Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pleadse help with the internal controld audit Financial Test Results Result #1 Sharon prepares a draft management representation letter for Jo, the partner, to review

Pleadse help with the internal controld audit

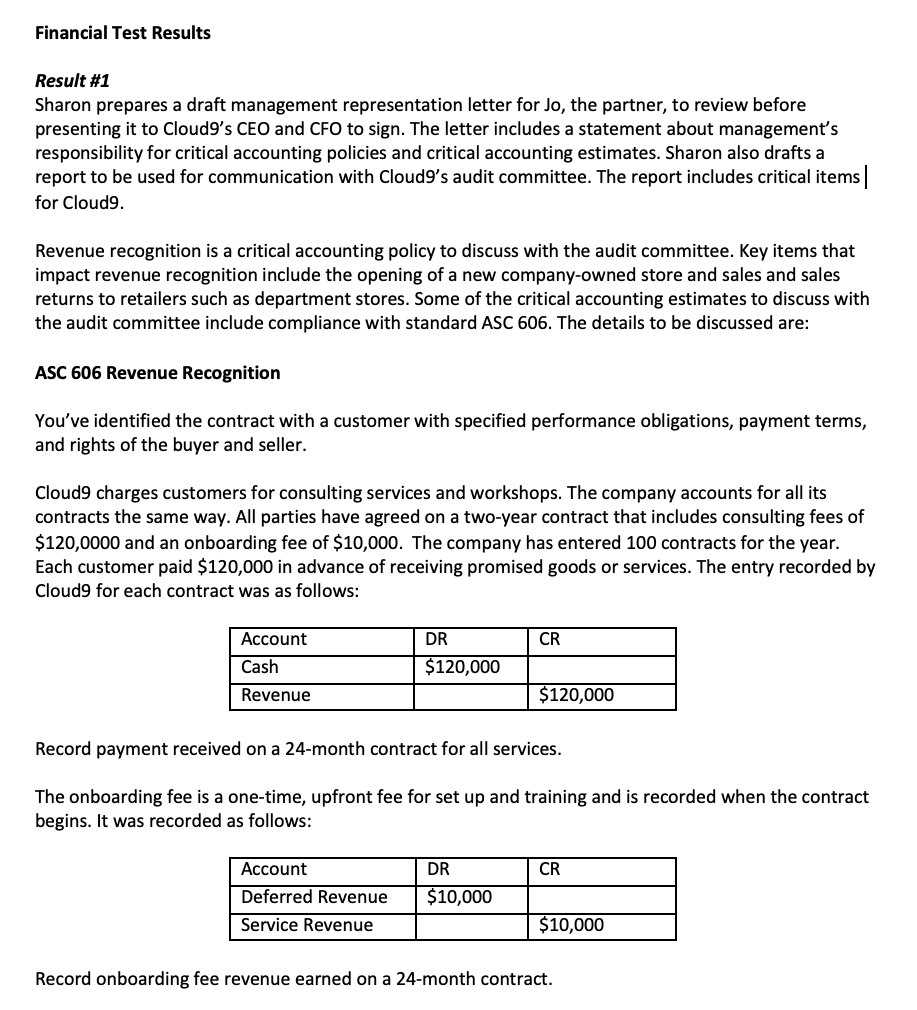

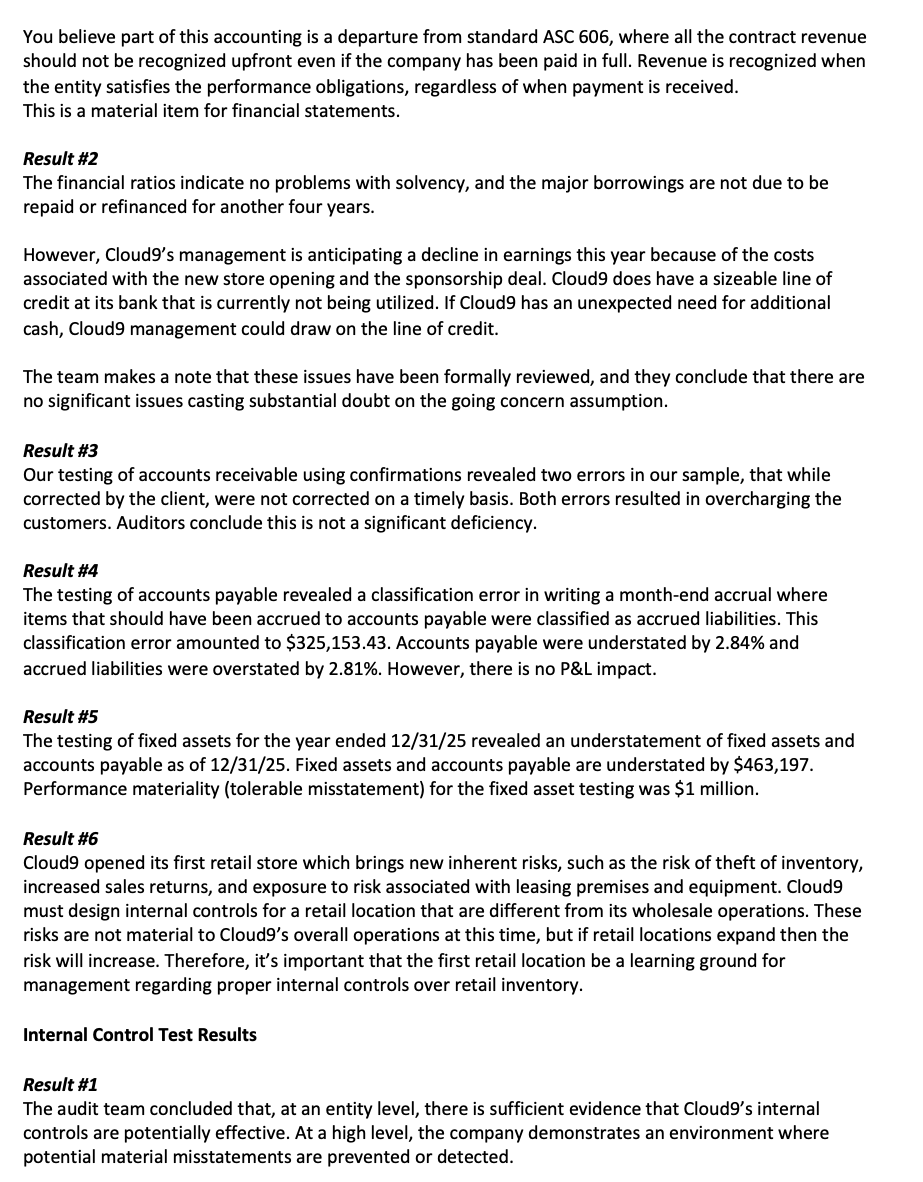

Financial Test Results Result \\#1 Sharon prepares a draft management representation letter for Jo, the partner, to review before presenting it to Cloud9's CEO and CFO to sign. The letter includes a statement about management's responsibility for critical accounting policies and critical accounting estimates. Sharon also drafts a report to be used for communication with Cloud9's audit committee. The report includes critical items | for Cloud9. Revenue recognition is a critical accounting policy to discuss with the audit committee. Key items that impact revenue recognition include the opening of a new company-owned store and sales and sales returns to retailers such as department stores. Some of the critical accounting estimates to discuss with the audit committee include compliance with standard ASC 606. The details to be discussed are: ASC 606 Revenue Recognition You've identified the contract with a customer with specified performance obligations, payment terms, and rights of the buyer and seller. Cloud9 charges customers for consulting services and workshops. The company accounts for all its contracts the same way. All parties have agreed on a two-year contract that includes consulting fees of \\( \\$ 120,0000 \\) and an onboarding fee of \\( \\$ 10,000 \\). The company has entered 100 contracts for the year. Each customer paid \\( \\$ 120,000 \\) in advance of receiving promised goods or services. The entry recorded by Cloud9 for each contract was as follows: Record payment received on a 24-month contract for all services. The onboarding fee is a one-time, upfront fee for set up and training and is recorded when the contract begins. It was recorded as follows: Record onboarding fee revenue earned on a 24-month contract. You believe part of this accounting is a departure from standard ASC 606, where all the contract revenue should not be recognized upfront even if the company has been paid in full. Revenue is recognized when the entity satisfies the performance obligations, regardless of when payment is received. This is a material item for financial statements. Result \\#2 The financial ratios indicate no problems with solvency, and the major borrowings are not due to be repaid or refinanced for another four years. However, Cloud9's management is anticipating a decline in earnings this year because of the costs associated with the new store opening and the sponsorship deal. Cloud9 does have a sizeable line of credit at its bank that is currently not being utilized. If Cloud9 has an unexpected need for additional cash, Cloud9 management could draw on the line of credit. The team makes a note that these issues have been formally reviewed, and they conclude that there are no significant issues casting substantial doubt on the going concern assumption. Result \\#3 Our testing of accounts receivable using confirmations revealed two errors in our sample, that while corrected by the client, were not corrected on a timely