Answered step by step

Verified Expert Solution

Question

1 Approved Answer

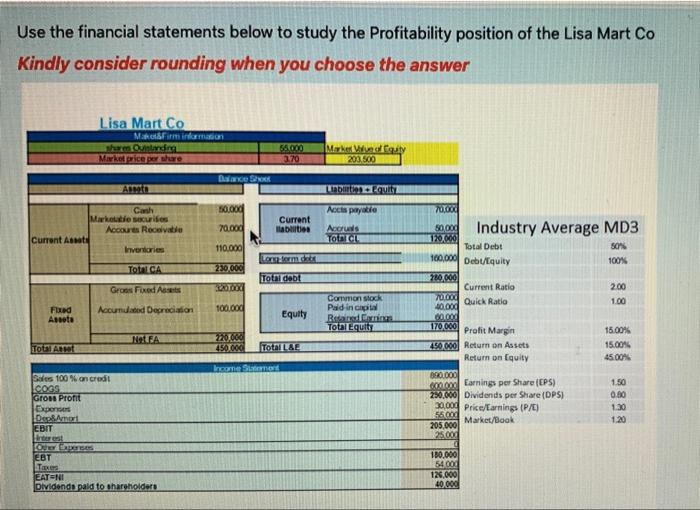

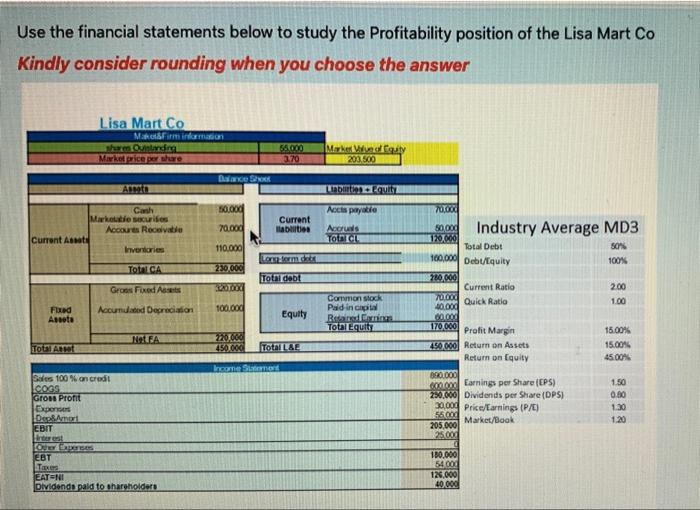

pleaase answer ASAAAP Use the financial statements below to study the Profitability position of the Lisa Mart Co Kindly consider rounding when you choose the

pleaase answer ASAAAP

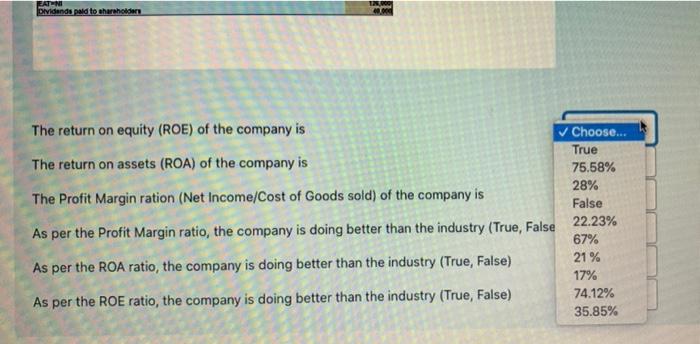

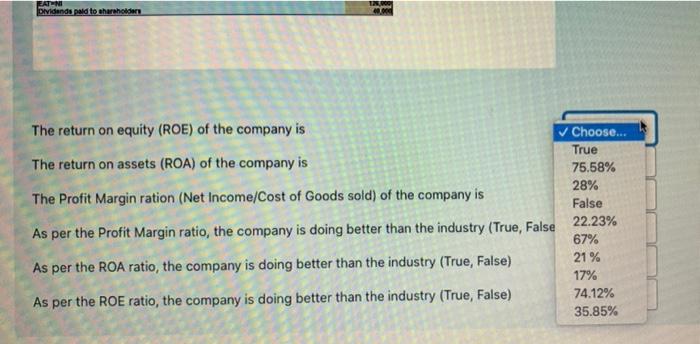

Use the financial statements below to study the Profitability position of the Lisa Mart Co Kindly consider rounding when you choose the answer Lisa Mart Co Mim information shem Quinlandia Market price per share 54.000 270 Marker Waduty 200500 Balance Art Labur quitt 50.000 Acts payable OOOO Canh Markete scribes Accounts Recevable Current Art Inventories 70.000 Current abiti Accu's TONIC 50,000 120.000 Industry Average MD3 110.000 Total Debt 50 100N mm 100.000 Debutquity TotalCA 230.000 Total debt Groes Fixed Assets 280,000 Current Ratio Tood Quick Ratio 40.000 00.000 200 1.00 Fixed Assets Accumulated Depreciation 100.000 Common stock Paid in Reading Total Equity Equity 170.000 Profit Margin NACEA 20 000 450.000 Tots Art Total LAE 15.00% 15.00% 45.00% Income Sales 100 Won credit COGS Gross Profit Exporters Dop&Amor EBIT 45.000 Return on Assets Return on Equity 800.000 Con Earnings per Share (EPS) 250.000 Dividends per Share (DPS) 30.000 Price/Earnings (P/E) Market/Book 205,000 1.50 0.00 1.30 1.20 55.000 25.000 OSTORE EBT Tea EATENI Dividend paid to shareholders 180.000 54000 120,000 40.000 IN EATON Dividends paid to shareholders The return on equity (ROE) of the company is Choose... True The return on assets (ROA) of the company is 75.58% 28% The Profit Margin ration (Net Income/Cost of Goods sold) of the company is False 22.23% As per the Profit Margin ratio, the company is doing better than the industry (True, False 67% 21% As per the ROA ratio, the company is doing better than the industry (True, False) 17% 74.12% As per the ROE ratio, the company is doing better than the industry (True, False) 35.85%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started