Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Plaza Company signed a 20-month lease on October 1, 20x1 for a copier machine from Lopez Office Supplies. The lease payments are $400 per

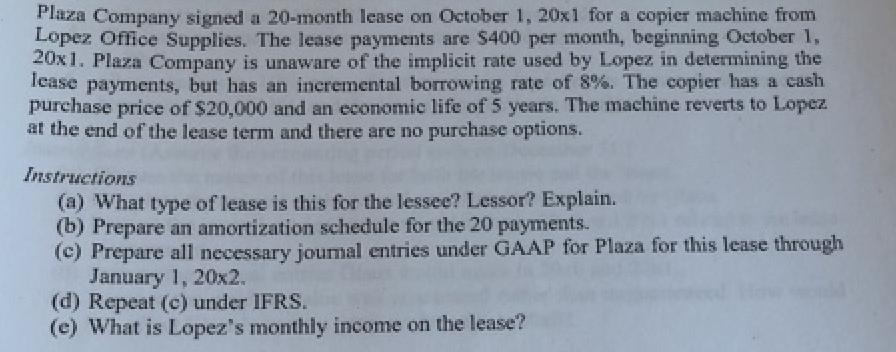

Plaza Company signed a 20-month lease on October 1, 20x1 for a copier machine from Lopez Office Supplies. The lease payments are $400 per month, beginning October 1, 20x1. Plaza Company is unaware of the implicit rate used by Lopez in determining the lease payments, but has an incremental borrowing rate of 8%. The copier has a cash purchase price of $20,000 and an economic life of 5 years. The machine reverts to Lopez at the end of the lease term and there are no purchase options. Instructions (a) What type of lease is this for the lessee? Lessor? Explain. (b) Prepare an amortization schedule for the 20 payments. (c) Prepare all necessary journal entries under GAAP for Plaza for this lease through January 1, 20x2. (d) Repeat (c) under IFRS. (e) What is Lopez's monthly income on the lease?

Step by Step Solution

★★★★★

3.42 Rating (171 Votes )

There are 3 Steps involved in it

Step: 1

a Type of Lease For the Lessee Plaza Company This lease is classified as a Finance Lease Capital Lease for the lessee under both GAAP and IFRS This is ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started