basis. Both errors resulted in overcharging the customers. Auditors conclude this is not a significant deficiency. Result \\#4 The testing of accounts payable revealed a classification error in writing a month-end accrual where items that should have been accrued to accounts payable were classified as accrued liabilities. This classification error amounted to \\( \\$ 325,153.43 \\). Accounts payable were understated by \2.84 and accrued liabilities were overstated by \2.81. However, there is no P\\&L impact. Result \\#5 The testing of fixed assets for the year ended 12/31/25 revealed an understatement of fixed assets and accounts payable as of \\( 12 / 31 / 25 \\). Fixed assets and accounts payable are understated by \\( \\$ 463,197 \\). Performance materiality (tolerable misstatement) for the fixed asset testing was \\( \\$ 1 \\) million. Result \\#6 Cloud9 opened its first retail store which brings new inherent risks, such as the risk of theft of inventory, increased sales returns, and exposure to risk associated with leasing premises and equipment. Cloud9 must design internal controls for a retail location that are different from its wholesale operations. These risks are not material to Cloud9's overall operations at this time, but if retail locations expand then the risk will increase. Therefore, it's important that the first retail location be a learning ground for management regarding proper internal controls over retail inventory. Internal Control Test Results Result \\#1 The audit team concluded that, at an entity level, there is sufficient evidence that Cloud9's internal controls are potentially effective. At a high level, the company demonstrates an environment where potential material misstatements are prevented or detected. Specific controls that affect transaction processes will be documented in more detail. Items to include: - Cloud9 has a tightly structured system of performance reviews. Managers at each level must report financial and operating performance against budgets at regular intervals. - Higher-level managers can access information about activities within their area of responsibility for monitoring purposes through the information system. - Losses at retail stores have been contained following the installation of additional security, including cameras. - Testing showed a thorough approach to appropriate segregation of duties. Result \\#2 Tests of controls show that IT general controls are effective. As a result, application controls can be relied upon for their financial applications. Testing of the application controls showed operational effectiveness. Result \\#3 Javier and Cheyenne are pleased with the results of tests of controls related to the purchasing process. They found strong controls over the master vendor file, and vouchers are prepared based only on original invoices. Cloud9 is very careful about entering the right invoice number, including any leading zeros, so an invoice is not paid twice. Finally, under David Collier's direction, Cloud9 developed clear procedures for accruing payables for goods received in the warehouse for which vendor invoices had not yet arrived. Other Test Results Result \\# 1 Cloud9's lawyers state that there are no pending legal issues, so there is nothing we need to emphasize in that area. Cloud9 has had a