Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please advise answer. An asset in the five-year MACRS property class costs $150,000 and has a zero estimated salvage value after six years of use.

Please advise answer.

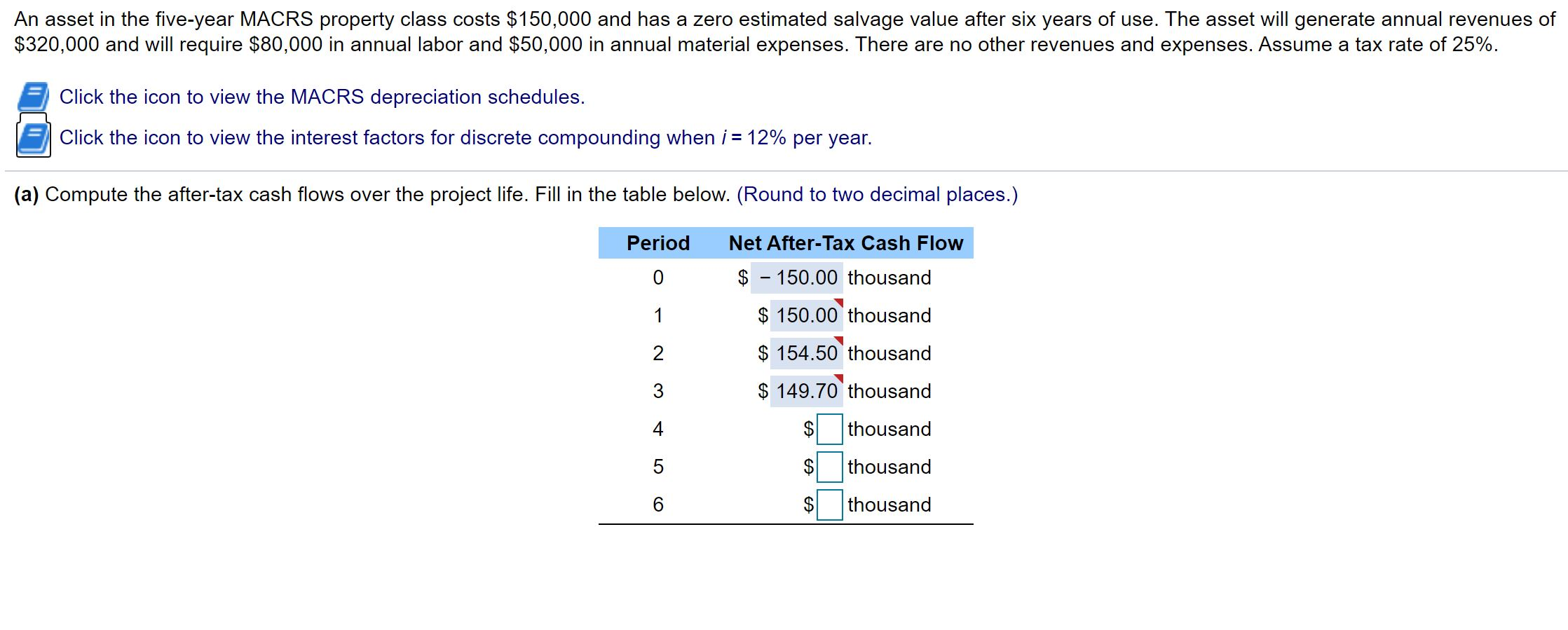

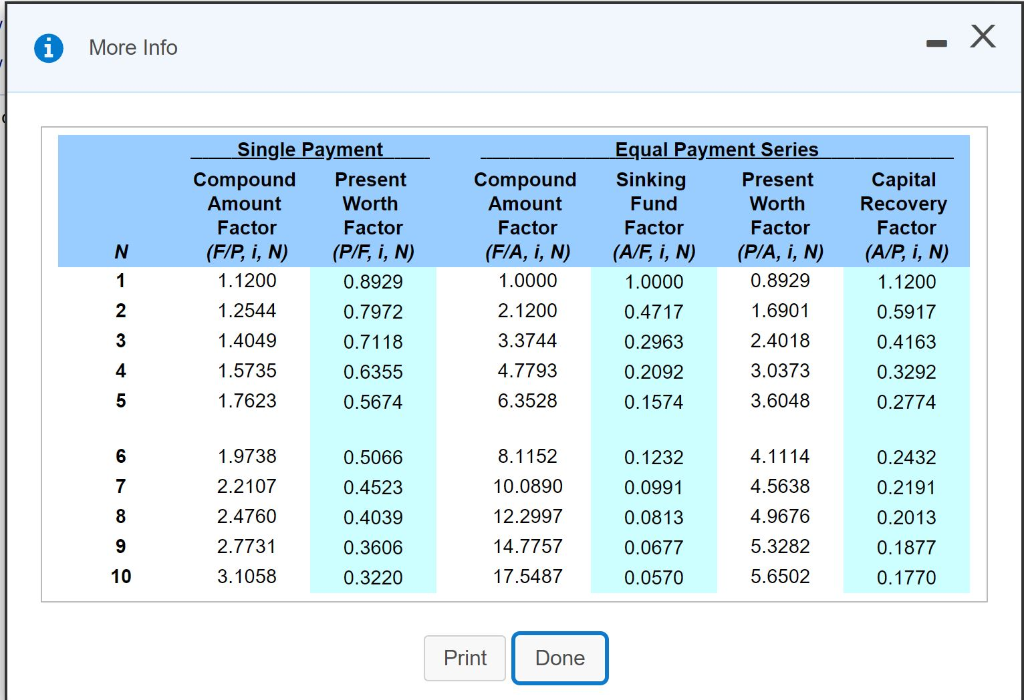

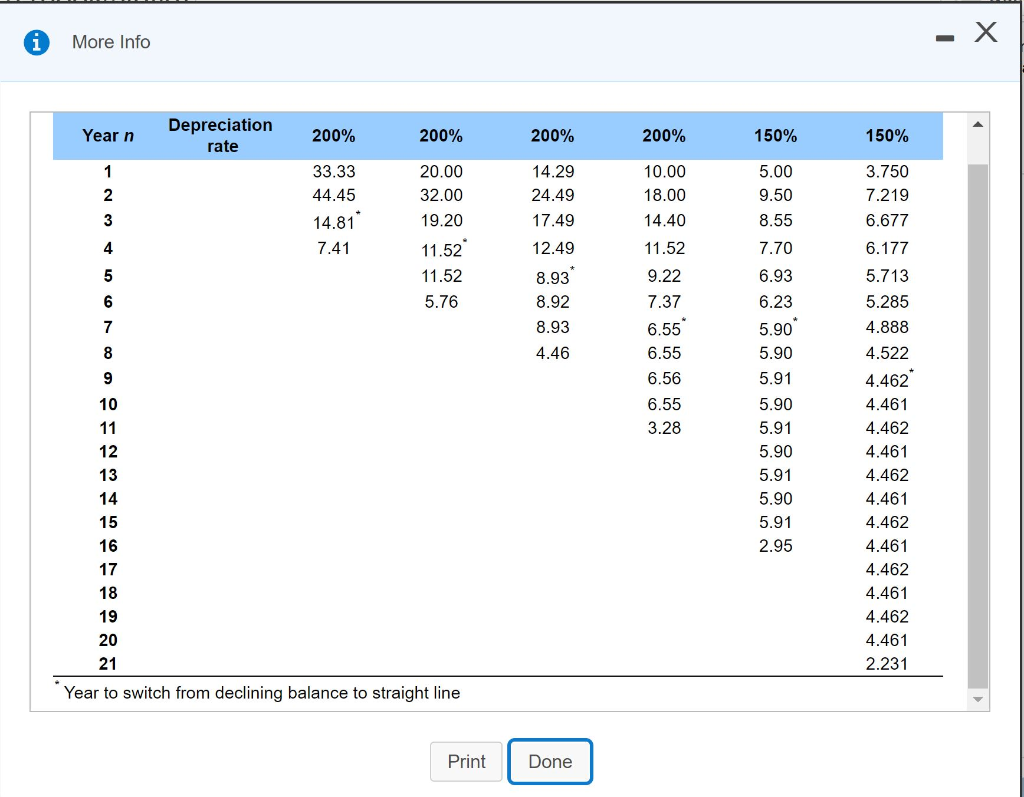

An asset in the five-year MACRS property class costs $150,000 and has a zero estimated salvage value after six years of use. The asset will generate annual revenues of $320,000 and will require $80,000 in annual labor and $50,000 in annual material expenses. There are no other revenues and expenses. Assume a tax rate of 25%. Click the icon to view the MACRS depreciation schedules. Click the icon to view the interest factors for discrete compounding when i = 12% per year. (a) Compute the after-tax cash flows over the project life. Fill in the table below. (Round to two decimal places.) Period Net After-Tax Cash Flow 0 $ - 150.00 thousand $ 150.00 thousand 1 2 $ 154.50 thousand 3 $ 149.70 thousand 4 $ thousand 5 FA thousand thousand - X More Info N 1 Single Payment Compound Present Amount Worth Factor Factor (F/P, i, N) (P/F, I, N) 1.1200 0.8929 1.2544 