Answered step by step

Verified Expert Solution

Question

1 Approved Answer

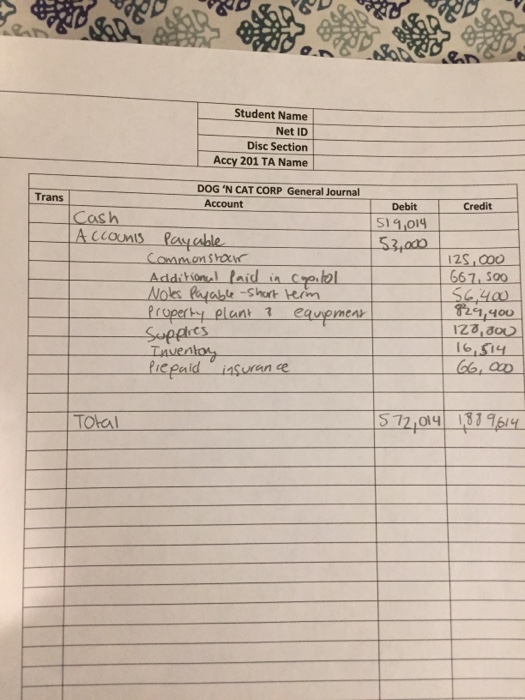

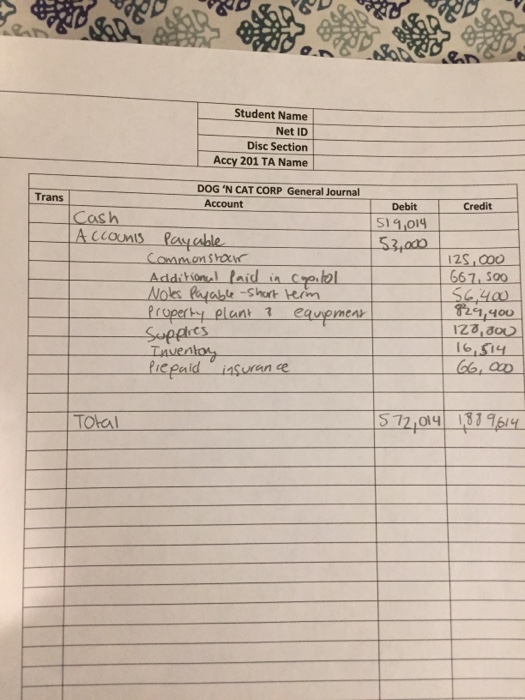

Pleas make a general journal. I made one but Im not sure if its correct. Student Name Net ID Disc Section Accy 201 TA Name

Pleas make a general journal. I made one but Im not sure if its correct.

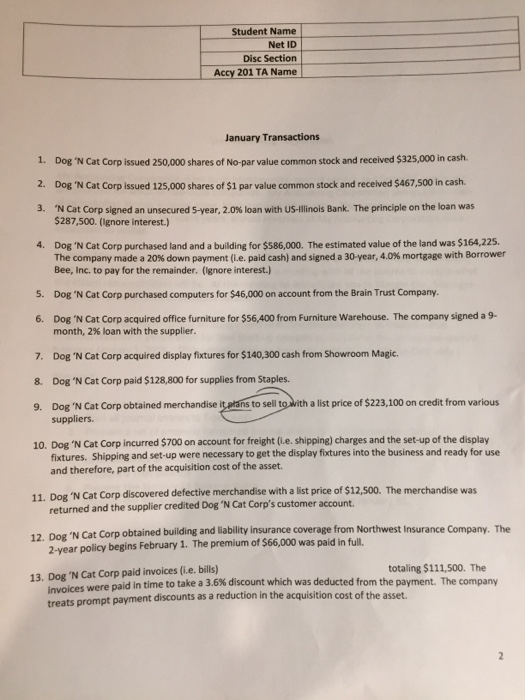

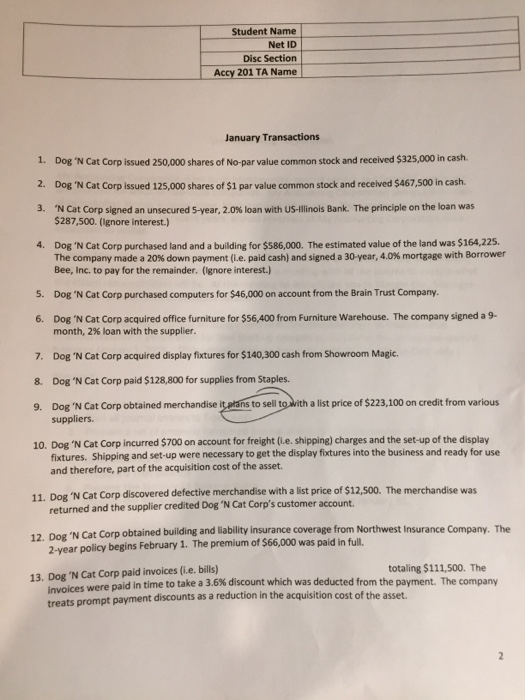

Student Name Net ID Disc Section Accy 201 TA Name January Transactions Dog 'N Cat Corp issued 250,000 shares of No-par value common stock and received $325,000 in cash. Dog 'N Cat Corp issued 125,000 shares of $1 par value common stock and received $467,500 in cash. 'N Cat Corp signed an unsecured 5-year, 2.0% loan with US-Illinois Bank. The principle on the loan was 1. 2. 3. $287,500. (lgnore interest.) 4. Dog 'N Cat Corp purchased land and a building for $586,000. The estimated value of the land was $164,225 The company made a 20% down payment (le. paid cash) and signed a 30-year, 4.0% mortgage with Borrower Bee, Inc. to pay for the remainder. (Ignore interest.) Dog 'N Cat Corp purchased computers for $46,000 on account from the Brain Trust Company. Dog 'N Cat Corp acquired office furniture for $56,400 from Furniture Warehouse. The company signed a 9- 5. 6. month, 2% loan with the supplier. 7. Dog 'N Cat Corp acquired display fixtures for $140,300 cash from Showroom Magic 8. Dog 'N Cat Corp paid $128,800 for supplies from Staples 9. Dog 'N Cat Corp obtained merchandise itatans to sell 10. Dog 'N Cat Corp incurred $700 on account for freight (i.e. shipping) charges and the set-up of the display a list price of $223,100 on credit from various suppliers fixtures. Shipping and set-up were necessary to get the display fixtures into the business and ready for use and therefore, part of the acquisition cost of the asset. 11. Dog 'N Cat Corp discovered defective merchandise with a list price of $12,500. The merchandise was returned and the supplier credited Dog'N Cat Corp's customer account The 12. Dog 'N Cat Corp 2-year policy begins February 1. The premium of $66,000 was paid in full. totaling $111,500. The 13. Dog 'N Cat Corp paid invoices (i.e. bills) were paid in time to take a 3.6% discount which was deducted from the payment. The company invoices treats prompt payment discounts as a reduction in the acquisition cost of the asset

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started