Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please 20 min Based on the information of the following bonds and the market: Par value: $1,000 Years to maturity: 15 years Coupon rate: 8%

please 20 min

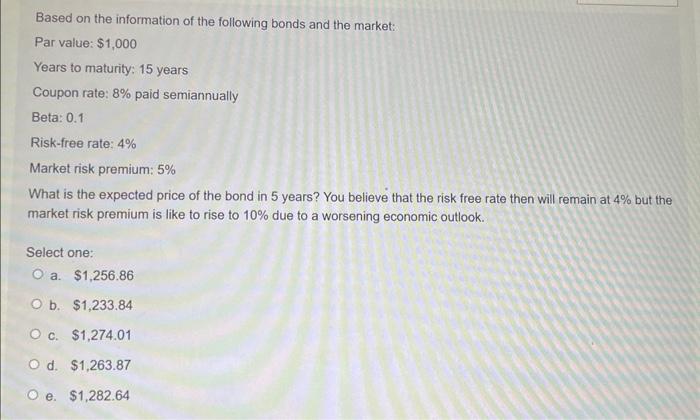

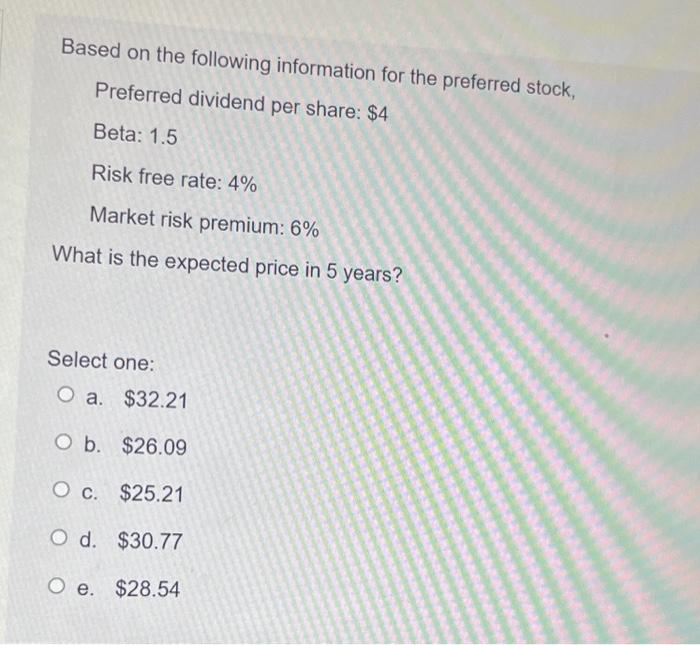

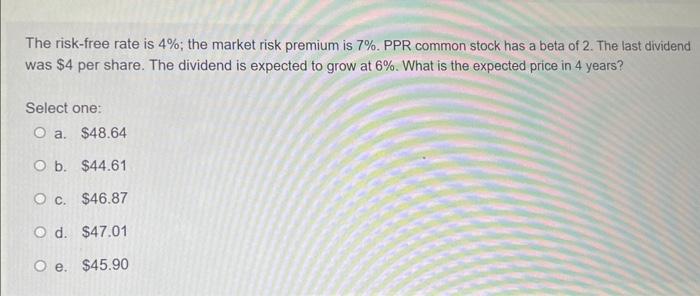

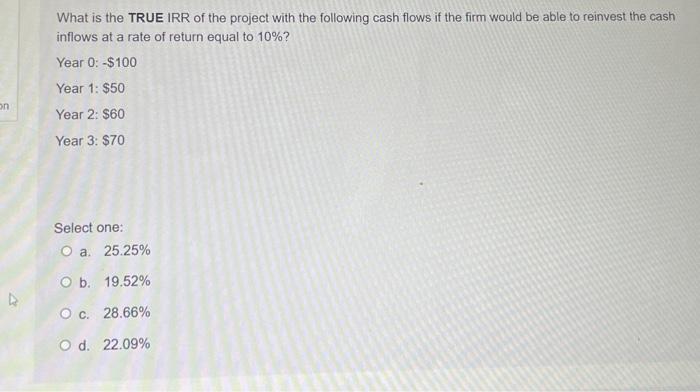

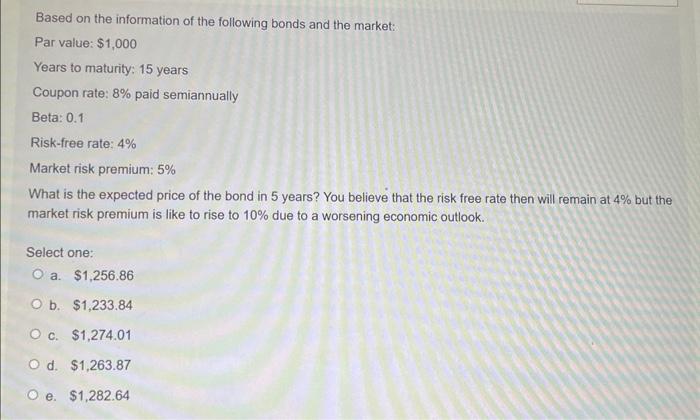

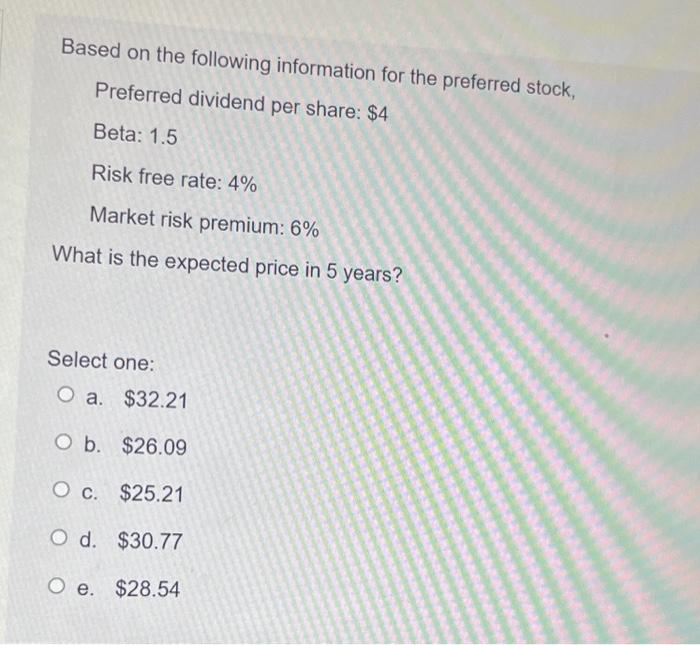

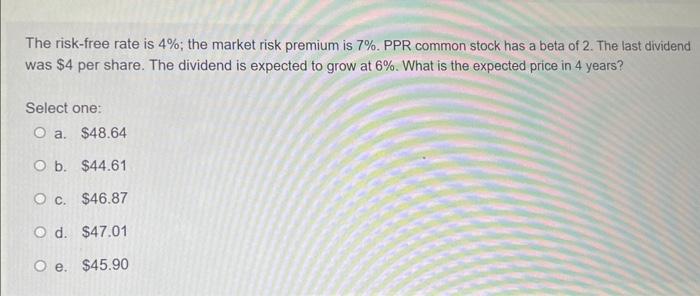

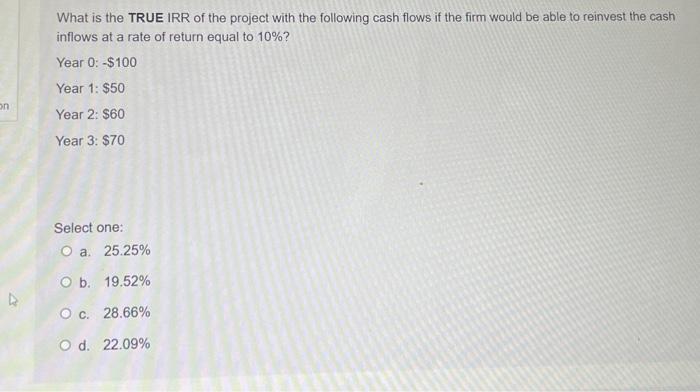

Based on the information of the following bonds and the market: Par value: $1,000 Years to maturity: 15 years Coupon rate: 8% paid semiannually Beta: 0.1 Risk-free rate: 4% Market risk premium: 5% What is the expected price of the bond in 5 years? You believe that the risk free rate then will remain at 4% but the market risk premium is like to rise to 10% due to a worsening economic outlook. Select one: a. $1,256.86 b. $1,233.84 c. $1,274.01 d. $1,263.87 e. $1,282.64 Based on the following information for the preferred stock, Preferred dividend per share: $4 Beta: 1.5 Risk free rate: 4% Market risk premium: 6% What is the expected price in 5 years? Select one: a. $32.21 b. $26.09 c. $25.21 d. $30.77 e. $28.54 The risk-free rate is 4%; the market risk premium is 7%. PPR common stock has a beta of 2 . The last dividend was $4 per share. The dividend is expected to grow at 6%. What is the expected price in 4 years? Select one: a. $48.64 b. $44.61 c. $46.87 d. $47.01 e. $45.90 What is the TRUE IRR of the project with the following cash flows if the firm would be able to reinvest the cash inflows at a rate of return equal to 10% ? Year 0: $100 Year 1: $50 Year 2: $60 Year 3: $70 Select one: a. 25.25% b. 19.52% c. 28.66% d. 22.09%

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started