Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pleaae help me with d and e. i did everything else i did A-C but i got stuck with d and e and would apperciate

pleaae help me with d and e. i did everything else

i did A-C but i got stuck with d and e and would apperciate your help.

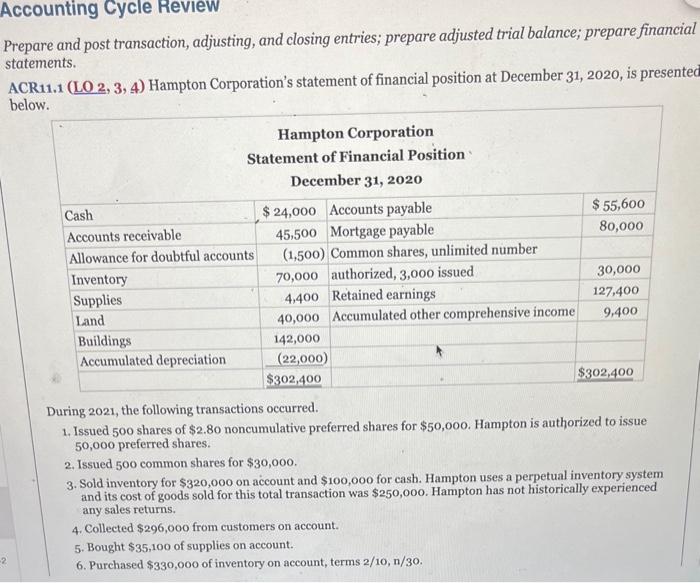

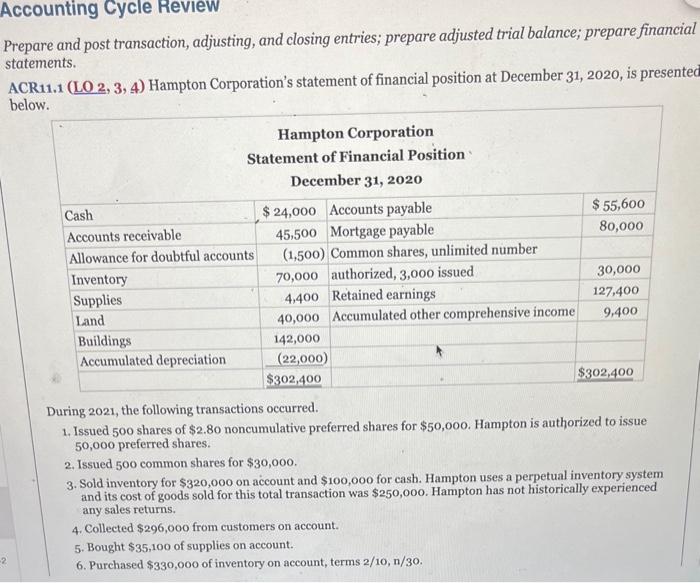

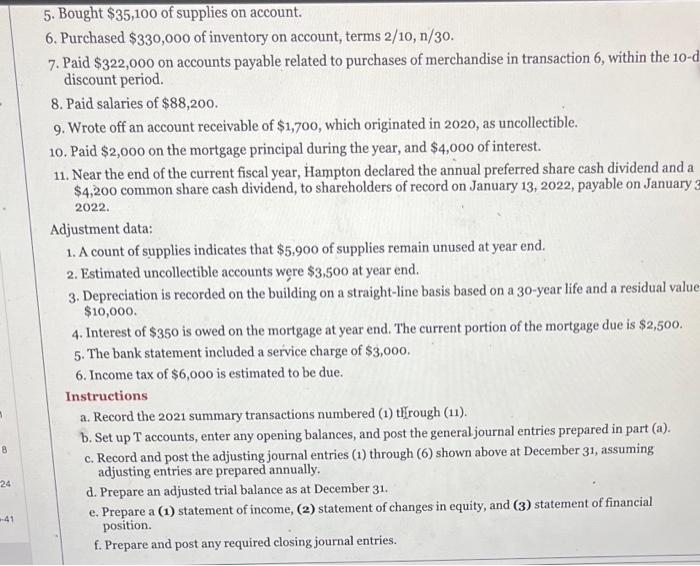

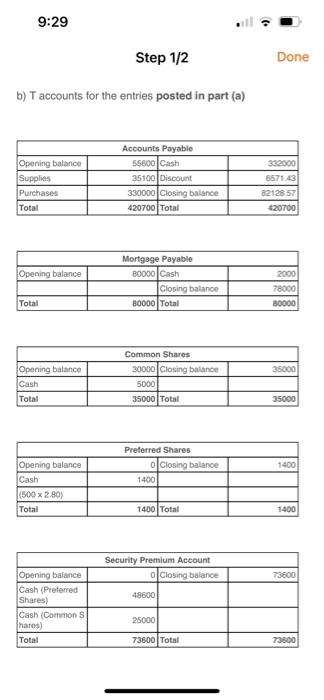

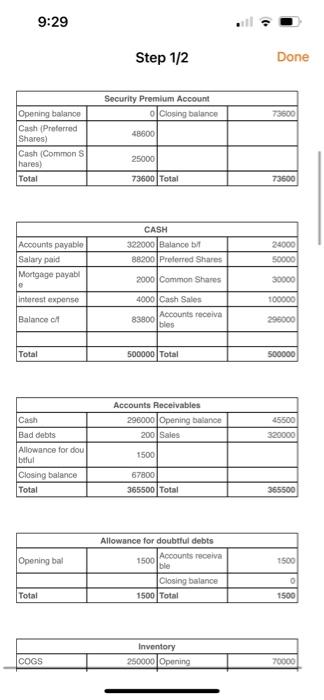

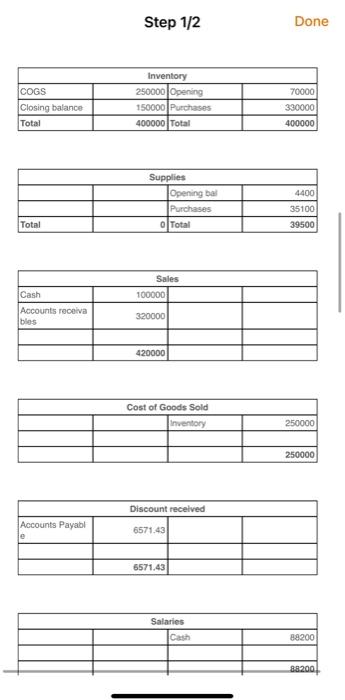

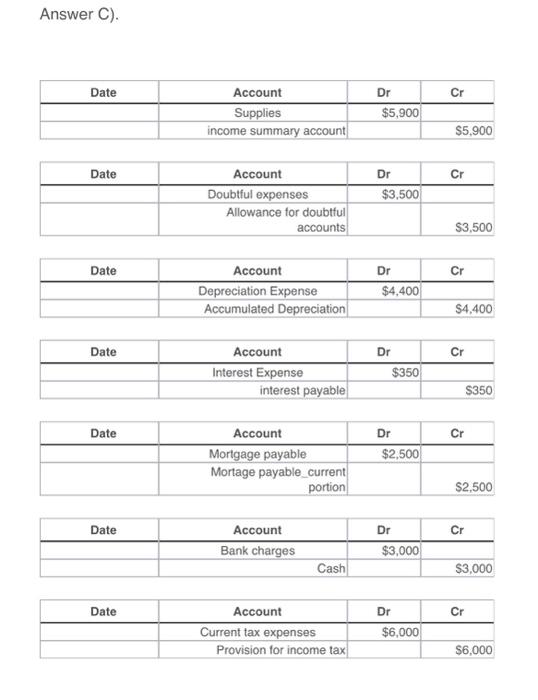

Prepare and post transaction, adjusting, and closing entries; prepare adjusted trial balance; prepare financial statements. ACR11.1 ( LO2,3,4 ) Hampton Corporation's statement of financial position at December 31, 2020, is presentec below. During 2021, the following transactions occurred. 1. Issued 500 shares of $2.80 noncumulative preferred shares for $50,000. Hampton is authorized to issue 50,000 preferred shares. 2. Issued 500 common shares for $30,000. 3. Sold inventory for $320,000 on account and $100,000 for cash. Hampton uses a perpetual inventory system and its cost of goods sold for this total transaction was $250,000. Hampton has not historically experienced any sales returns. 4. Collected $296,000 from customers on account. 5. Bought $35,100 of supplies on account. 6. Purchased $330,000 of inventory on account, terms 2/10,n/30. 5. Bought $35,100 of supplies on account. 6. Purchased $330,000 of inventory on account, terms 2/10, n/30. 7. Paid $322,000 on accounts payable related to purchases of merchandise in transaction 6 , within the 10-1 discount period. 8. Paid salaries of $88,200. 9. Wrote off an account receivable of $1,700, which originated in 2020 , as uncollectible. 10. Paid $2,000 on the mortgage principal during the year, and $4,000 of interest. 