pleas show your work so i can actually learn how to do this.

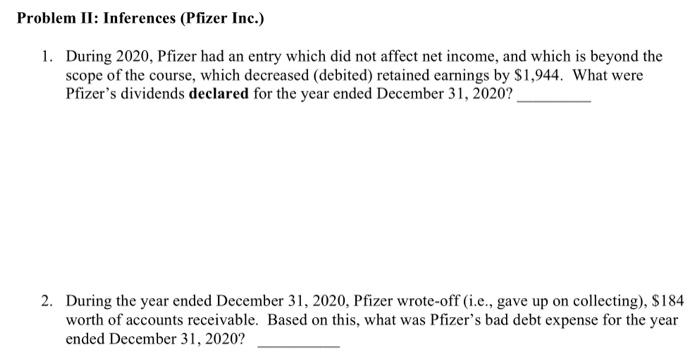

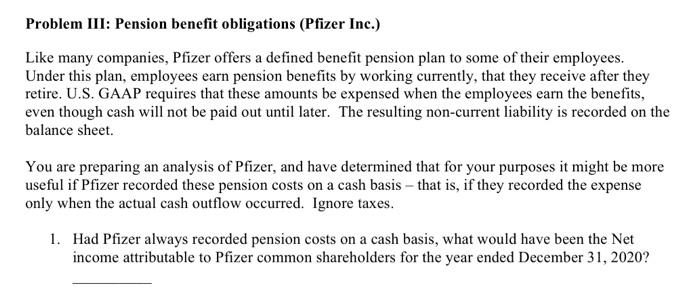

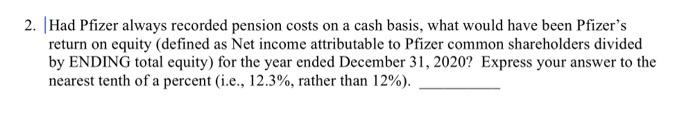

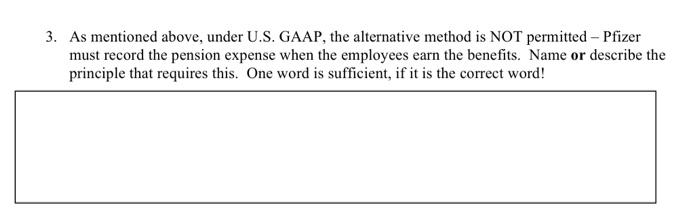

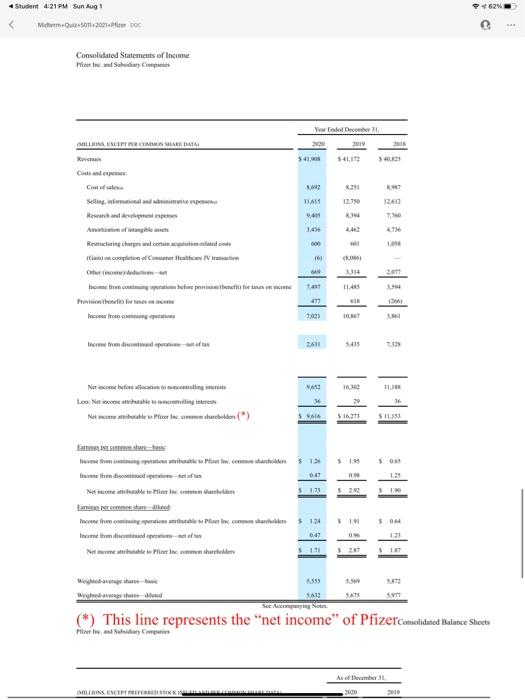

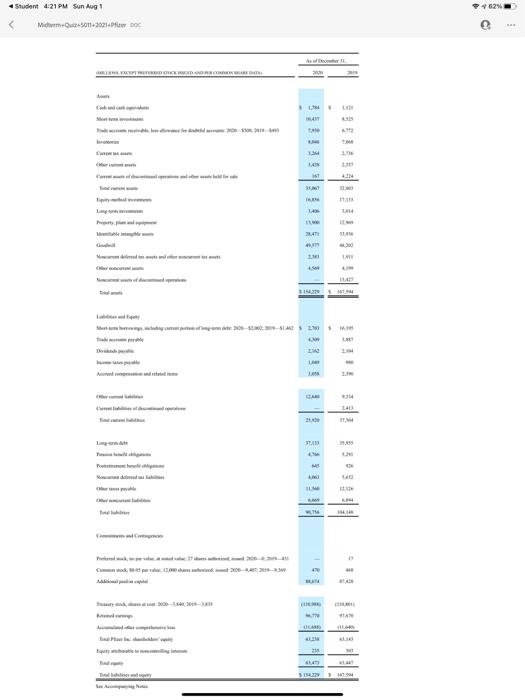

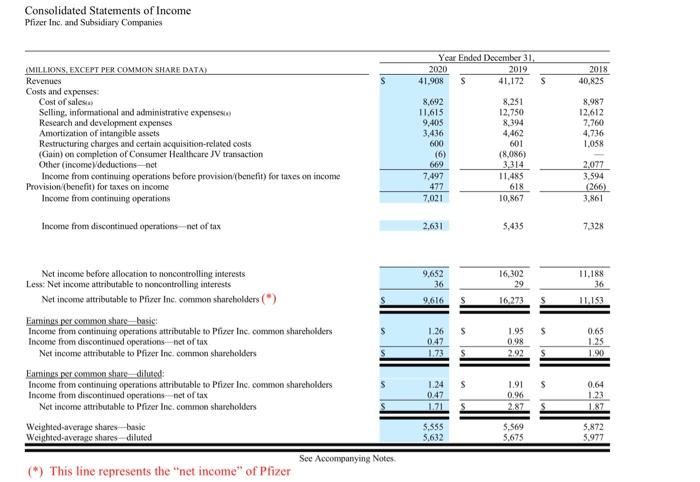

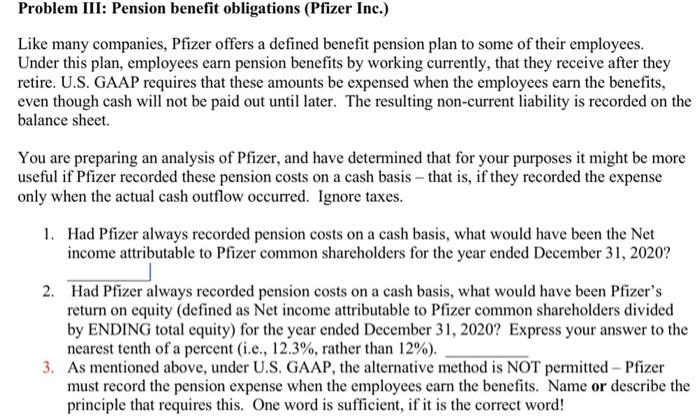

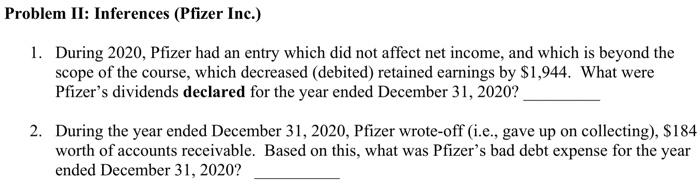

Problem II: Inferences (Pfizer Inc.) 1. During 2020, Pfizer had an entry which did not affect net income, and which is beyond the scope of the course, which decreased (debited) retained earnings by $1,944. What were Pfizer's dividends declared for the year ended December 31, 2020? 2. During the year ended December 31, 2020, Pfizer wrote-off (i.e., gave up on collecting), $184 worth of accounts receivable. Based on this, what was Pfizer's bad debt expense for the year ended December 31, 2020? Problem III: Pension benefit obligations (Pfizer Inc.) Like many companies, Pfizer offers a defined benefit pension plan to some of their employees. Under this plan, employees earn pension benefits by working currently, that they receive after they retire. U.S. GAAP requires that these amounts be expensed when the employees earn the benefits, even though cash will not be paid out until later. The resulting non-current liability is recorded on the balance sheet. You are preparing an analysis of Pfizer, and have determined that for your purposes it might be more useful if Pfizer recorded these pension costs on a cash basis - that is, if they recorded the expense only when the actual cash outflow occurred. Ignore taxes. 1. Had Pfizer always recorded pension costs on a cash basis, what would have been the Net income attributable to Pfizer common shareholders for the year ended December 31, 2020? 2. Had Pfizer always recorded pension costs on a cash basis, what would have been Pfizer's return on equity (defined as Net income attributable to Pfizer common shareholders divided by ENDING total equity) for the year ended December 31, 2020? Express your answer to the nearest tenth of a percent (i.e., 12.3%, rather than 12%). 3. As mentioned above, under U.S. GAAP, the alternative method is NOT permitted - Pfizer must record the pension expense when the employees earn the benefits. Name or describe the principle that requires this. One word is sufficient, if it is the correct word! 62% Student 4:21 PM Sun Aug 1 Michomson Consolidated Statements of Income Min. Sy You del December 2000 300 28 541.172 500 2 RT 251 12.750 1165 2,42 MILLIONS, EXCEPT RECOMMON SHARE DATA R Cits Cole Seling experie Mkwrahi Aat everywhere exywhe Anfangible Remcturing charges a certain la completion of Commerce tract Chweincome dette Inocencom per before