Answered step by step

Verified Expert Solution

Question

1 Approved Answer

pleas help me with this question, make sure to answer all gor a up vote. thanks! Gifford Company experienced the following accounting events during Year

pleas help me with this question, make sure to answer all gor a up vote. thanks!

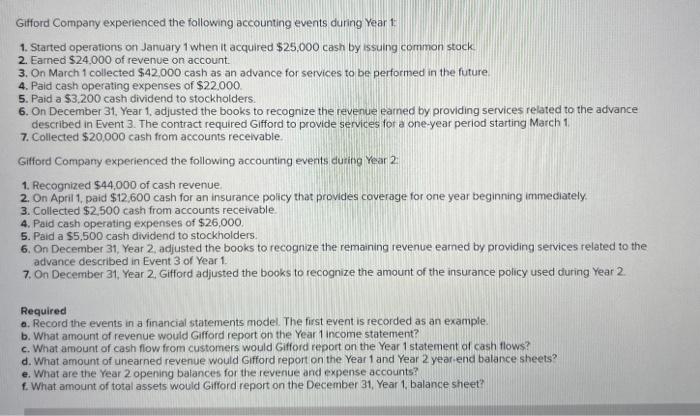

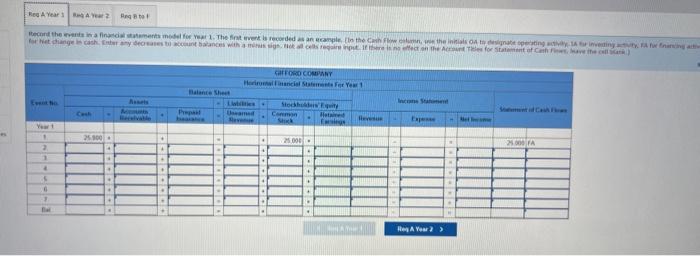

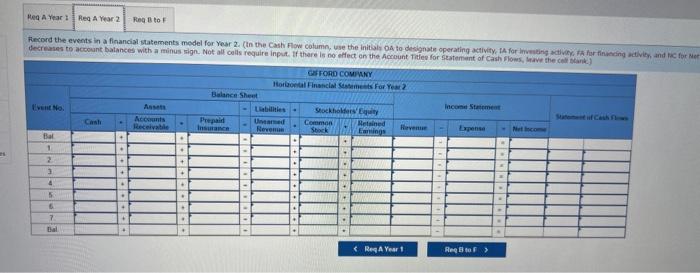

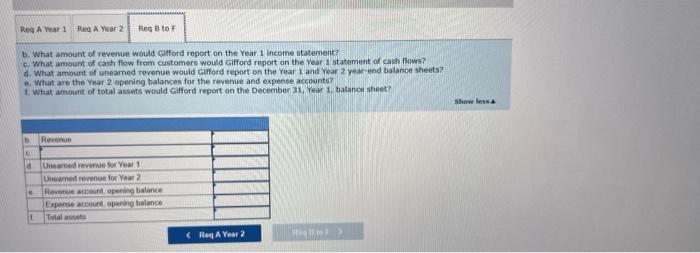

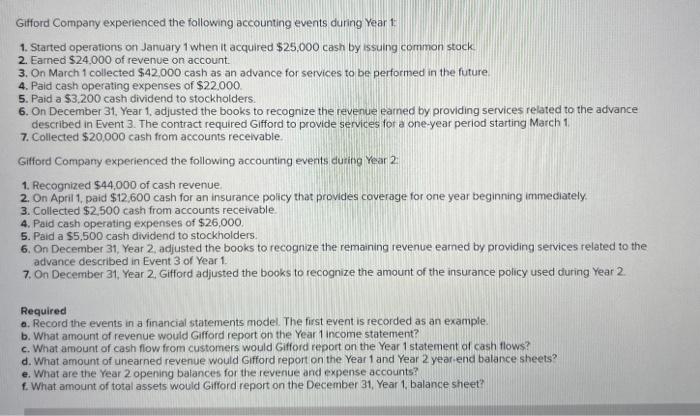

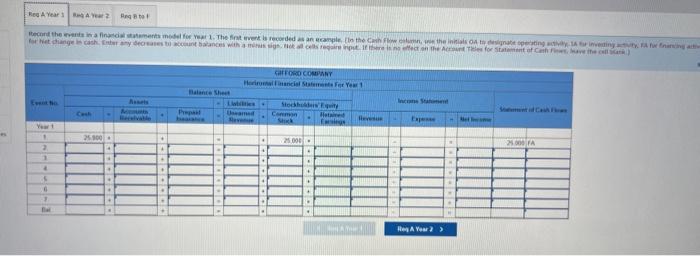

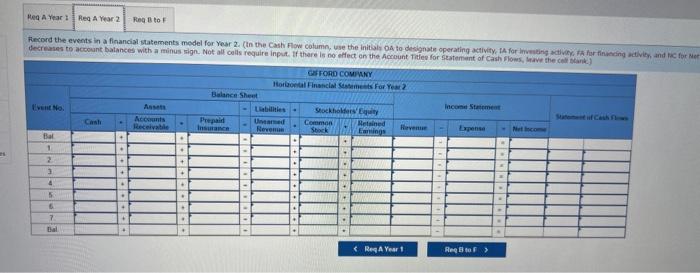

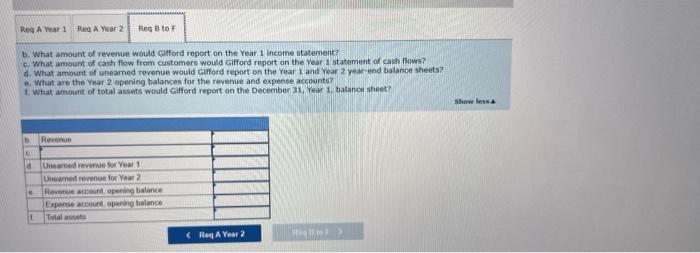

Gifford Company experienced the following accounting events during Year 1 : 1. Started operations on January 1 when it acquired $25,000 cash by issuing common stock 2. Eamed $24.000 of revenue on account. 3. On March 1 collected $42.000 cash as an advance for services to be performed in the future. 4. Paid cash operating expenses of $22.000. 5. Paid a $3.200 cash dividend to stockholders. 6. On December 31, Year 1, adjusted the books to recognize the revenue eamed by providing services related to the advance described in Event 3. The contract required Gifford to provide services for a one-year period starting March 1. 7. Collected $20.000 cash from accounts recelvable. Gifford Company experienced the following accounting events dufing Year 2 : 1. Recognized $44,000 of cash revenue. 2. On April 1, paid $12,600 cash for an insurance policy that provides coverage for one year beginning immedately. 