Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Pleas help please help, some people on here are trying to chage money, im not going to pay out side the app, that is NOT

Pleas help

please help, some people on here are trying to chage money, im not going to pay out side the app, that is NOT allowed.

no.

.

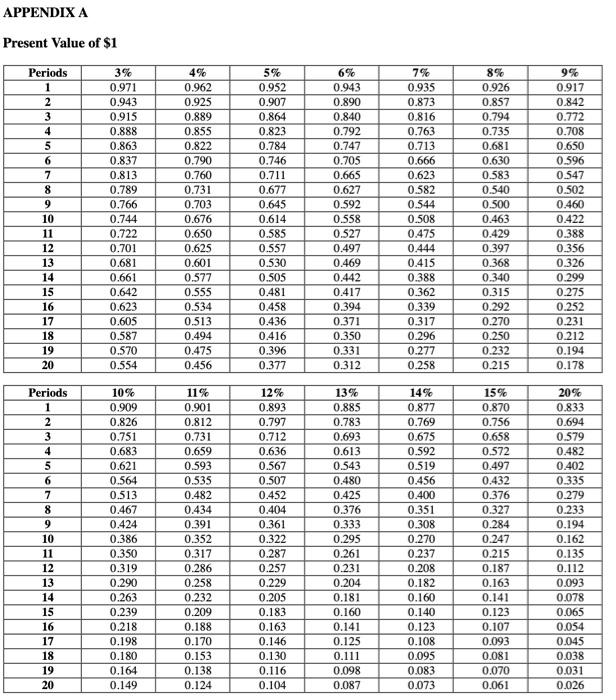

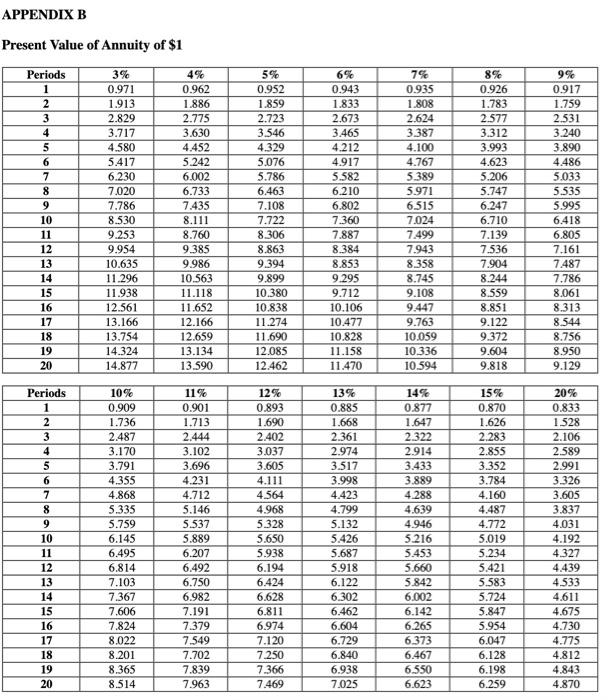

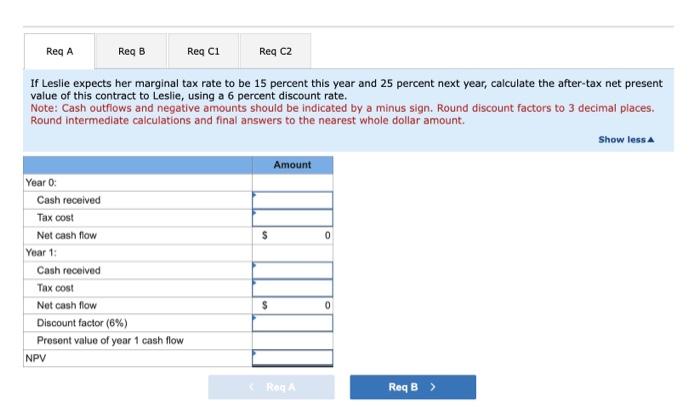

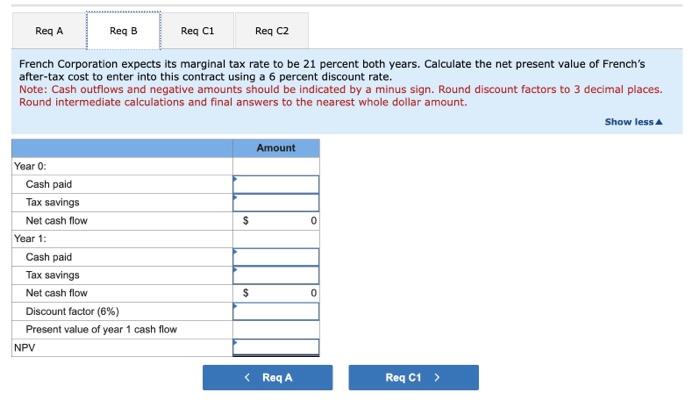

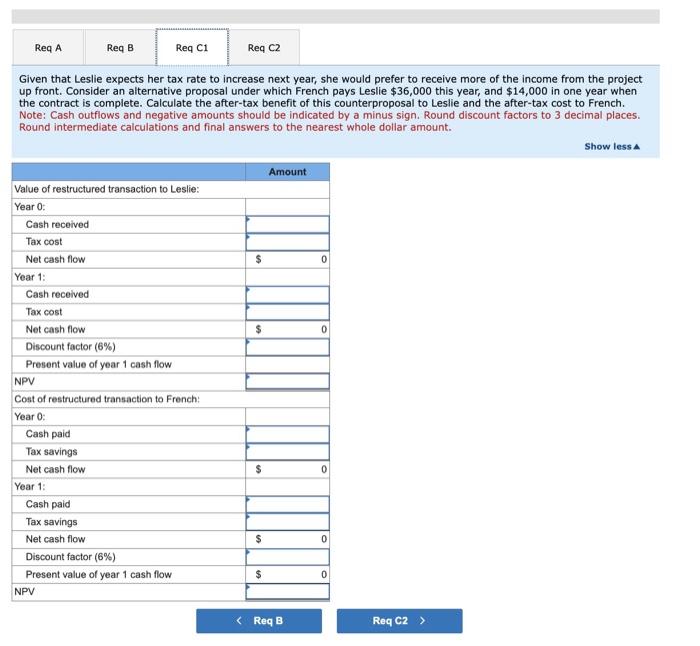

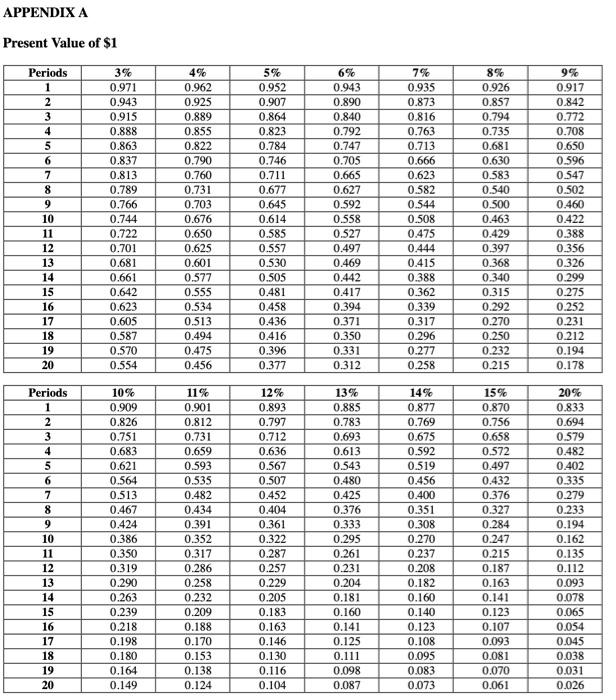

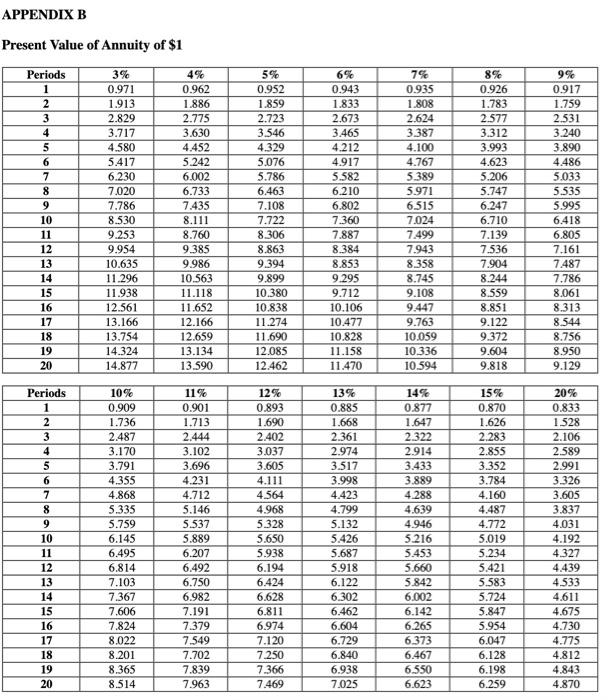

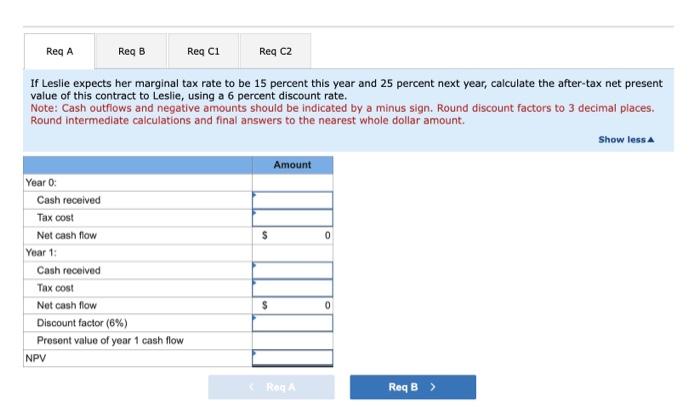

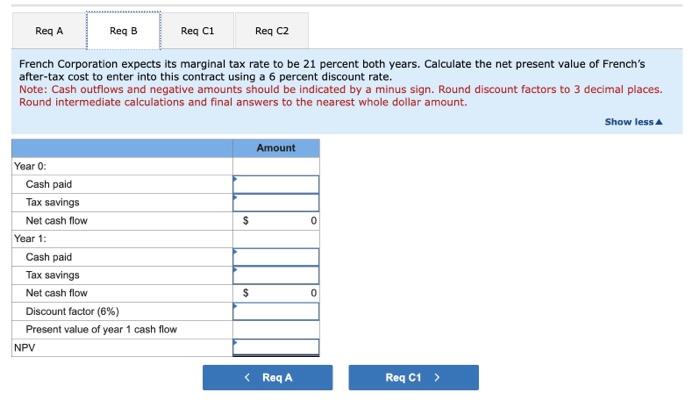

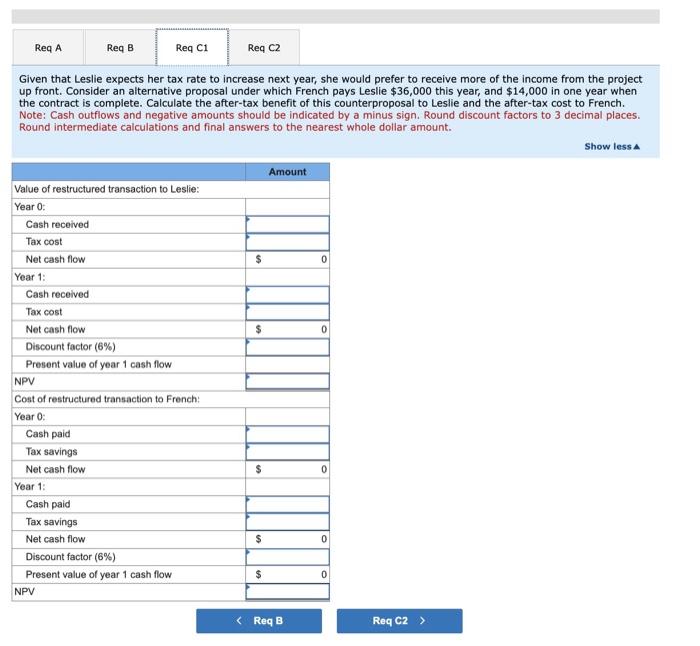

Present Value of \$1 APPENDIX B Present Value of Annuity of \$1 \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline Periods & 3% & 4% & 5% & 6% & 7% & 8% & 9% \\ \hline 1 & 0.971 & 0.962 & 0.952 & 0.943 & 0.935 & 0.926 & 0.917 \\ \hline 2 & 1.913 & 1.886 & 1.859 & 1.833 & 1.808 & 1.783 & 1.759 \\ \hline 3 & 2.829 & 2.775 & 2.723 & 2.673 & 2.624 & 2.577 & 2.531 \\ \hline 4 & 3.717 & 3.630 & 3.546 & 3.465 & 3.387 & 3.312 & 3.240 \\ \hline 5 & 4.580 & 4.452 & 4.329 & 4.212 & 4.100 & 3.993 & 3.890 \\ \hline 6 & 5.417 & 5.242 & 5.076 & 4.917 & 4.767 & 4.623 & 4.486 \\ \hline 7 & 6.230 & 6.002 & 5.786 & 5.582 & 5.389 & 5.206 & 5.033 \\ \hline 8 & 7.020 & 6.733 & 6.463 & 6.210 & 5.971 & 5.747 & 5.535 \\ \hline 9 & 7.786 & 7.435 & 7.108 & 6.802 & 6.515 & 6.247 & 5.995 \\ \hline 10 & 8.530 & 8.111 & 7.722 & 7.360 & 7.024 & 6.710 & 6.418 \\ \hline 11 & 9.253 & 8.760 & 8.306 & 