promene for technice Presse for Income from.com 4736 1.050 600 2 7,401 3.54 479 2431 7.33 MAS Les Nanote abordagem Not in the tour de commercelen (*) 2016 516211 SI 50 12 - Income timing getuienie Per cathode 136 Iniche fondo pertene 0.49 Not income the lecture Face Income from congue. Perchanthers 51.34 Income from dovted petectos 049 Net som ble 5 11 50 OW 122 Wegwerphared 3.4 See Accompany Note (*) This line represents the net income" of Pfizer Consolidated Balance Sheets Pin Say Chi Ashow OMLINSECTIFERREDOX 000 2010 Student 4:21 PM Sun Aug 1 62% Mimerson-3021 ESET GEWORCES . 5 . 20 19 1 Consolidated Statements of Income Pfizer Inc. and Subsidiary Companies Year Ended December 31, 2020 2019 41.908 s 41,172 $ 2018 40.825 (MILLIONS, EXCEPT PER COMMON SHARE DATA) Revenues Costs and expenses: Cost of sales Selling informational and administrative expenses Research and development expenses Amortization of intangible assets Restructuring charges and certain acquisition-related costs (Gain) on completion of Consumer Healthcare JV transaction Other (income) deductions -net Income from continuing operations before provision (benefit) for taxes on income Provision (benefit) for taxes on income Income from continuing operations 8.987 12.612 7,760 4.736 1.058 8,692 11.615 9,405 3,436 600 (6) 669 7.497 477 7,021 8.251 12,750 8,394 4,462 601 (8,086) 3,314 11,485 618 10,867 2.077 3.594 (266) 3.861 Income from discontinued operations net of tax 2.631 5,435 7.328 9,652 36 16,302 29 11.188 36 9.616 S 16.273 $ 11.153 $ S $ Net income before allocation to noncontrolling interests Less: Net income attributable to noncontrolling interests Net income attributable to Pfizer Inc. common shareholders (*) Earings per common share-basic: Income from continuing operations attributable to Pfizer Inc. common shareholders Income from discontinued operations net of tax Net income attributable to Pfizer Inc. common shareholders Earingsst.common share_diluted: Income from continuing operations attributable to Pfizer Inc. common sharcholders Income from discontinued operations net of tax Net income attributable to Pfizer Inc.common shareholders Weighted average shares-basie Weighted average shares-diluted 1.26 0.47 1.73 1.95 0.98 2.92 0.65 1.25 1.90 S S S 1.24 0.47 1.71 1.91 0.96 2.87 0.64 1.23 187 5.555 5.632 5.569 5,675 5.872 5.977 See Accompanying Notes (*) This line represents the "net income" of Pfizer Problem III: Pension benefit obligations (Pfizer Inc.) Like many companies, Pfizer offers a defined benefit pension plan to some of their employees. Under this plan, employees earn pension benefits by working currently, that they receive after they retire. U.S. GAAP requires that these amounts be expensed when the employees earn the benefits, even though cash will not be paid out until later. The resulting non-current liability is recorded on the balance sheet. You are preparing an analysis of Pfizer, and have determined that for your purposes it might be more useful if Pfizer recorded these pension costs on a cash basis that is, if they recorded the expense only when the actual cash outflow occurred. Ignore taxes. 