Question

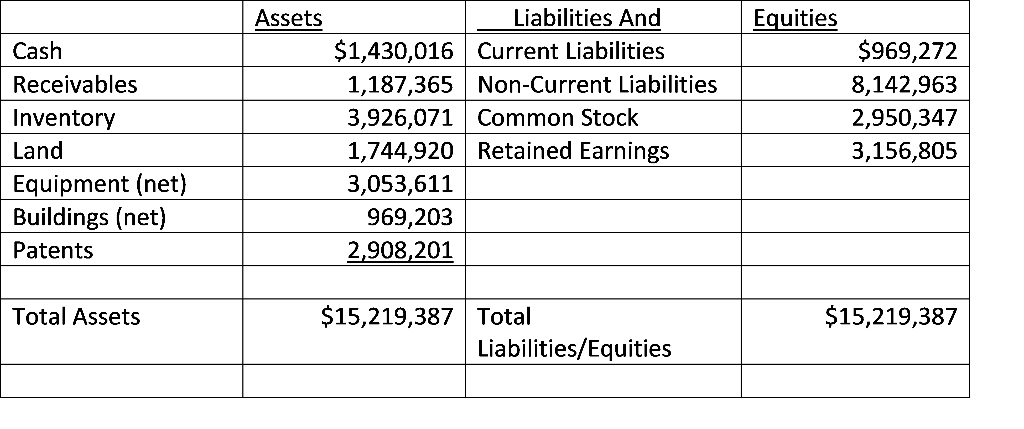

Playground Co. acquired 100 percent of Sandbox's outstanding stock for $29,082,045 cash on January 1, 2023, when Sandbox Company had the following balance sheet: At

Playground Co. acquired 100 percent of Sandbox's outstanding stock for $29,082,045 cash on January 1, 2023, when Sandbox Company had the following balance sheet:

At the purchase date, the fair market values of each identifiable asset and liability that differed from book value were as follows:

Land $1,454,100

Equipment 4,362,301 (15-year estimated useful life)

Buildings 1,211,750 (20-year estimated useful life)

Patents 6,834,272 (10-year estimated useful life)

The following additional information is available:

- During 2023, Sandbox earns $1,560,732 and paid dividends of $290,727. In 2024, Sandbox earned $1,866,096 and paid dividends of $349,009. In 2025 Sandbox earned $2,447,736 and paid dividends of $484,700.