7.887 & 7.499 & 7.139 & 6.805 \\ \hline 12 & 9.954 & 9.385 & 8.863 & 8.384 & 7.943 & 7.536 & 7.161 \\ \hline 13 & 10.635 & 9.986 & 9.394 & 8.853 & 8.358 & 7.904 & 7.487 \\ \hline 14 & 11.296 & 10.563 & 9.899 & 9.295 & 8.745 & 8.244 & 7.786 \\ \hline 15 & 11.938 & 11.118 & 10.380 & 9.712 & 9.108 & 8.559 & 8.061 \\ \hline 16 & 12.561 & 11.652 & 10.838 & 10.106 & 9.447 & 8.851 & 8.313 \\ \hline 17 & 13.166 & 12.166 & 11.274 & 10.477 & 9.763 & 9.122 & 8.544 \\ \hline 18 & 13.754 & 12.659 & 11.690 & 10.828 & 10.059 & 9.372 & 8.756 \\ \hline 19 & 14.324 & 13.134 & 12.085 & 11.158 & 10.336 & 9.604 & 8.950 \\ \hline 20 & 14.877 & 13.590 & 12.462 & 11.470 & 10.594 & 9.818 & 9.129 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline Periods & 10% & 11% & 12% & 13% & 14% & 15% & 20% \\ \hline 1 & 0.909 & 0.901 & 0.893 & 0.885 & 0.877 & 0.870 & 0.833 \\ \hline 2 & 1.736 & 1.713 & 1.690 & 1.668 & 1.647 & 1.626 & 1.528 \\ \hline 3 & 2.487 & 2.444 & 2.402 & 2.361 & 2.322 & 2.283 & 2.106 \\ \hline 4 & 3.170 & 3.102 & 3.037 & 2.974 & 2.914 & 2.855 & 2.589 \\ \hline 5 & 3.791 & 3.696 & 3.605 & 3.517 & 3.433 & 3.352 & 2.991 \\ \hline 6 & 4.355 & 4.231 & 4.111 & 3.998 & 3.889 & 3.784 & 3.326 \\ \hline 7 & 4.868 & 4.712 & 4.564 & 4.423 & 4.288 & 4.160 & 3.605 \\ \hline 8 & 5.335 & 5.146 & 4.968 & 4.799 & 4.639 & 4.487 & 3.837 \\ \hline 9 & 5.759 & 5.537 & 5.328 & 5.132 & 4.946 & 4.772 & 4.031 \\ \hline 10 & 6.145 & 5.889 & 5.650 & 5.426 & 5.216 & 5.019 & 4.192 \\ \hline 11 & 6.495 & 6.207 & 5.938 & 5.687 & 5.453 & 5.234 & 4.327 \\ \hline 12 & 6.814 & 6.492 & 6.194 & 5.918 & 5.660 & 5.421 & 4.439 \\ \hline 13 & 7.103 & 6.750 & 6.424 & 6.122 & 5.842 & 5.583 & 4.533 \\ \hline 14 & 7.367 & 6.982 & 6.628 & 6.302 & 6.002 & 5.724 & 4.611 \\ \hline 15 & 7.606 & 7.191 & 6.811 & 6.462 & 6.142 & 5.847 & 4.675 \\ \hline 16 & 7.824 & 7.379 & 6.974 & 6.604 & 6.265 & 5.954 & 4.730 \\ \hline 17 & 8.022 & 7.549 & 7.120 & 6.729 & 6.373 & 6.047 & 4.775 \\ \hline 18 & 8.201 & 7.702 & 7.250 & 6.840 & 6.467 & 6.128 & 4.812 \\ \hline 19 & 8.365 & 7.839 & 7.366 & 6.938 & 6.550 & 6.198 & 4.843 \\ \hline 20 & 8.514 & 7.963 & 7.469 & 7.025 & 6.623 & 6.259 & 4.870 \\ \hline \end{tabular} If Leslie expects her marginal tax rate to be 15 percent this year and 25 percent next year, calculate the after-tax net present value of this contract to Leslie, using a 6 percent discount rate. Note: Cash outflows and negative amounts should be indicated by a minus sign. Round discount factors to 3 decimal places. Round intermediate calculations and final answers to the nearest whole dollar amount. French Corporation expects its marginal tax rate to be 21 percent both years. Calculate the net present value of French's after-tax cost to enter into this contract using a 6 percent discount rate. Note: Cash outflows and negative amounts should be indicated by a minus sign. Round discount factors to 3 decimal places. Round intermediate calculations and final answers to the nearest whole dollar amount. Given that Leslie expects her tax rate to increase next year, she would prefer to receive more of the income from the project up front. Consider an alternative proposal under which French pays Leslie $36,000 this year, and $14,000 in one year when