1. Had Pfizer always recorded pension costs on a cash basis, what would have been the Net income attributable to Pfizer common shareholders for the year ended December 31, 2020? 2. Had Pfizer always recorded pension costs on a cash basis, what would have been Pfizer's return on equity (defined as Net income attributable to Pfizer common shareholders divided by ENDING total equity) for the year ended December 31, 2020? Express your answer to the nearest tenth of a percent (i.e., 12.3%, rather than 12%). 3. As mentioned above, under U.S. GAAP, the alternative method is NOT permitted - Pfizer must record the pension expense when the employees earn the benefits. Name or describe the principle that requires this. One word is sufficient, if it is the correct word! Problem II: Inferences (Pfizer Inc.) 1. During 2020, Pfizer had an entry which did not affect net income, and which is beyond the scope of the course, which decreased (debited) retained earnings by $1,944. What were Pfizer's dividends declared for the year ended December 31, 2020? 2. During the year ended December 31, 2020, Pfizer wrote-off (i.e., gave up on collecting), $184 worth of accounts receivable. Based on this, what was Pfizer's bad debt expense for the year ended December 31, 2020? Problem II: Inferences (Pfizer Inc.) 1. During 2020, Pfizer had an entry which did not affect net income, and which is beyond the scope of the course, which decreased (debited) retained earnings by $1,944. What were Pfizer's dividends declared for the year ended December 31, 2020? 2. During the year ended December 31, 2020, Pfizer wrote-off (i.e., gave up on collecting), $184 worth of accounts receivable. Based on this, what was Pfizer's bad debt expense for the year ended December 31, 2020? Problem III: Pension benefit obligations (Pfizer Inc.) Like many companies, Pfizer offers a defined benefit pension plan to some of their employees. Under this plan, employees earn pension benefits by working currently, that they receive after they retire. U.S. GAAP requires that these amounts be expensed when the employees earn the benefits, even though cash will not be paid out until later. The resulting non-current liability is recorded on the balance sheet. You are preparing an analysis of Pfizer, and have determined that for your purposes it might be more useful if Pfizer recorded these pension costs on a cash basis - that is, if they recorded the expense only when the actual cash outflow occurred. Ignore taxes. 