the Financial Accountant of the Group Mr. Knowitall, who was suddenly attacked by the new Omicron BA12 variant of the coronavirus. The Group Finance Director Mrs. Nononsense knows you have been working with Mr. Knowitall and hence give you the following information for the group. On 1 October 2020 Plateau acquired 3 million equity shares in Savannah by an exchange of one share in Plateau for every two shares in Savannah plus N$1.25 per acquired Savannah share in cash. The market price of each Plateau share at the date of acquisition was N$6. Savannah also expects Plateau to pay an additional amount of N$1 000 000 at the end of 30 June 2025 as part of the consideration transferred. The cost of capital for Plateau is 14% p.a. Only the cash consideration paid of the above investments has been recorded by Plateau.

In addition, N$500,000 of professional costs relating to the acquisition of Savannah are also included in the cost of the investment. At the date of acquisition, the fair values of Savannah’s assets were equal to their carrying amounts with the exception of Savannah’s land which had a fair value of N$500,000 below it’s carrying amount; it was written down by this amount shortly after acquisition and has not changed in value since then. During the year ended 30 September, 2021 Savannah sold goods to Plateau for N$2.7 million. Savannah’s profit on sales of these goods is 33 1/3%. Plateau had a third of the goods still in its inventory on 30 September 2021. There were no intragroup payables/receivables on 30 September 2021. The fair value through profit or loss investments is included in Plateau’s statement of financial position (above) at their fair value on 1 October 2020, but they have a fair value of N$9 million on 30 September 2021. Plateau sold an asset with a carrying amount of N$ 500 000 to Savanna on 1 May 2021 for an amount of N$600 000. On the date of sale, the asset’s remaining useful life was 4 years.

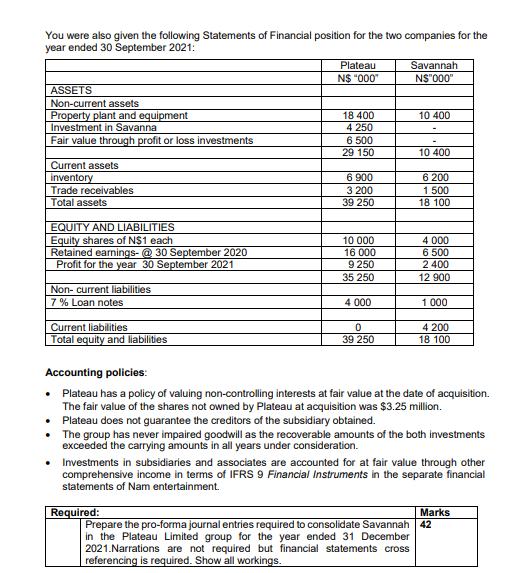

You were also given the following Statements of Financial position for the two companies for the year ended 30 September 2021: ASSETS Non-current assets. Property plant and equipment Investment in Savannal Fair value through profit or loss investments Current assets inventory Trade receivables Total assets EQUITY AND LIABILITIES Equity shares of N$1 each Retained earnings- @ 30 September 2020 Profit for the year 30 September 2021 Non- current liabilities 7% Loan notes Current liabilities Total equity and liabilities Plateau N$"000" 18 400 4 250 6 500 29 150 6 900 3 200 39 250 10 000 16 000 9 250 35 250 4 000 0 39 250 Savannah. N$"000" 10 400 10 400 6 200 1.500 18 100 4 000 6 500 2400 12 900 1 000 4 200 18 100 Accounting policies: Plateau has a policy of valuing non-controlling interests at fair value at the date of acquisition. The fair value of the shares not owned by Plateau at acquisition was $3.25 million. Plateau does not guarantee the creditors of the subsidiary obtained. The group has never impaired goodwill as the recoverable amounts of the both investments exceeded the carrying amounts in all years under consideration. Investments in subsidiaries and associates are accounted for at fair value through other comprehensive income in terms of IFRS 9 Financial Instruments in the separate financial statements of Nam entertainment. Required: Marks Prepare the pro-forma journal entries required to consolidate Savannah 42 in the Plateau Limited group for the year ended 31 December 2021.Narrations are not required but financial statements cross referencing is required. Show all workings.

Step by Step Solution

3.46 Rating (149 Votes )

There are 3 Steps involved in it

Step: 1

Proforma Jounal entries Particulous Dr Cash Cr Accou...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started