Answered step by step

Verified Expert Solution

Question

1 Approved Answer

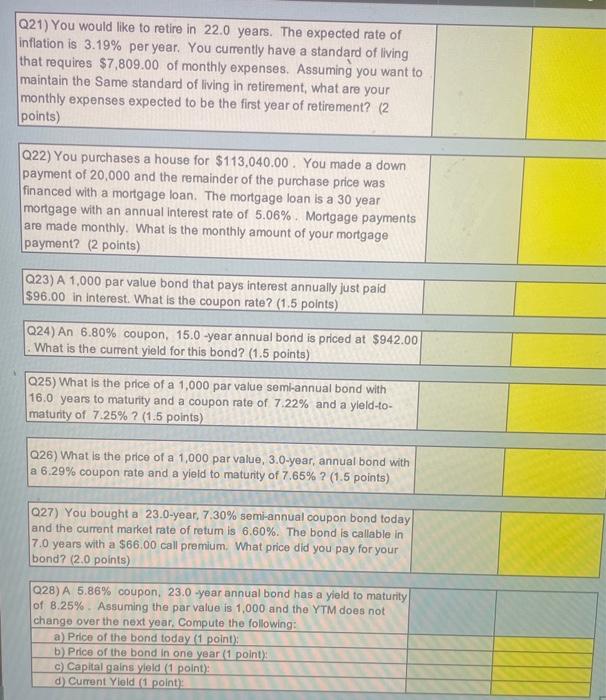

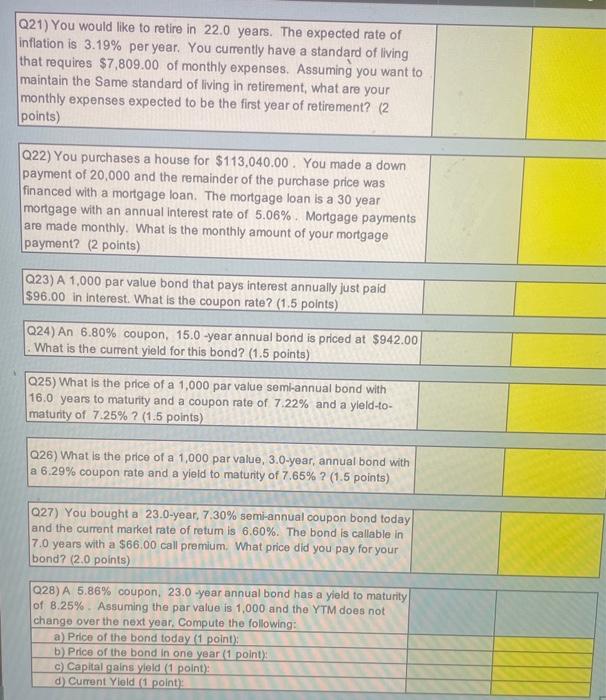

plea help with 21-28 thank you Q21) You would like to retire in 22.0 years. The expected rate of inflation is 3.19% per year. You

plea help with 21-28 thank you

Q21) You would like to retire in 22.0 years. The expected rate of inflation is 3.19% per year. You currently have a standard of living that requires $7,809.00 of monthly expenses. Assuming you want to maintain the Same standard of living in retirement, what are your monthly expenses expected to be the first year of retirement? (2) points) \begin{tabular}{|l|l|l} \hline Q22) You purchases a house for $113,040.00. You made a down \\ payment of 20,000 and the remainder of the purchase price was \\ financed with a mortgage loan. The mortgage loan is a 30 year \\ mortgage with an annual interest rate of 5.06%. Mortgage payments \\ are made monthly. What is the monthly amount of your mortgage \\ payment? (2 points) \end{tabular} Q23) A 1,000 par value bond that pays interest annually just paid $96.00 in interest. What is the coupon rate? ( 1.5 points) Q24) An 6.80% coupon, 15.0-year annual bond is priced at $942.00 What is the current yield for this bond? (1.5 points) Q25) What is the price of a 1,000 par value seml-annual bond with 16.0 years to maturity and a coupon rate of 7.22% and a yleld-tomaturity of 7.25% ? (1.5 points) Q26) What is the price of a 1,000 par value, 3.0-year, annual bond with a 6.29% coupon rate and a yield to maturity of 7.65% ? (1.5 points) Q27) You bought a 23.0-year, 7.30\% semi-annual coupon bond today and the current market rate of retum is 6.60%. The bond is callable in 7.0 years with a $66.00 call premium. What price did you pay for your bond? (2.0 points) Q28) A 5.86% coupon, 23.0-year annual bond has a yield to maturity of 8.25%. Assuming the par value is 1,000 and the YTM does not change over the next year, Compute the following: a) Price of the bond today ( 1 point): b) Price of the bond in one year (1 point): c) Capital gains yleld (1 point): d) Current Yleld (1 point)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started