decline in earnings this year, but that does not represent a growing concern. There are no consistency issues with Cloudg's application of accounting principles. So, we do not need to add an emphasis-of-matter paragraph to this year's audit report. Result \\#2 Cloud9 opened its first retail store which brings new inherent risks, such as the risk of theft of inventory, increased sales returns, and exposure to risk associated with leasing premises and equipment. Cloudg must design internal controls for a retail location that are different from its wholesale operations. These risks are not material to Cloud9's overall operations. Scenario The auditing team of your CPA firm has performed an audit engagement for the Cloud9 company, which consists of testing financial statements, internal controls, and other factors that could have an impact on the company's position. Using the Summary of Audit Findings document from this engagement, provided in the Supporting Materials section, you will provide two written audit reports. Each report should include all sections of the audit in accordance with the Generally Accepted Auditing Standards (GAAS) you've studied within this course. Directions After reviewing the Scenario and Supporting Materials sections of this document, you will complete an analysis of the audit engagement program using the Summary of Audit Findings document and then write your financial statements and internal controls audit reports. For each report, you will: 1. Begin by analyzing the results from the Summary of Audit Findings document to identify anomalies, control deficiencies, and materiality that will impact your opinion. 2. You will then identify critical matters to be incorporated into the financial statements and internal controls audit reports. Use the auditing standards provided in the Supporting Materials section to guide your decisions (e.g., AS 2201). 3. Next, you will formulate your opinion, whether a qualified opinion or unqualified opinion, using the correct auditing standard foun in the Supporting Materials section. Use these accounting standards along with the results from the Summary of Audit Findings document. 4. Finally, once you have all of the necessary information gathered and your analysis is complete, you will create two written audit reports, one covering financial statements and one covering internal controls. Each audit report will be based on Generally Accepted Auditing Standards (GAAS). Specifically, you must address the following rubric criteria: 1. Identify anomalies found during substantive and control testing for each audit report. 2. Analyze materiality of control deficiencies and financial misstatements that impact materiality for each audit report. 3. Identify critical matters for each audit report. 4. Formulate an opinion of the audit based on audit results for each audit report. 5. Create audit reports (a financial statement report and an internal controls report) based on Generally Accepted Auditing Standards. Include the following: A. Type of audit report to be communicated to client B. Title C. Client information D. Introductory paragraph E. Auditor's opinion F. Basis of the opinion i. Client's responsibility ii. Auditor's responsibility G. Critical audit mattersStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started