Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Play-More Toys produces inflatable beach balls, selling $56438 balls per year. Each ball produced has a variable operating cost of $7 and sells for

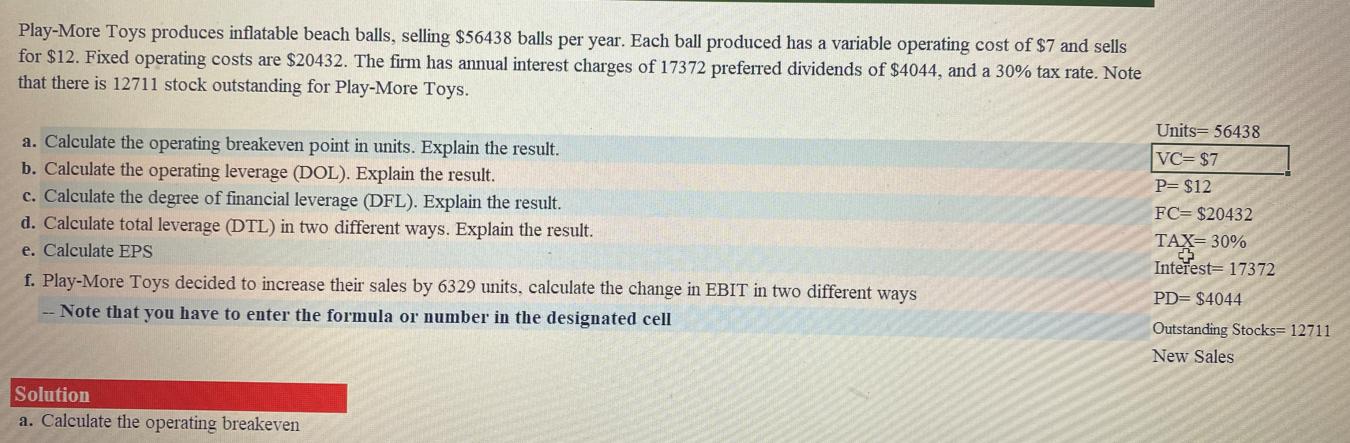

Play-More Toys produces inflatable beach balls, selling $56438 balls per year. Each ball produced has a variable operating cost of $7 and sells for $12. Fixed operating costs are $20432. The firm has annual interest charges of 17372 preferred dividends of $4044, and a 30% tax rate. Note that there is 12711 stock outstanding for Play-More Toys. a. Calculate the operating breakeven point in units. Explain the result. b. Calculate the operating leverage (DOL). Explain the result. c. Calculate the degree of financial leverage (DFL). Explain the result. d. Calculate total leverage (DTL) in two different ways. Explain the result. e. Calculate EPS f. Play-More Toys decided to increase their sales by 6329 units, calculate the change in EBIT in two different ways Note that you have to enter the formula or number in the designated cell Units=56438 VC=$7 P= $12 FC= $20432 TAX= 30% TAX Interest 17372 PD= $4044 Outstanding Stocks= 12711 New Sales Solution a. Calculate the operating breakeven

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started