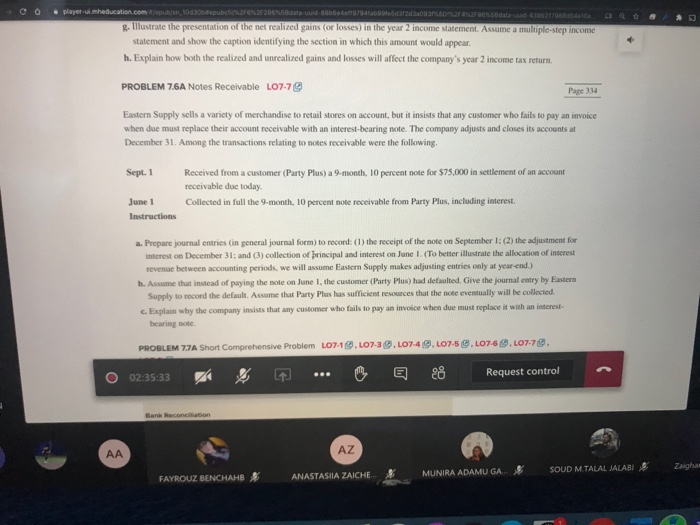

player.meducation.com/en_10032F1.2 2001 data-68664ed9794ebda2002.2datud 4300277000 R. Illustrate the presentation of the net realized gains (or losses) in the year 2 income statement. Assume a multiple-step income statement and show the caption identifying the section in which this amount would appear. h. Explain how both the realized and unrealized gains and losses will affect the company's year 2 income tax return. PROBLEM 7.6A Notes Receivable 107.7 Page 34 Eastern Supply sells a variety of merchandise to retail stores on account, but it insists that any customer who fails to pay an invoice when due must replace their account receivable with an interest-bearing note. The company adjusts and closes its accounts at December 31. Among the transactions relating to notes receivable were the following Sept. 1 Received from a customer (Party Plus) a 9-month, 10 percent note for $75,000 in settlement of an account receivable due today Collected in full the 9-month, 10 percent note receivable from Party Plus, including interest June 1 Instructions a. Prepare journal entries (in general journal form) to record: (1) the receipt of the note on September 1. (2) the adjustment for interest on December 31; and (3) collection of brincipal and interest on June 1. (To better illustrate the allocation of interest revenue between accounting periods, we will assume Eastern Supply makes adjusting entries only at year-end.) h. Assume that instead of paying the note on June 1, the customer (Party Plus) had defaulted. Give the journal entry by Fastern Supply to record the default Assume that Party Plus has sufficient resources that the note eventually will be collected c. Explain why the company insists that any customer who fails to pay an invoice when due must replace it with an interest bearing note PROBLEM ZJA Short Comprehensive Problem L07-19. LO73. L07-4. L07-5.LO7-6.107-79. 02:35:33 eee 28 Request control Bank Reconciation AA AZ Zaiga SOUD M.TALAL JALABIS MUNIRA ADAMU GA FAYROUZ BENCHAHB & ANASTASIIA ZAICHE player.meducation.com/en_10032F1.2 2001 data-68664ed9794ebda2002.2datud 4300277000 R. Illustrate the presentation of the net realized gains (or losses) in the year 2 income statement. Assume a multiple-step income statement and show the caption identifying the section in which this amount would appear. h. Explain how both the realized and unrealized gains and losses will affect the company's year 2 income tax return. PROBLEM 7.6A Notes Receivable 107.7 Page 34 Eastern Supply sells a variety of merchandise to retail stores on account, but it insists that any customer who fails to pay an invoice when due must replace their account receivable with an interest-bearing note. The company adjusts and closes its accounts at December 31. Among the transactions relating to notes receivable were the following Sept. 1 Received from a customer (Party Plus) a 9-month, 10 percent note for $75,000 in settlement of an account receivable due today Collected in full the 9-month, 10 percent note receivable from Party Plus, including interest June 1 Instructions a. Prepare journal entries (in general journal form) to record: (1) the receipt of the note on September 1. (2) the adjustment for interest on December 31; and (3) collection of brincipal and interest on June 1. (To better illustrate the allocation of interest revenue between accounting periods, we will assume Eastern Supply makes adjusting entries only at year-end.) h. Assume that instead of paying the note on June 1, the customer (Party Plus) had defaulted. Give the journal entry by Fastern Supply to record the default Assume that Party Plus has sufficient resources that the note eventually will be collected c. Explain why the company insists that any customer who fails to pay an invoice when due must replace it with an interest bearing note PROBLEM ZJA Short Comprehensive Problem L07-19. LO73. L07-4. L07-5.LO7-6.107-79. 02:35:33 eee 28 Request control Bank Reconciation AA AZ Zaiga SOUD M.TALAL JALABIS MUNIRA ADAMU GA FAYROUZ BENCHAHB & ANASTASIIA ZAICHE