11. Near the end of the current fiscal year, Hampton declared the annual preferred share cash dividend and a $4,200 common share cash dividend, to shareholders of record on January 13,2022 , payable on January: 2022. Adjustment data: 1. A count of supplies indicates that $5,900 of supplies remain unused at year end. 2. Estimated uncollectible accounts were $3,500 at year end. 3. Depreciation is recorded on the building on a straight-line basis based on a 30 -year life and a residual valuc $10,000. 4. Interest of $350 is owed on the mortgage at year end. The current portion of the mortgage due is $2,500. 5. The bank statement included a service charge of $3,000. 6 . Income tax of $6,000 is estimated to be due. Instructions a. Record the 2021 summary transactions numbered (1) through (11). b. Set up T accounts, enter any opening balances, and post the general journal entries prepared in part (a). c. Record and post the adjusting journal entries (1) through (6) shown above at December 31 , assuming adjusting entries are prepared annually. d. Prepare an adjusted trial balance as at December 31 . e. Prepare a (1) statement of income, (2) statement of changes in equity, and (3) statement of financial position. f. Prepare and post any required closing journal entries. b) T accounts for the entries posted in part (a) Step 1/2 Step 1/2 Done \begin{tabular}{|l|r|l|r|} \hline \multicolumn{4}{|c|}{ Inventory } \\ \hline COGS & 250000 & Cpening & 70000 \\ \hline Closing balance & 150000 & Purchases & 330000 \\ \hline Total & 400000 & Total & 400000 \\ \hline \end{tabular} \begin{tabular}{|l|l|l|r|} \hline \multicolumn{3}{|c|}{ Supplies } \\ \hline & & Opening bal & 4400 \\ \hline & & Purchases & 35100 \\ \hline Total & 0 & Total & 39500 \\ \hline \end{tabular} \begin{tabular}{|l|r|l|l|} \hline \multicolumn{3}{|c|}{ Sales } \\ \hline Cash & 100000 & & \\ \hline Accounts