Answered step by step

Verified Expert Solution

Question

1 Approved Answer

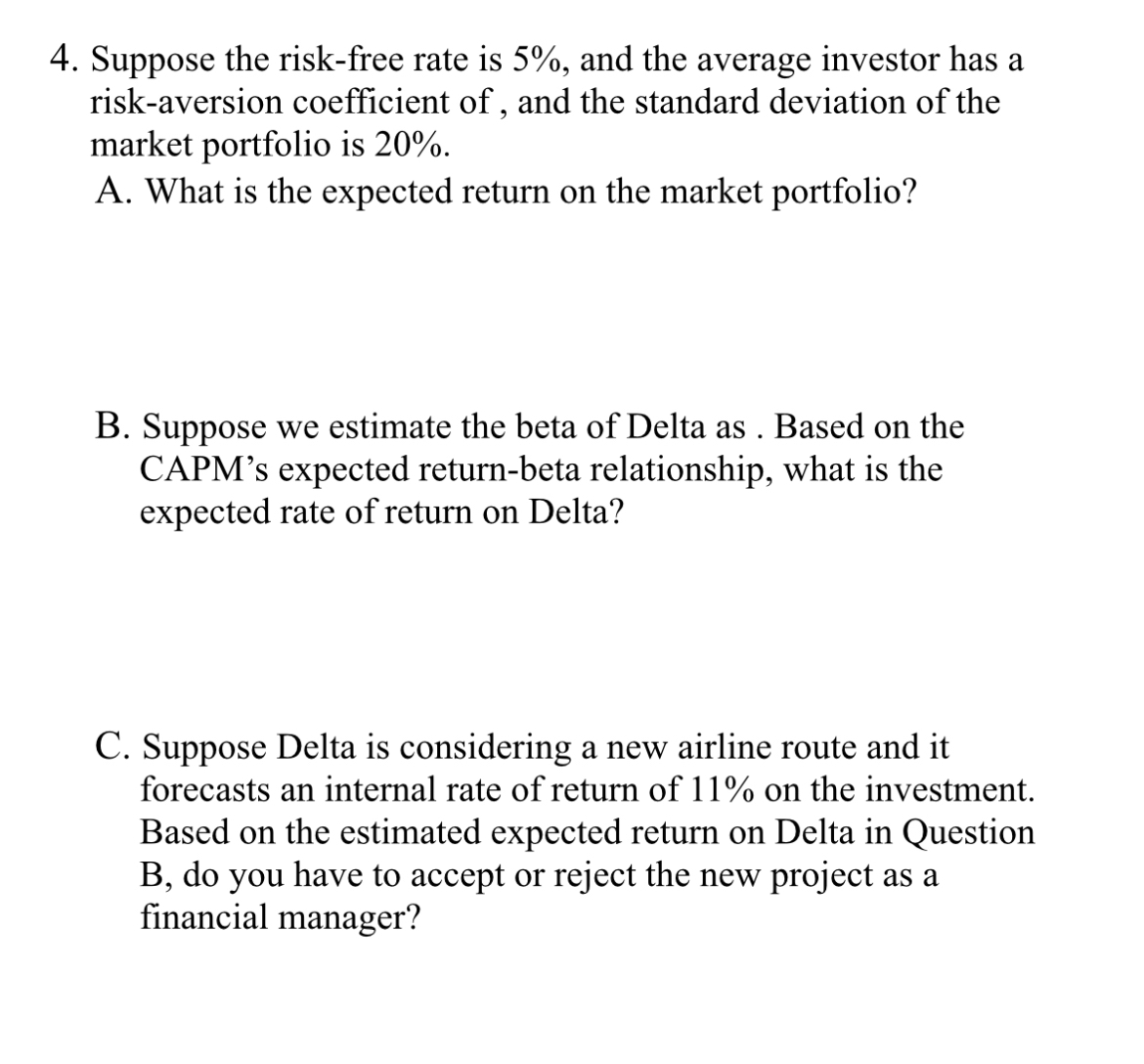

Pleas solve a , b , c Suppose the risk - free rate is 5 % , and the average investor has a risk -

Pleas solve a b c

Suppose the riskfree rate is and the average investor has a riskaversion coefficient of and the standard deviation of the market portfolio is

A What is the expected return on the market portfolio?

B Suppose we estimate the beta of Delta as Based on the CAPM's expected returnbeta relationship, what is the expected rate of return on Delta?

C Suppose Delta is considering a new airline route and it forecasts an internal rate of return of on the investment. Based on the estimated expected return on Delta in Question do you have to accept or reject the new project as a financial manager?

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started