Answered step by step

Verified Expert Solution

Question

1 Approved Answer

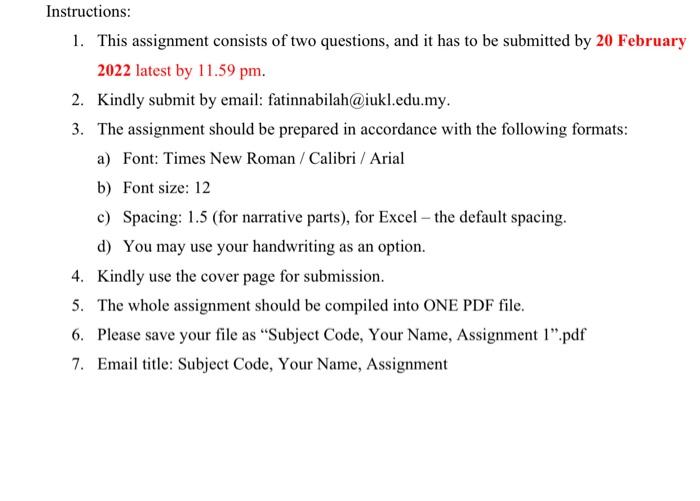

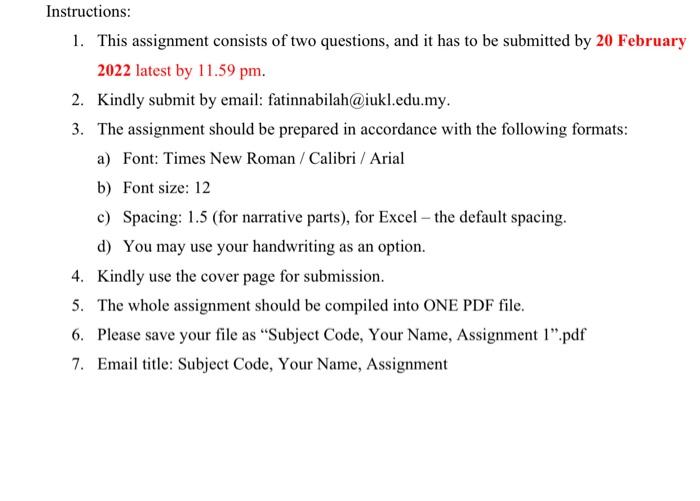

pleas typing Instructions: 1. This assignment consists of two questions, and it has to be submitted by 20 February 2022 latest by 11.59 pm.

pleas typing """"""

