please address all questions. I will give Kudos

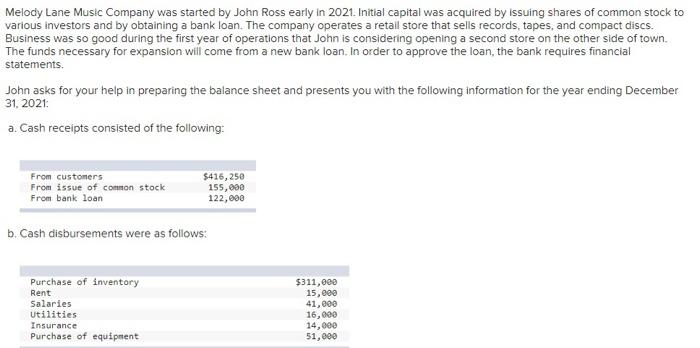

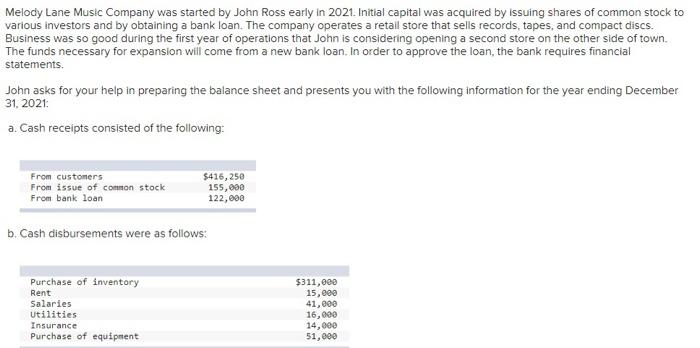

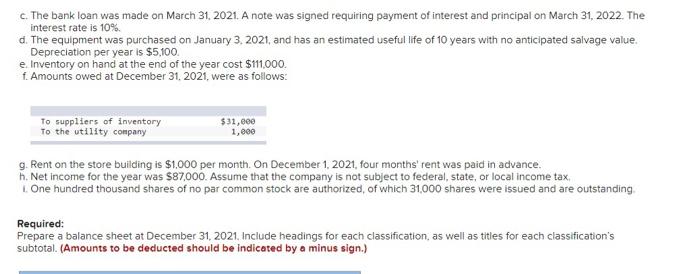

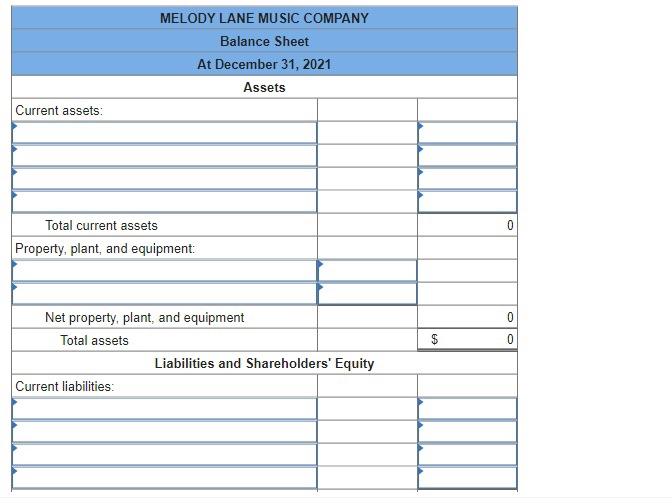

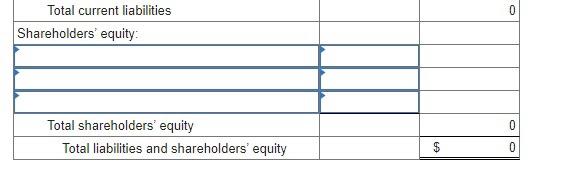

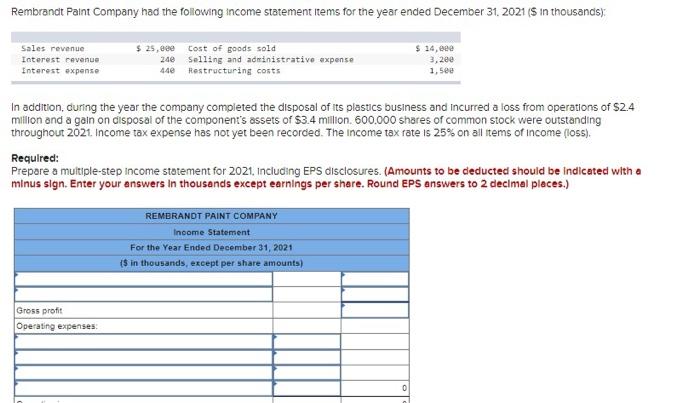

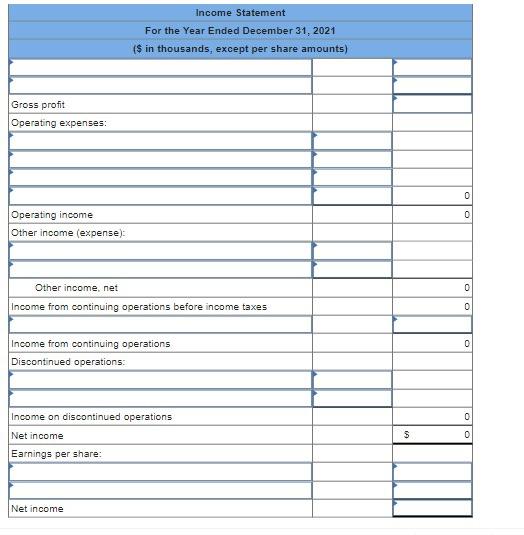

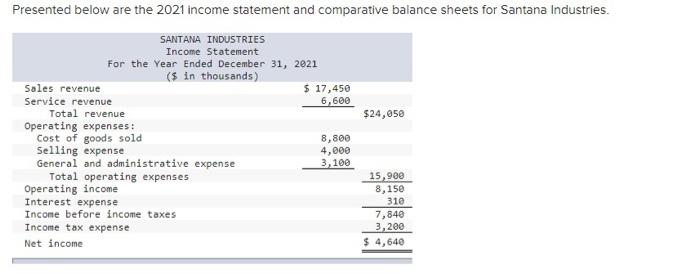

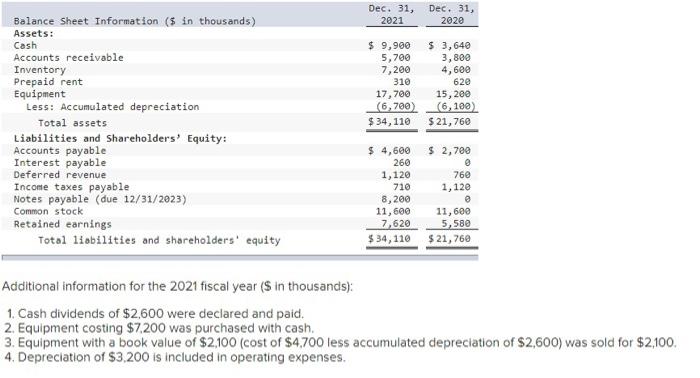

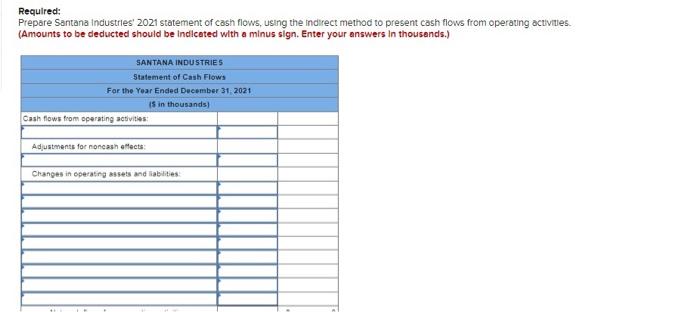

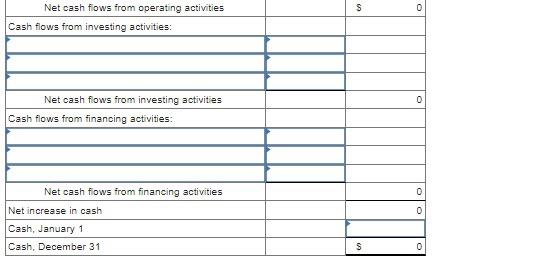

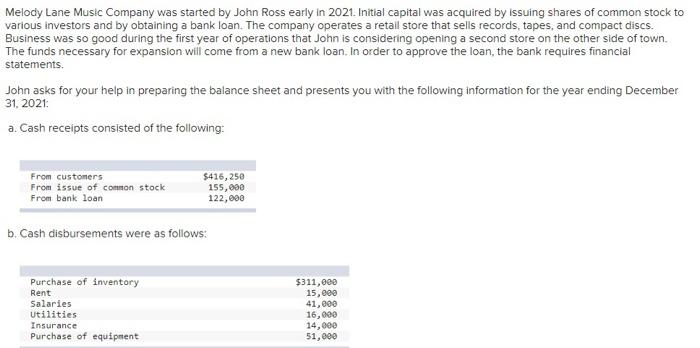

Melody Lane Music Company was started by John Ross early in 2021. Initial capital was acquired by issuing shares of common stock to various investors and by obtaining a bank loan. The company operates a retall store that sells records, tapes, and compact discs. Business was so good during the first year of operations that John is considering opening a second store on the other side of town. The funds necessary for expansion will come from a new bank loan, In order to approve the loan, the bank requires financial statements. John asks for your help in preparing the balance sheet and presents you with the following information for the year ending December 31, 2021: a. Cash receipts consisted of the following: b. Cash disbursements were as follows: \begin{tabular}{|c|c|c|} \hline \multicolumn{3}{|c|}{ MELODY LANE MUSIC COMPANY } \\ \hline \multicolumn{3}{|c|}{ Balance Sheet } \\ \hline \multicolumn{3}{|c|}{ At December 31, 2021} \\ \hline \multicolumn{3}{|c|}{ Assets } \\ \hline \multicolumn{3}{|l|}{ Current assets: } \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline