Please and thank you list with clean writing thank you so much!

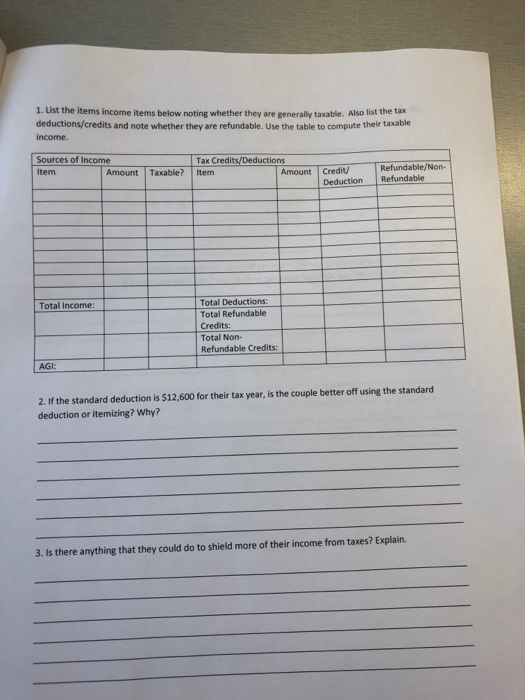

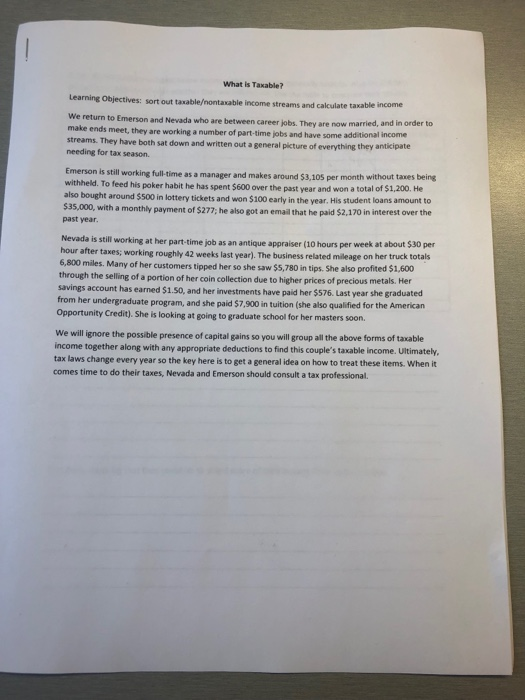

What is Taxable? Learning Objectives: sort out taxableontaxable income streams and calculate taxable income We return make ends streams. They have both sat down and written out a general picture of everything they anticipate to Emerson and Nevada who are between career jobs. They are now married, and in order to meet, they are working a number of part-time jobs and have some additional income needing for tax season. Emerson is still working full-time as a withheld. To feed his poker habit he has spent $600 over the past year and won a also bought around i manager and makes around $3,105 per month without taxes being total of S1.200. He 5500 in lottery tickets and won $100 early in the year. His student loans amount to $35,000, with a monthly payment of $277, he also got an email that he paid $2,170 in interest over the past year Nevada is still working at her part-time job as an antique appraiser (10 hours per week at about $30 per hour after taxes; working roughly 42 weeks last year). The business related mileage on her truck totals 6,800 miles. Many of her customers tipped her so she saw $5,780 in tips. She also profited $1,600 through the savings account has earned $1.50, and her investments have paid her $576. Last year she graduated from selling of a portion of her coin collection due to higher prices of precious metals. Her her undergraduate program, and she paid $7,900 in tuition (she also qualified for the American Opportunity Credit). She is looking at going to graduate school for her masters soon We will ignore the possible presence of capital gains so you will group all the above forms of taxable income together along with any appropriate deductions to find this couple's taxable income. Ultimately tax laws change every year so the key here is to get a general idea on how to treat these items. When it comes time to do their taxes, Nevada and Emerson should consult a tax professional 1. List the items income items below noting whether they are generally taxable. Also list the tax deductions/credits and note whether they are refundable. Use the table to compute their taxable income. Sources of Income Item Tax Credits/Deductions Refundable/Non Amount Taxable? Item Amount Credit/ Deduction Refundable Total Deductions Total Refundable Credits: Total Non- Refundable Credits: Total Income: AGI: 2. If the standard deduction is $12,600 for their tax year, is the couple better off using the standard deduction or itemizing? Why? 3. Is there anything that they could do to shield more of their income from taxes? Explain. 4. Nevada is thinking about taking 4 years part-time to finish her master's Instead of 2 vears Would this option have any influence on their taxes? ar can be very expensive (on average $17,000 per year). Should children/dependents warrant Explain the type and amount of tax credit or tax deduction that you feel is most appropriate tax breaks? to account for this