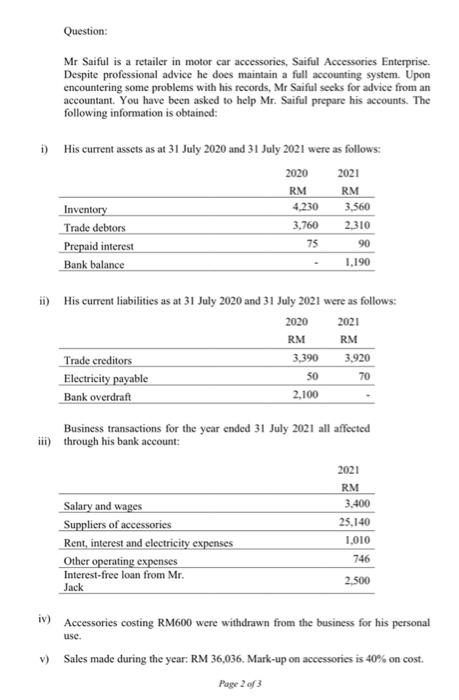

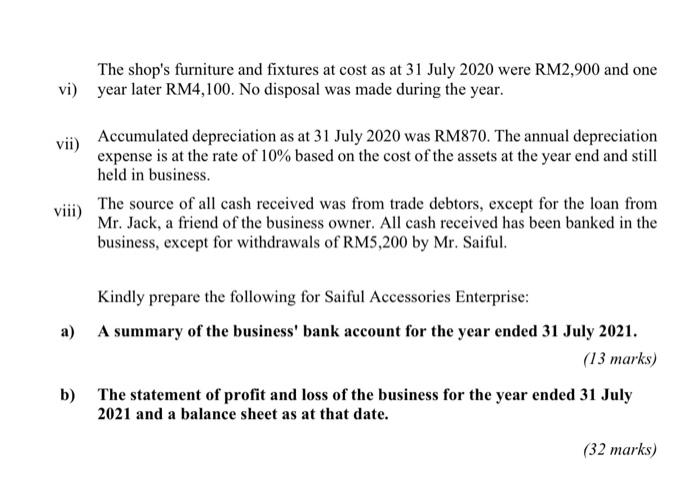

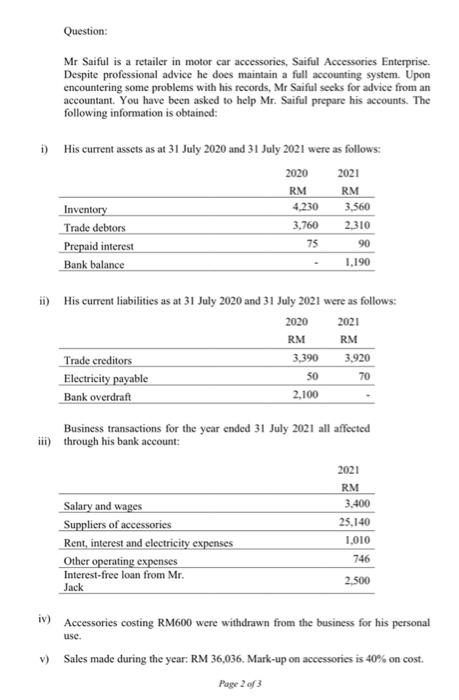

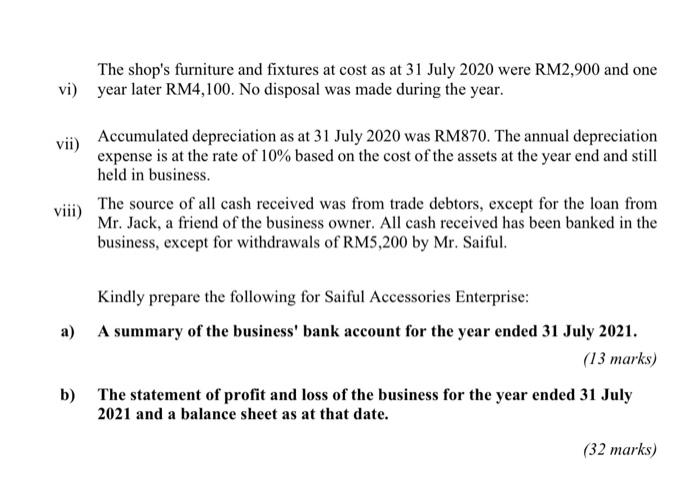

Instructions: 1. This assignment consists of two questions, and it has to be submitted by 20 February 2022 latest by 11.59 pm. 2. Kindly submit by email: fatinnabilah@iukl.edu.my. 3. The assignment should be prepared in accordance with the following formats: a) Font: Times New Roman / Calibri / Arial b) Font size: 12 c) Spacing: 1.5 (for narrative parts), for Excel - the default spacing. d) You may use your handwriting as an option. 4. Kindly use the cover page for submission. 5. The whole assignment should be compiled into ONE PDF file. 6. Please save your file as "Subject Code, Your Name, Assignment I".pdf 7. Email title: Subject Code, Your Name, Assignment Question: Mr Saiful is a retailer in motor car accessories, Saiful Accessories Enterprise. Despite professional advice he does maintain a full accounting system. Upon encountering some problems with his records, Mr Saiful seeks for advice from an accountant. You have been asked to help Mr. Saiful prepare his accounts. The following information is obtained: i) His current assets as at 31 July 2020 and 31 July 2021 were as follows: 2020 2021 RM RM Inventory 4,230 3,560 Trade debtors 3,760 2.310 Prepaid interest 75 Bank balance 1.190 90 2020 RM ii) His current liabilities as at 31 July 2020 and 31 July 2021 were as follows: 2021 RM Trade creditors 3.390 3.920 Electricity payable 70 Bank overdraft 2,100 50 Business transactions for the year ended 31 July 2021 all affected iii) through his bank account: Salary and wages Suppliers of accessories Rent, interest and electricity expenses Other operating expenses Interest-free loan from Mr. 2021 RM 3,400 25,140 1,010 746 Jack 2.500 i) Accessories costing RM600 were withdrawn from the business for his personal use. V) Sales made during the year: RM 36,036, Mark-up on accessories is 40% on cost. Page 2 of 3 The shop's furniture and fixtures at cost as at 31 July 2020 were RM2,900 and one vi) year later RM4,100. No disposal was made during the year. vii) Accumulated depreciation as at 31 July 2020 was RM870. The annual depreciation expense is at the rate of 10% based on the cost of the assets at the year end and still held in business. The source of all cash received was from trade debtors, except for the loan from Mr. Jack, a friend of the business owner. All cash received has been banked in the business, except for withdrawals of RM5,200 by Mr. Saiful. viii) Kindly prepare the following for Saiful Accessories Enterprise: a) A summary of the business' bank account for the year ended 31 July 2021. (13 marks) b) The statement of profit and loss of the business for the year ended 31 July 2021 and a balance sheet as at that date. (32 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started