rocoiva bles & 320000 & & \\ \hline & & & \\ \hline & 420000 & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|l|} \hline \multicolumn{3}{|c|}{ Cost of Goods Sold } \\ \hline & & Inventory & 250000 \\ \hline & & & \\ \hline & & & 250000 \\ \hline \end{tabular} \begin{tabular}{|l|c|l|l|} \hline \multicolumn{4}{|c|}{ Discount recelved } \\ \hline Accounts Payabl e & 6571.43 & & \\ \hline & & & \\ \hline & 6571.43 & & \\ \hline \end{tabular} \begin{tabular}{|l|l|l|r|} \hline \multicolumn{2}{|c|}{ Salaries } \\ \hline & & Cash & 88200 \\ \hline & & & 88200 \\ \hline & & & \\ \hline \end{tabular} Answer C). \begin{tabular}{|c|c|c|c|} \hline Date & Account & Dr & Cr \\ \hline & Supplies & $5,900 & \\ \hline & income summary account & & $5,900 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Date & Account & Dr & Cr \\ \hline & Doubtful expenses & $3,500 & \\ \hline & Allowance for doubtful accounts & & $3,500 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Date & Account & Dr & Cr \\ \hline & Depreciation Expense & $4,400 & \\ \hline & Accumulated Depreciation & & $4,400 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Date & Account & Dr & Cr \\ \hline & Interest Expense & $350 & \\ \hline & interest payable & & $350 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Date & Account & Dr & Cr \\ \hline & Mortgage payable & $2,500 & \\ \hline & Mortage payable_current & & \\ \hline & portion & & $2,500 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Date & Account & Dr & Cr \\ \hline & Bank charges & $3,000 & \\ \hline \multicolumn{2}{|c|}{ Cash } & & $3,000 \\ \hline & & & \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|} \hline Date & Account & Dr & Cr \\ \hline & Current tax expenses & $6,000 & \\ \hline & Provision for income tax & & $6,000 \\ \hline \end{tabular} Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started