Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please and please Chegg instructors help me i need the answer of this question urgently Monster Bhd, a leading manufacturer in textile industry, had successfully

please and please Chegg instructors help me i need the answer of this question urgently

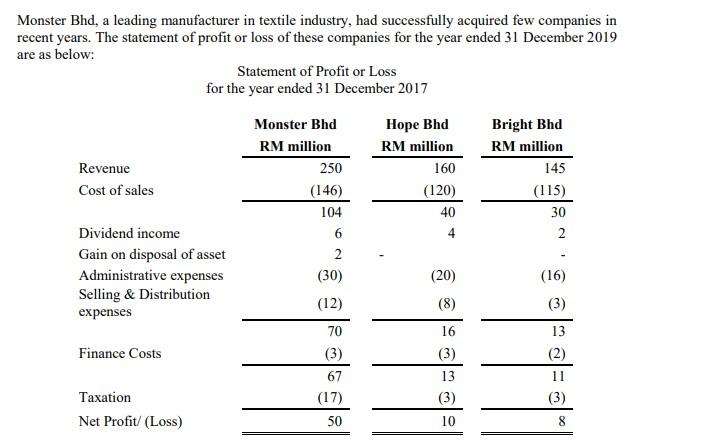

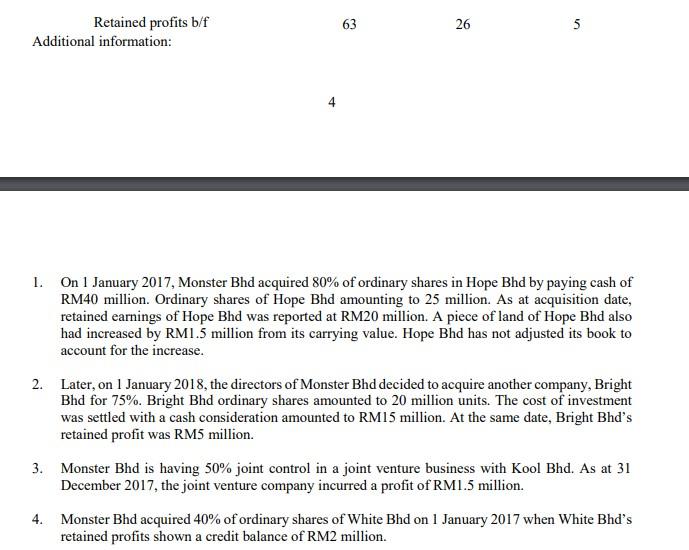

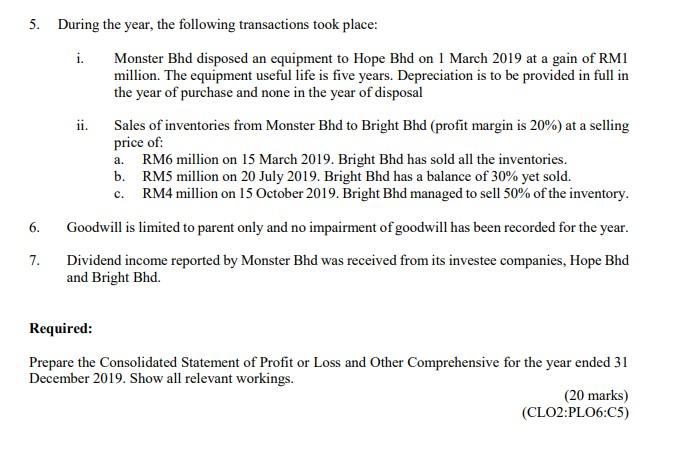

Monster Bhd, a leading manufacturer in textile industry, had successfully acquired few companies in recent years. The statement of profit or loss of these companies for the year ended 31 December 2019 are as below: Statement of Profit or Loss for the year ended 31 December 2017 Revenue Cost of sales Monster Bhd RM million 250 (146) 104 6 2 (30) (12) Hope Bhd RM million 160 (120) 40 Bright Bhd RM million 145 (115) 30 2 4 Dividend income Gain on disposal of asset Administrative expenses Selling & Distribution expenses (20) (8) (16) (3) 16 13 Finance Costs (3) (2) 70 (3) 67 (17) 50 13 11 (3) Taxation Net Profit/ (Loss) (3) 10 8 Retained profits b/f Additional information: 63 26 5 1. On 1 January 2017, Monster Bhd acquired 80% of ordinary shares in Hope Bhd by paying cash of RM40 million. Ordinary shares of Hope Bhd amounting to 25 million. As at acquisition date, retained earnings of Hope Bhd was reported at RM20 million. A piece of land of Hope Bhd also had increased by RM1.5 million from its carrying value. Hope Bhd has not adjusted its book to account for the increase. 2. Later, on 1 January 2018, the directors of Monster Bhd decided to acquire another company, Bright Bhd for 75%. Bright Bhd ordinary shares amounted to 20 million units. The cost of investment was settled with a cash consideration amounted to RM15 million. At the same date, Bright Bhd's retained profit was RM5 million. 3. Monster Bhd is having 50% joint control in a joint venture business with Kool Bhd. As at 31 December 2017, the joint venture company incurred a profit of RM1.5 million. 4. Monster Bhd acquired 40% of ordinary shares of White Bhd on 1 January 2017 when White Bhd's retained profits shown a credit balance of RM2 million. 5. During the year, the following transactions took place: i. Monster Bhd disposed an equipment to Hope Bhd on 1 March 2019 at a gain of RMI million. The equipment useful life is five years. Depreciation is to be provided in full in the year of purchase and none in the year of disposal ii. Sales of inventories from Monster Bhd to Bright Bhd (profit margin is 20%) at a selling price of: a. RM6 million on 15 March 2019. Bright Bhd has sold all the inventories. b. RM5 million on 20 July 2019. Bright Bhd has a balance of 30% yet sold. C. RM4 million on 15 October 2019. Bright Bhd managed to sell 50% of the inventory. 