1. Had Pfizer always recorded pension costs on a cash basis, what would have been the Net income attributable to Pfizer common shareholders for the year ended December 31, 2020? 2. Had Pfizer always recorded pension costs on a cash basis, what would have been Pfizer's return on equity (defined as Net income attributable to Pfizer common shareholders divided by ENDING total equity) for the year ended December 31, 2020? Express your answer to the nearest tenth of a percent (i.e., 12.3%, rather than 12%). 3. As mentioned above, under U.S. GAAP, the alternative method is NOT permitted - Pfizer must record the pension expense when the employees earn the benefits. Name or describe the principle that requires this. One word is sufficient, if it is the correct word! 62% Student 4:21 PM Sun Aug 1 Michomson Consolidated Statements of Income Min. Sy You del December 2000 300 28 541.172 500 2 RT 251 12.750 1165 2,42 MILLIONS, EXCEPT RECOMMON SHARE DATA R Cits Cole Seling experie Mkwrahi Aat everywhere exywhe Anfangible Remcturing charges a certain la completion of Commerce tract Chweincome dette Inocencom per before promene for technice Presse for Income from.com 4736 1.050 600 2 7,401 3.54 479 2431 7.33 MAS Les Nanote abordagem Not in the tour de commercelen (*) 2016 516211 SI 50 12 - Income timing getuienie Per cathode 136 Iniche fondo pertene 0.49 Not income the lecture Face Income from congue. Perchanthers 51.34 Income from dovted petectos 049 Net som ble 5 11 50 OW 122 Wegwerphared 3.4 See Accompany Note (*) This line represents the net income" of Pfizer Consolidated Balance Sheets Pin Say Chi Ashow OMLINSECTIFERREDOX 000 2010 Student 4:21 PM Sun Aug 1 62% Mimerson-3021 ESET GEWORCES . 5 . 20 19 1 Consolidated Statements of Income Pfizer Inc. and Subsidiary Companies Year Ended December 31, 2020 2019 41.908 s 41,172 $ 2018 40.825 (MILLIONS, EXCEPT PER COMMON SHARE DATA) Revenues Costs and expenses: Cost of sales Selling informational and administrative expenses Research and development expenses Amortization of intangible assets Restructuring charges and certain acquisition-related costs (Gain) on completion of Consumer Healthcare JV transaction Other (income) deductions -net Income from continuing operations before provision (benefit) for taxes on income Provision (benefit) for taxes on income Income from continuing operations 8.987 12.612 7,760 4.736 1.058 8,692 11.615 9,405 3,436 600 (6) 669 7.497 477 7,021 8.251 12,750 8,394 4,462 601 (8,086) 3,314 11,485 618 10,867 2.077 3.594 (266) 3.861 Income from discontinued operations net of tax 2.631 5,435 7.328 9,652 36 16,302 29 11.188 36 9.616 S 16.273 $ 11.153 $ S $ Net income before allocation to noncontrolling interests Less: Net income attributable