Question: please add full spreadsheet with formulas Lets look at a real world example of how the portfolio value of a bond can change over a

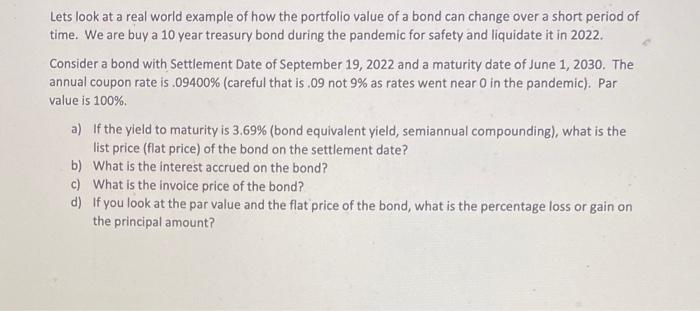

Lets look at a real world example of how the portfolio value of a bond can change over a short period of time. We are buy a 10 year treasury bond during the pandemic for safety and liquidate it in 2022. Consider a bond with Settlement Date of September 19, 2022 and a maturity date of June 1, 2030. The annual coupon rate is . 09400% (careful that is .09 not 9% as rates went near 0 in the pandemic). Par value is 100% a) If the yield to maturity is 3.69% (bond equivalent yield, semiannual compounding), what is the list price (flat price) of the bond on the settlement date? b) What is the interest accrued on the bond? c) What is the invoice price of the bond? d) If you look at the par value and the flat price of the bond, what is the percentage loss or gain on the principal amount

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts