Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Please also upload a screenshot of the formulas used for your calculations in excel, thanks! Case: You and your business partners are considering a car

Please also upload a screenshot of the formulas used for your calculations in excel, thanks!

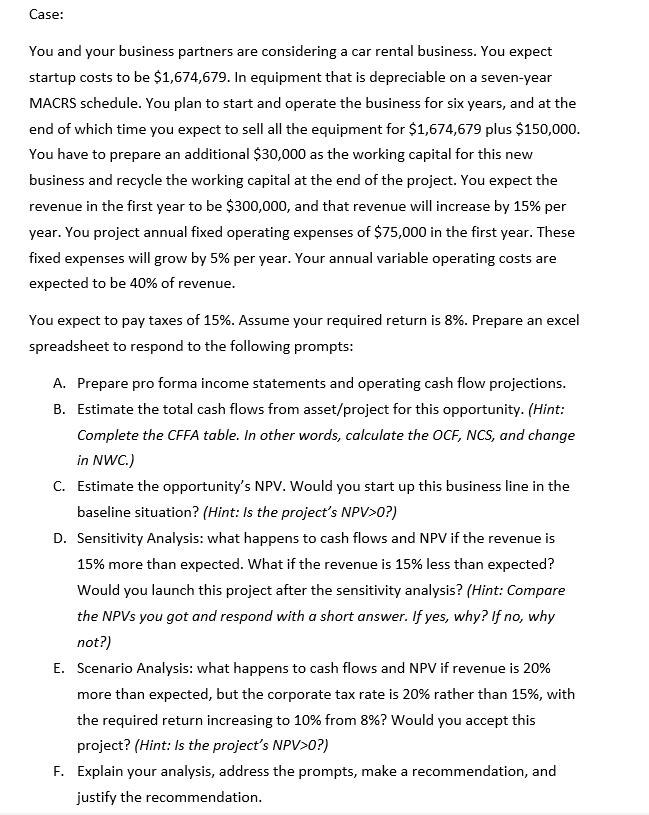

Case: You and your business partners are considering a car rental business. You expect startup costs to be $1,674,679. In equipment that is depreciable on a seven-year MACRS schedule. You plan to start and operate the business for six years, and at the end of which time you expect to sell all the equipment for $1,674,679 plus $150,000. You have to prepare an additional $30,000 as the working capital for this new business and recycle the working capital at the end of the project. You expect the revenue in the first year to be $300,000, and that revenue will increase by 15% per year. You project annual fixed operating expenses of $75,000 in the first year. These fixed expenses will grow by 5% per year. Your annual variable operating costs are expected to be 40% of revenue. You expect to pay taxes of 15%. Assume your required return is 8%. Prepare an excel spreadsheet to respond to the following prompts: A. Prepare pro forma income statements and operating cash flow projections. B. Estimate the total cash flows from asset/project for this opportunity. (Hint: Complete the CFFA table. In other words, calculate the OCF, NCS, and change in NWC.) C. Estimate the opportunity's NPV. Would you start up this business line in the baseline situation? (Hint: Is the project's NPV>0?) D. Sensitivity Analysis: what happens to cash flows and NPV if the revenue is 15% more than expected. What if the revenue is 15% less than expected? Would you launch this project after the sensitivity analysis? (Hint: Compare the NPVs you got and respond with a short answer. If yes, why? If no, why not?) E. Scenario Analysis: what happens to cash flows and NPV if revenue is 20% more than expected, but the corporate tax rate is 20% rather than 15%, with the required return increasing to 10% from 8%? Would you accept this project? (Hint: Is the project's NPV>0?) F. Explain your analysis, address the prompts, make a recommendation, and justify the recommendation. Case: You and your business partners are considering a car rental business. You expect startup costs to be $1,674,679. In equipment that is depreciable on a seven-year MACRS schedule. You plan to start and operate the business for six years, and at the end of which time you expect to sell all the equipment for $1,674,679 plus $150,000. You have to prepare an additional $30,000 as the working capital for this new business and recycle the working capital at the end of the project. You expect the revenue in the first year to be $300,000, and that revenue will increase by 15% per year. You project annual fixed operating expenses of $75,000 in the first year. These fixed expenses will grow by 5% per year. Your annual variable operating costs are expected to be 40% of revenue. You expect to pay taxes of 15%. Assume your required return is 8%. Prepare an excel spreadsheet to respond to the following prompts: A. Prepare pro forma income statements and operating cash flow projections. B. Estimate the total cash flows from asset/project for this opportunity. (Hint: Complete the CFFA table. In other words, calculate the OCF, NCS, and change in NWC.) C. Estimate the opportunity's NPV. Would you start up this business line in the baseline situation? (Hint: Is the project's NPV>0?) D. Sensitivity Analysis: what happens to cash flows and NPV if the revenue is 15% more than expected. What if the revenue is 15% less than expected? Would you launch this project after the sensitivity analysis? (Hint: Compare the NPVs you got and respond with a short answer. If yes, why? If no, why not?) E. Scenario Analysis: what happens to cash flows and NPV if revenue is 20% more than expected, but the corporate tax rate is 20% rather than 15%, with the required return increasing to 10% from 8%? Would you accept this project? (Hint: Is the project's NPV>0?) F. Explain your analysis, address the prompts, make a recommendation, and justify the recommendationStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started