0.7972 1.4049 0.7118 1.5735 0.6355 1.7623 0.5674 Compound Amount Factor (F/A, I, N) 1.0000 2.1200 3.3744 Equal Payment Series Sinking Present Fund Worth Factor Factor (A/F, I, N) (P/A, i, N) 1.0000 0.8929 0.4717 1.6901 0.2963 2.4018 0.2092 3.0373 0.1574 3.6048 Capital Recovery Factor (A/P, i, N) 1.1200 0.5917 0.4163 0.3292 0.2774 2 3 4 5 4.7793 6.3528 6 7 1.9738 2.2107 2.4760 2.7731 3.1058 0.5066 0.4523 0.4039 0.3606 8 8.1152 10.0890 12.2997 14.7757 17.5487 0.1232 0.0991 0.0813 0.0677 0.0570 4.1114 4.5638 4.9676 5.3282 5.6502 0.2432 0.2191 0.2013 0.1877 0.1770 9 10 0.3220 Print Done More Info Year n Depreciation rate 200% 200% 200% 200% 150% 150% 1 2 33.33 44.45 14.81 7.41 20.00 32.00 19.20 14.29 24.49 17.49 12.49 10.00 18.00 14.40 11.52 5.00 9.50 8.55 3 4 11.52 7.70 5 11.52 5.76 6 8.93 8.92 8.93 7 9.22 7.37 6.55 6.55 6.56 8 4.46 9 10 6.55 3.28 6.93 6.23 5.90 5.90 5.91 5.90 5.91 5.90 5.91 5.90 5.91 2.95 3.750 7.219 6.677 6.177 5.713 5.285 4.888 4.522 4.462* 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 4.462 4.461 2.231 11 12 13 14 15 16 17 18 19 20 21 Year to switch from declining balance to straight line Print Done Done

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started