Total current assets & & 0 \\ \hline \multicolumn{3}{|l|}{ Property, plant, and equipment: } \\ \hline \\ \hline & & \\ \hline Net property, plant, and equipment & & 0 \\ \hline Total assets & $ & 0 \\ \hline \multicolumn{3}{|c|}{ Liabilities and Shareholders' Equity } \\ \hline \multicolumn{3}{|l|}{ Current liabilities: } \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline & & \\ \hline \end{tabular} \begin{tabular}{|c|c|} \hline Total current liabilities & 0 \\ \hline \multicolumn{2}{|l|}{ Shareholders' equity: } \\ \hline 7 & \\ \hline & \\ \hline & \\ \hline Total shareholders' equity & 0 \\ \hline Total liabilities and shareholders' equity & $ \\ \hline \end{tabular} In addition, during the year the company completed the disposal of its plastics business and incurred a loss from operations of $2.4 milition and a gain on cisposai of the component's assets of $3.4 million. 600,000 shares of common stock were outstanding throughout 2021. Income tax expense has not yet been recorded. The income tax fate is 25% on all items of income (los5). Required: Prepare a muitiple-step income statement for 2021, Including EPS disclosures. (Amounts to be deducted should be indicated with a minus sign. Enter your answers In thousands except earnings per share. Round EPS answers to 2 decimal places.) Presented below are the 2021 income statement and comparative balance sheets for Santana Industries. \begin{tabular}{|c|c|c|} \hline \begin{tabular}{c} SANTANA INDUSTRIES \\ Income Statement \\ For the Year Ended December 31 , \\ ( $ in thousands) \end{tabular} & 2021 & \\ \hline Sales revenue & 517,450 & \\ \hline Service revenue & 6,600 & \\ \hline Total revenue & & $24,056 \\ \hline Operating expenses: & & \\ \hline Cost of goods sold & 8,800 & \\ \hline Selling expense & 4,000 & \\ \hline General and administrative expense & 3,100 & \\ \hline Total operating expenses & & 15,900 \\ \hline Operating income & & 8,150 \\ \hline Interest expense & & 310 \\ \hline Income before income taxes & & 7,840 \\ \hline Income tax expense & & 3,200 \\ \hline Net income & & $4,640 \\ \hline \end{tabular} Additional information for the 2021 fiscal year ( $ in thousands): 1. Cash dividends of $2,600 were declared and paid. 2. Equipment costing $7,200 was purchased with cash. 3. Equipment with a book value of $2,100 (cost of $4,700 less accumulated depreciation of $2,600 ) was sold for $2,100. 4. Depreciation of $3,200 is included in operating expenses. Requlred: Prepare Santana industries' 2021 statement of cash flows, using the indirect method to present cash flows from operating activites. (Amounts to be deducted should be indlceted with a minus sign. Enter your answers in thousands.) \begin{tabular}{|l|l|l|} \hline \multicolumn{1}{|c|}{ Net cash flows from operating activities } & & \\ \hline Cash flows from investing activities: & & \\ \hline & & \\ \hline & & \\ \hline Net cash flows from investing activities & & \\ \hline Cash flows from financing activities: & & \\ \hline & & \\ \hline & & \\ \hline Net cash flows from financing activities & & \\ \hline Net increase in cash & & \\ \hline Cash, January 1 & & \\ \hline Cash, December 31 & & \\ \hline \end{tabular}