6. Goodwill is limited to parent only and no impairment of goodwill has been recorded for the year. 7. Dividend income reported by Monster Bhd was received from its investee companies, Hope Bhd and Bright Bhd. Required: Prepare the Consolidated Statement of Profit or Loss and Other Comprehensive for the year ended 31 December 2019. Show all relevant workings. (20 marks) (CLO2:PLO6:05) Monster Bhd, a leading manufacturer in textile industry, had successfully acquired few companies in recent years. The statement of profit or loss of these companies for the year ended 31 December 2019 are as below: Statement of Profit or Loss for the year ended 31 December 2017 Revenue Cost of sales Monster Bhd RM million 250 (146) 104 6 2 (30) (12) Hope Bhd RM million 160 (120) 40 Bright Bhd RM million 145 (115) 30 2 4 Dividend income Gain on disposal of asset Administrative expenses Selling & Distribution expenses (20) (8) (16) (3) 16 13 Finance Costs (3) (2) 70 (3) 67 (17) 50 13 11 (3) Taxation Net Profit/ (Loss) (3) 10 8 Retained profits b/f Additional information: 63 26 5 1. On 1 January 2017, Monster Bhd acquired 80% of ordinary shares in Hope Bhd by paying cash of RM40 million. Ordinary shares of Hope Bhd amounting to 25 million. As at acquisition date, retained earnings of Hope Bhd was reported at RM20 million. A piece of land of Hope Bhd also had increased by RM1.5 million from its carrying value. Hope Bhd has not adjusted its book to account for the increase. 2. Later, on 1 January 2018, the directors of Monster Bhd decided to acquire another company, Bright Bhd for 75%. Bright Bhd ordinary shares amounted to 20 million units. The cost of investment was settled with a cash consideration amounted to RM15 million. At the same date, Bright Bhd's retained profit was RM5 million. 3. Monster Bhd is having 50% joint control in a joint venture business with Kool Bhd. As at 31 December 2017, the joint venture company incurred a profit of RM1.5 million. 4. Monster Bhd acquired 40% of ordinary shares of White Bhd on 1 January 2017 when White Bhd's retained profits shown a credit balance of RM2 million. 5. During the year, the following transactions took place: i. Monster Bhd disposed an equipment to Hope Bhd on 1 March 2019 at a gain of RMI million. The equipment useful life is five years. Depreciation is to be provided in full in the year of purchase and none in the year of disposal ii. Sales of inventories from Monster Bhd to Bright Bhd (profit margin is 20%) at a selling price of: a. RM6 million on 15 March 2019. Bright Bhd has sold all the inventories. b. RM5 million on 20 July 2019. Bright Bhd has a balance of 30% yet sold. C. RM4 million on 15 October 2019. Bright Bhd managed to sell 50% of the inventory. 6. Goodwill is limited to parent only and no impairment of goodwill has been recorded for the year. 7. Dividend income reported by Monster Bhd was received from its investee companies, Hope Bhd and Bright Bhd. Required: Prepare the Consolidated Statement of Profit or Loss and Other Comprehensive for the year ended 31 December 2019. Show all relevant workings. (20 marks) (CLO2:PLO6:05)Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started