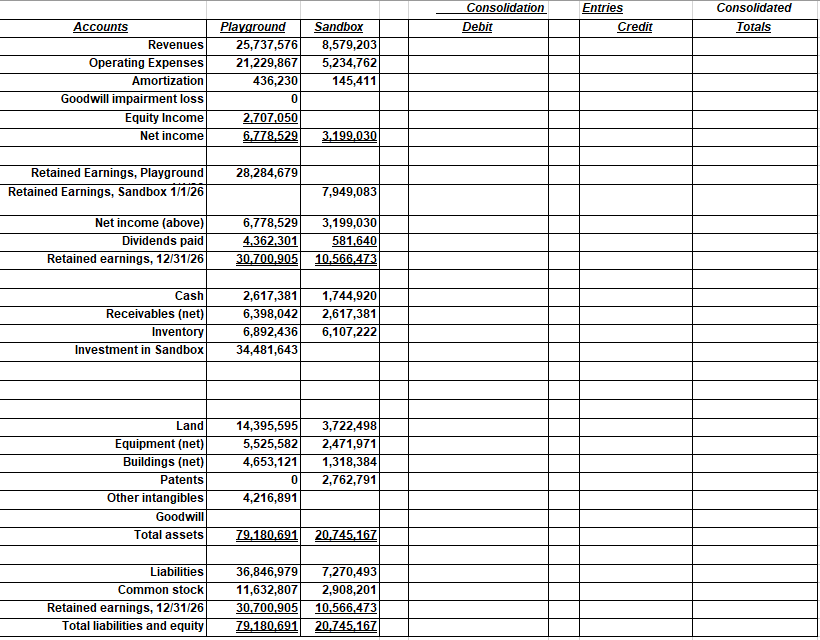

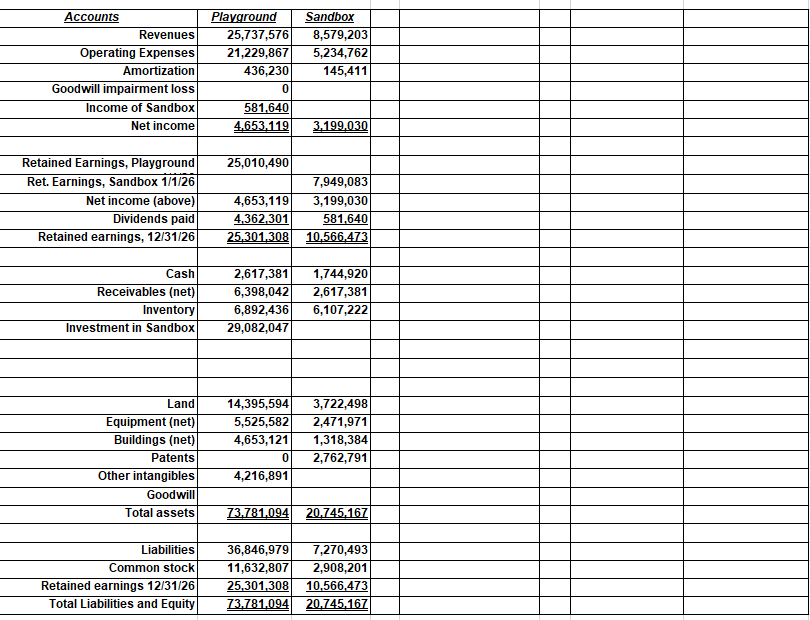

- Selected amounts from Playground and Sandbox's separate financial statements at December 31, 2026, are presented in the Consolidated Worksheet.

- Playground has 2,374,042 common shares outstanding for EPS calculations and reported $66,888,622 of consolidated assets at the beginning of the year.

REQUIRED:

1. Prepare the consolidation entries for 12/31/2026 necessary to complete both worksheets.

2. Complete the attached worksheets.

3. Provide an explanation or schedule showing how the balances were determined for:

a. Equity Income (worksheet 1)

b. Income of Sandbox (worksheet 2)

c. Investment in Sandbox (worksheets 1 and 2)

4. Show what gives rise to the difference between 1/1/26 balance in Playground's Retained Earnings on the two worksheets.

5. For purposes of questions 1-5, assume there is no potential goodwill impairment.

6. If at the end of 2026, Playground believes that goodwill in Sandbox should be measured for potential impairment, how would this impact the consolidated financials (be specific as to accounts and amounts) if Playground were to estimate the fair value of Sandbox at 12/31/26 as $26,755,448. Are there options as to how to record an impairment loss related to an investment in an acquired company?

7. Provide any additional documentation (calculations, schedules, etc.) you feel are necessary to complement your work.

Cash Receivables Inventory Land Equipment (net) Buildings (net) Patents Total Assets Assets Liabilities And Current Liabilities $1,430,016 1,187,365 Non-Current Liabilities 3,926,071 Common Stock 1,744,920 Retained Earnings 3,053,611 969,203 2,908,201 $15,219,387 Total Liabilities/Equities Equities $969,272 8,142,963 2,950,347 3,156,805 $15,219,387

Step by Step Solution

3.38 Rating (154 Votes )

There are 3 Steps involved in it

Step: 1

1 The consolidation entries for 12312026 would be as follows Dr Accounts Receivable 1560732 Cr Sales 1560732 Dr Inventory 1866096 Cr Cost of Goods Sold 1866096 Dr Accounts Receivable 2447736 Cr Sales ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started