Answered step by step

Verified Expert Solution

Question

1 Approved Answer

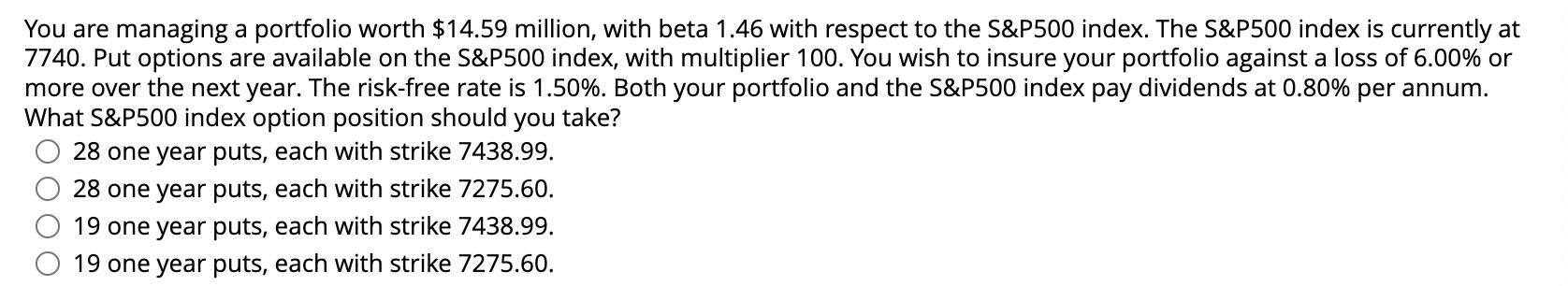

Please add (excel)steps if possible! much appreciate! You are managing a portfolio worth $14.59 million, with beta 1.46 with respect to the S&P500 index. The

Please add (excel)steps if possible! much appreciate!

Please add (excel)steps if possible! much appreciate!

You are managing a portfolio worth $14.59 million, with beta 1.46 with respect to the S\&P500 index. The S\&P500 index is currently at 7740. Put options are available on the S\&P500 index, with multiplier 100 . You wish to insure your portfolio against a loss of 6.00% or more over the next year. The risk-free rate is 1.50%. Both your portfolio and the S\&P500 index pay dividends at 0.80% per annum. What S\&P500 index option position should you take? 28 one year puts, each with strike 7438.99. 28 one year puts, each with strike 7275.60. 19 one year puts, each with strike 7438.99. 19 one year puts, each with strike 7275.60. You are managing a portfolio worth $14.59 million, with beta 1.46 with respect to the S\&P500 index. The S\&P500 index is currently at 7740. Put options are available on the S\&P500 index, with multiplier 100 . You wish to insure your portfolio against a loss of 6.00% or more over the next year. The risk-free rate is 1.50%. Both your portfolio and the S\&P500 index pay dividends at 0.80% per annum. What S\&P500 index option position should you take? 28 one year puts, each with strike 7438.99. 28 one year puts, each with strike 7275.60. 19 one year puts, each with strike 7438.99. 19 one year puts, each with strike 7275.60

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started