Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please add 3A to question 2 that is provide Oleg Buzzini is the sole stockholder of Cutting Edge Fashion Corporation, a fashion consulting firm that

Please add 3A to question 2 that is provide

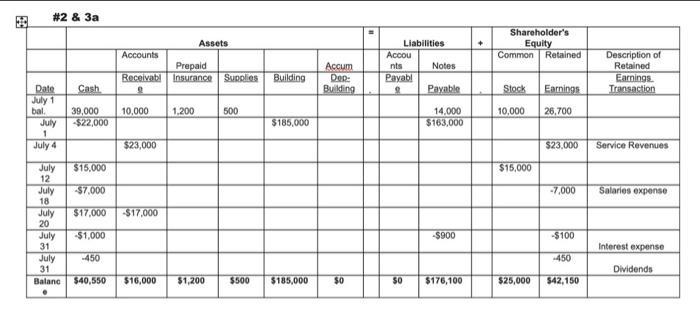

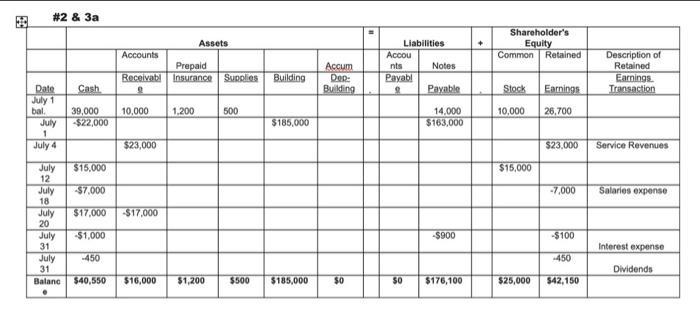

Oleg Buzzini is the sole stockholder of Cutting Edge Fashion Corporation, a fashion consulting firm that earns its revenue in the form of consulting fees. Below are the transactions which occurred in the operation of Cutting Edge during the month of June. Record each transaction of Cutting Edge on the worksheet that has been supplied for this purpose, including entries in the description column in proper form where required. There is no need to total all of the columns. ( 36 points) \#2 \& 3a \begin{tabular}{|c|c|c|c|c|c|c|c|c|c|c|c|c|c|} \hline & \multicolumn{6}{|c|}{ Assets } & \multirow[t]{2}{*}{=} & \multicolumn{2}{|c|}{ Liabilities } & \multirow[t]{2}{*}{+} & \multicolumn{2}{|c|}{\begin{tabular}{c} Shareholder's \\ Equity \end{tabular}} & \multirow[b]{2}{*}{\begin{tabular}{c} Description of \\ Retained \end{tabular}} \\ \hline & & Accounts & Prepaid & & & Accum & & \begin{tabular}{l} Accou \\ nts \end{tabular} & Notes & & Common & Retained & \\ \hline Date & Cash. & 2Receivabil & insurance & Supolies & Building & \begin{tabular}{l} Ded: \\ Building \end{tabular} & & \begin{tabular}{c} Payab! \\ 2 \end{tabular} & Paxable & & Stock & Earnings: & \begin{tabular}{l} Earnings. \\ Transaction \end{tabular} \\ \hline \begin{tabular}{l} July 1 \\ bal. \end{tabular} & 39,000 & 10,000 & 1,200 & 500 & & & & & 14.000 & & 10,000 & 26,700 & \\ \hline \begin{tabular}{c} July \\ 1 \end{tabular} & $22,000 & & & & $185,000 & & & & $163,000 & & & & \\ \hline July 4 & & $23,000 & & & & & & & & & & $23.000 & Service Revenues \\ \hline \begin{tabular}{l} July \\ 12 \end{tabular} & $15,000 & & & & & & & & & & $15,000 & & \\ \hline \begin{tabular}{l} July \\ 18 \end{tabular} & $7,000 & & & & & & & & & & & 7,000 & Salaries expense \\ \hline \begin{tabular}{l} July \\ 20 \end{tabular} & $17,000 & $17,000 & & & & & & & & & & & \\ \hline \begin{tabular}{l} July \\ 31 \end{tabular} & $1,000 & & & & & & & & $900 & & & $100 & Interest expense \\ \hline \begin{tabular}{l} July \\ 31 \end{tabular} & -450 & & & & & & & & & & & 450 & Dividends \\ \hline \begin{tabular}{c} Balane \\ - \end{tabular} & $40,550 & $16,000 & $1,200 & $500 & $185,000 & $0 & & 50 & $176,100 & & $25,000 & $42,150 & \\ \hline \end{tabular} 3) Refer to the accounting record that you completed in \#2. (13 points) a) The building depreciated $800 for the month of July. Record the adjustment for depreciation in the accounting record you created in \#2. (4 points)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started