Answered step by step

Verified Expert Solution

Question

1 Approved Answer

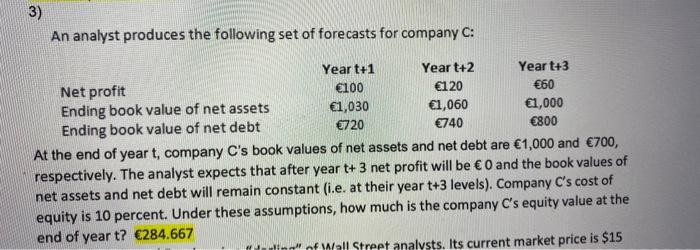

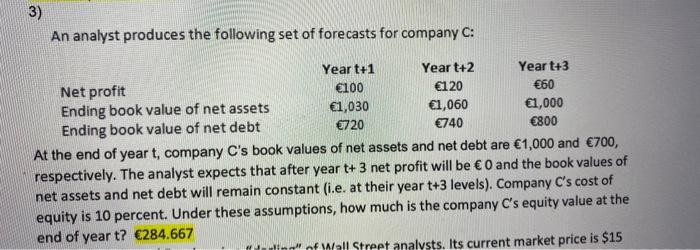

pleae write formla and explain 3) An analyst produces the following set of forecasts for company C: Yeart+1 Yeart+2 Yeart+3 Net profit 100 120 60

pleae write formla and explain

3) An analyst produces the following set of forecasts for company C: Yeart+1 Yeart+2 Yeart+3 Net profit 100 120 60 Ending book value of net assets 1,030 1,060 1,000 Ending book value of net debt 720 740 800 At the end of year t, company C's book values of net assets and net debt are 1,000 and 700, respectively. The analyst expects that after year t+ 3 net profit will be 0 and the book values of net assets and net debt will remain constant (.e. at their year t+3 levels). Company C's cost of equity is 10 percent. Under these assumptions, how much is the company C's equity value at the end of year t? 284.667 in of Wall Street analysts. Its current market price is $15

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started