to noncontrolling interests Net income attributable to Pfizer Inc. common shareholders (*) Earings per common share-basic: Income from continuing operations attributable to Pfizer Inc. common shareholders Income from discontinued operations net of tax Net income attributable to Pfizer Inc. common shareholders Earingsst.common share_diluted: Income from continuing operations attributable to Pfizer Inc. common sharcholders Income from discontinued operations net of tax Net income attributable to Pfizer Inc.common shareholders Weighted average shares-basie Weighted average shares-diluted 1.26 0.47 1.73 1.95 0.98 2.92 0.65 1.25 1.90 S S S 1.24 0.47 1.71 1.91 0.96 2.87 0.64 1.23 187 5.555 5.632 5.569 5,675 5.872 5.977 See Accompanying Notes (*) This line represents the "net income" of Pfizer Problem III: Pension benefit obligations (Pfizer Inc.) Like many companies, Pfizer offers a defined benefit pension plan to some of their employees. Under this plan, employees earn pension benefits by working currently, that they receive after they retire. U.S. GAAP requires that these amounts be expensed when the employees earn the benefits, even though cash will not be paid out until later. The resulting non-current liability is recorded on the balance sheet. You are preparing an analysis of Pfizer, and have determined that for your purposes it might be more useful if Pfizer recorded these pension costs on a cash basis that is, if they recorded the expense only when the actual cash outflow occurred. Ignore taxes. 1. Had Pfizer always recorded pension costs on a cash basis, what would have been the Net income attributable to Pfizer common shareholders for the year ended December 31, 2020? 2. Had Pfizer always recorded pension costs on a cash basis, what would have been Pfizer's return on equity (defined as Net income attributable to Pfizer common shareholders divided by ENDING total equity) for the year ended December 31, 2020? Express your answer to the nearest tenth of a percent (i.e., 12.3%, rather than 12%). 3. As mentioned above, under U.S. GAAP, the alternative method is NOT permitted - Pfizer must record the pension expense when the employees earn the benefits. Name or describe the principle that requires this. One word is sufficient, if it is the correct word! Problem II: Inferences (Pfizer Inc.) 1. During 2020, Pfizer had an entry which did not affect net income, and which is beyond the scope of the course, which decreased (debited) retained earnings by $1,944. What were Pfizer's dividends declared for the year ended December 31, 2020? 2. During the year ended December 31, 2020, Pfizer wrote-off (i.e., gave up on collecting), $184 worth of accounts receivable. Based on this, what was Pfizer's bad debt expense for the year ended December 31, 2020