3. Collected $2,500 cash from accounts receivable. 4. Paid cash operating expenses of $26,000. 5. Paid a $5,500 cash dividend to stockholders. 6. On December 31, Year 2, adjusted the books to recognize the remaining revenue eamed by providing services related to the advance described in Event 3 of Year 1. 7. On December 31, Year 2. Gifford adjusted the books to recognize the amount of the insurance policy used during Year 2. Required a. Record the events in a financial statements model. The first event is recorded as an example. b. What amount of revenue would Gifford report on the Year 1 income statement? c. What amount of cash flow from customers would Gifford report on the Year 1 statement of cash flows? d. What amount of unearned revenue would Gifford report on the Year 1 and Year 2 year-end balance sheets? e. What are the Year 2 opening balances for the revenue and expense accounts? f. What amount of total assets would Gifford report on the December 31 , Year 1, balance sheet? Head Yas \&? \&. Rega Year 1 Reekitor? b. What amount of revenue would Glfford report on the Year i income statement? c. What armount of cash flow from customers would Gifford report on the vear 1 statiment of cash fiows? d. What amount of uneamed revenue would Gifford report on the Year 1 and year 2 ye. en end batance sheits? e. What are the Year 2 opening balances for the revenue and expense accounts? 1. What amount of total assets would Gifford report on the December 31 , Year 1 , batance aheet

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started