the contract is complete. Calculate the after-tax benefit of this counterproposal to Leslie and the after-tax cost to French. Note: Cash outflows and negative amounts should be indicated by a minus sign. Round discount factors to 3 decimal places. Round intermediate calculations and final answers to the nearest whole dollar amount. Present Value of \$1 APPENDIX B Present Value of Annuity of \$1 \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline Periods & 3% & 4% & 5% & 6% & 7% & 8% & 9% \\ \hline 1 & 0.971 & 0.962 & 0.952 & 0.943 & 0.935 & 0.926 & 0.917 \\ \hline 2 & 1.913 & 1.886 & 1.859 & 1.833 & 1.808 & 1.783 & 1.759 \\ \hline 3 & 2.829 & 2.775 & 2.723 & 2.673 & 2.624 & 2.577 & 2.531 \\ \hline 4 & 3.717 & 3.630 & 3.546 & 3.465 & 3.387 & 3.312 & 3.240 \\ \hline 5 & 4.580 & 4.452 & 4.329 & 4.212 & 4.100 & 3.993 & 3.890 \\ \hline 6 & 5.417 & 5.242 & 5.076 & 4.917 & 4.767 & 4.623 & 4.486 \\ \hline 7 & 6.230 & 6.002 & 5.786 & 5.582 & 5.389 & 5.206 & 5.033 \\ \hline 8 & 7.020 & 6.733 & 6.463 & 6.210 & 5.971 & 5.747 & 5.535 \\ \hline 9 & 7.786 & 7.435 & 7.108 & 6.802 & 6.515 & 6.247 & 5.995 \\ \hline 10 & 8.530 & 8.111 & 7.722 & 7.360 & 7.024 & 6.710 & 6.418 \\ \hline 11 & 9.253 & 8.760 & 8.306 & 7.887 & 7.499 & 7.139 & 6.805 \\ \hline 12 & 9.954 & 9.385 & 8.863 & 8.384 & 7.943 & 7.536 & 7.161 \\ \hline 13 & 10.635 & 9.986 & 9.394 & 8.853 & 8.358 & 7.904 & 7.487 \\ \hline 14 & 11.296 & 10.563 & 9.899 & 9.295 & 8.745 & 8.244 & 7.786 \\ \hline 15 & 11.938 & 11.118 & 10.380 & 9.712 & 9.108 & 8.559 & 8.061 \\ \hline 16 & 12.561 & 11.652 & 10.838 & 10.106 & 9.447 & 8.851 & 8.313 \\ \hline 17 & 13.166 & 12.166 & 11.274 & 10.477 & 9.763 & 9.122 & 8.544 \\ \hline 18 & 13.754 & 12.659 & 11.690 & 10.828 & 10.059 & 9.372 & 8.756 \\ \hline 19 & 14.324 & 13.134 & 12.085 & 11.158 & 10.336 & 9.604 & 8.950 \\ \hline 20 & 14.877 & 13.590 & 12.462 & 11.470 & 10.594 & 9.818 & 9.129 \\ \hline \end{tabular} \begin{tabular}{|c|c|c|c|c|c|c|c|} \hline Periods & 10% & 11% & 12% & 13% & 14% & 15% & 20% \\ \hline 1 & 0.909 & 0.901 & 0.893 & 0.885 & 0.877 & 0.870 & 0.833 \\ \hline 2 & 1.736 & 1.713 & 1.690 & 1.668 & 1.647 & 1.626 & 1.528 \\ \hline 3 & 2.487 & 2.444 & 2.402 & 2.361 & 2.322 & 2.283 & 2.106 \\ \hline 4 & 3.170 & 3.102 & 3.037 & 2.974 & 2.914 & 2.855 & 2.589 \\ \hline 5 & 3.791 & 3.696 & 3.605 & 3.517 & 3.433 & 3.352 & 2.991 \\ \hline 6 & 4.355 & 4.231 & 4.111 & 3.998 & 3.889 & 3.784 & 3.326 \\ \hline 7 & 4.868 & 4.712 & 4.564 & 4.423 & 4.288 & 4.160 & 3.605 \\ \hline 8 & 5.335 & 5.146 & 4.968 & 4.799 & 4.639 & 4.487 & 3.837 \\ \hline 9 & 5.759 & 5.537 & 5.328 & 5.132 & 4.946 & 4.772 & 4.031 \\ \hline 10 & 6.145 & 5.889 & 5.650 & 5.426 & 5.216 & 5.019 & 4.192 \\ \hline 11 & 6.495 & 6.207 & 5.938 & 5.687 & 5.453 & 5.234 & 4.327 \\ \hline 12 & 6.814 & 6.492 & 6.194 & 5.918 & 5.660 & 5.421 & 4.439 \\ \hline 13 & 7.103 & 6.750 & 6.424 & 6.122 & 5.842 & 5.583 & 4.533 \\ \hline 14 & 7.367 & 6.982 & 6.628 & 6.302 & 6.002 & 5.724 & 4.611 \\ \hline 15 & 7.606 & 7.191 & 6.811 & 6.462 & 6.142 & 5.847 & 4.675 \\ \hline 16 & 7.824 & 7.379 & 6.974 & 6.604 & 6.265 & 5.954 & 4.730 \\ \hline 17 & 8.022 & 7.549 & 7.120 & 6.729 & 6.373 & 6.047 & 4.775 \\ \hline 18 & 8.201 & 7.702 & 7.250 & 6.840 & 6.467 & 6.128 & 4.812 \\ \hline 19 & 8.365 & 7.839 & 7.366 & 6.938 & 6.550 & 6.198 & 4.843 \\ \hline 20 & 8.514 & 7.963 & 7.469 & 7.025 & 6.623 & 6.259 & 4.870 \\ \hline \end{tabular} If Leslie expects her marginal tax rate to be 15 percent this year and 25 percent next year, calculate the after-tax net present value of this contract to Leslie, using a 6 percent discount rate. Note: Cash outflows and negative amounts should be indicated by a minus sign. Round discount factors to 3 decimal places. Round intermediate calculations and final answers to the nearest whole dollar amount. French Corporation expects its marginal tax rate to be 21 percent both years. Calculate the net present value of French's after-tax cost to enter into this contract using a 6 percent discount rate. Note: Cash outflows and negative amounts should be indicated by a minus sign. Round discount factors to 3 decimal places. Round intermediate calculations and final answers to the nearest whole dollar amount. Given that Leslie expects her tax rate to increase next year, she would prefer to receive more of the income from the project up front. Consider an alternative proposal under which French pays Leslie $36,000 this year, and $14,000 in one year when the contract is complete. Calculate the after-tax benefit of this counterproposal to Leslie and the after-tax cost to French. Note: Cash outflows and negative amounts should be indicated by a minus sign. Round discount factors to 3 decimal places. Round intermediate calculations and final answers to the nearest whole dollar amount Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started