please ans all ques asap please thanks

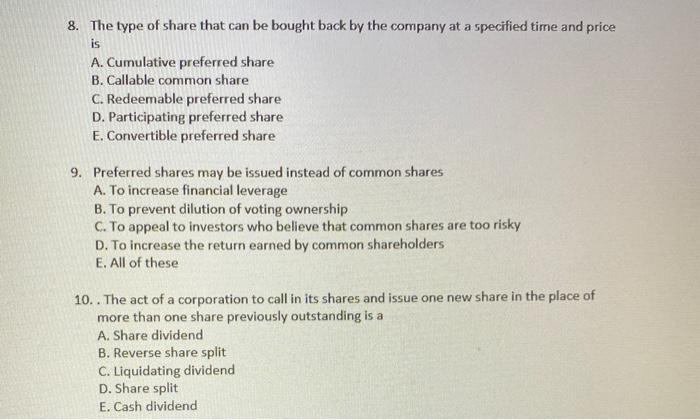

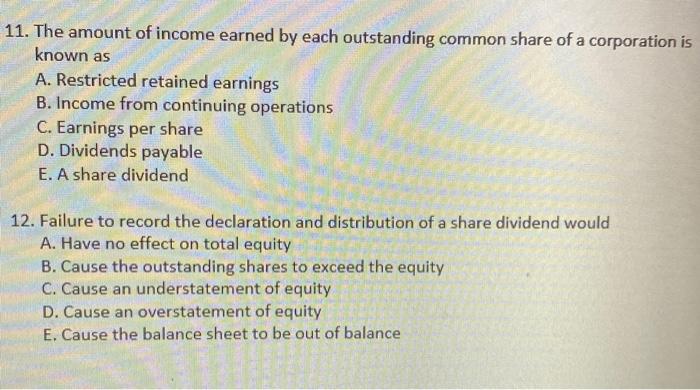

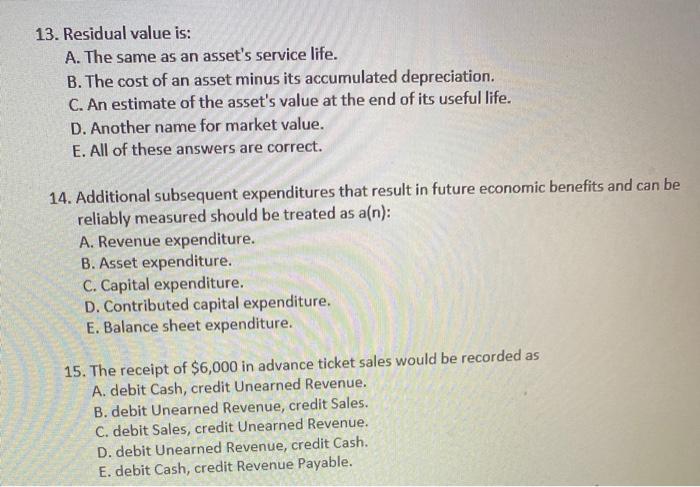

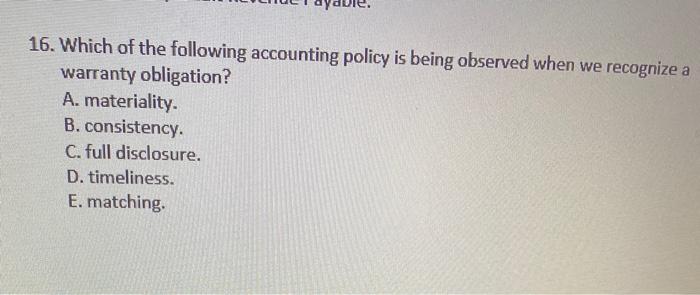

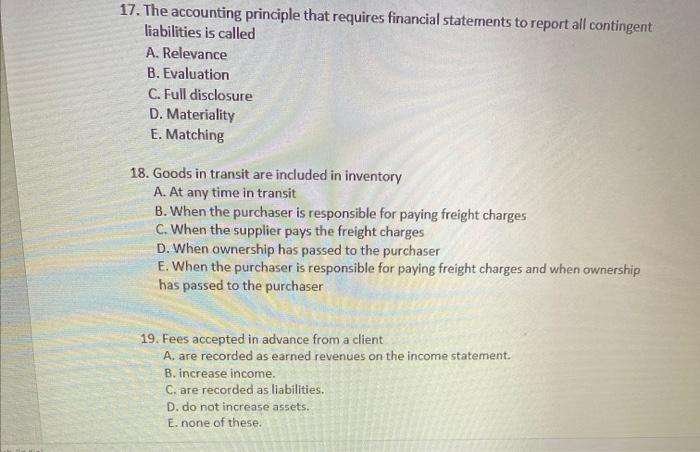

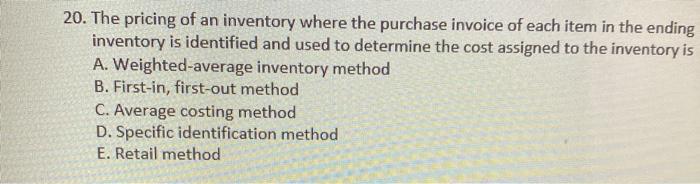

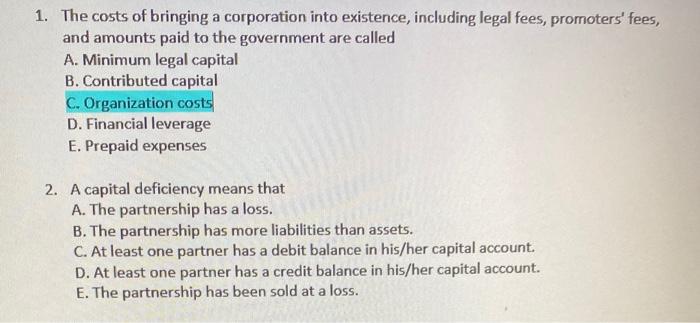

1. The costs of bringing a corporation into existence, including legal fees, promoters' fees, and amounts paid to the government are called A. Minimum legal capital B. Contributed capital C. Organization costs D. Financial leverage E. Prepaid expenses 2. A capital deficiency means that A. The partnership has a loss. B. The partnership has more liabilities than assets. C. At least one partner has a debit balance in his/her capital account. D. At least one partner has a credit balance in his/her capital account. E. The partnership has been sold at a loss. 3. In the absence of a partnership agreement, the law says income/loss sharing should be based on A. A fractional basis B. The ratio of capital investments C. Salary allowances D. Equal shares E. Interest allowances 4. The fact that partnership assets are owned jointly by all partners is called A. Mutual agency B. Unlimited liability C. Co-ownership of property D. Limited partnership E. Sole proprietorship 5. When a partner is unable to pay a capital deficiency A. The partner must take out a loan to cover the deficiency. B. The deficiency is absorbed by the remaining partners. C. The partnership ends. D. The deficient partner has a personal liability to the other partners. E. The deficiency is absorbed by the remaining partners and the deficient partner has a personal liability to the other partners. 6. Partnership accounting A. Is the same as accounting for a sole proprietorship B. Is the same as accounting for a corporation C. Is the same as accounting for a sole proprietorship, except that separate capital and withdrawal accounts are kept for each partner D. Is the same as accounting for a not-for profit organization E. None of these 7. The total amount of shares that a corporation's charter allows it to issue is A. Authorized B. Issued C. Outstanding D. Common E. Preferred 8. The type of share that can be bought back by the company at a specified time and price is A. Cumulative preferred share B. Callable common share C. Redeemable preferred share D. Participating preferred share E. Convertible preferred share 9. Preferred shares may be issued instead of common shares A. To increase financial leverage B. To prevent dilution of voting ownership C. To appeal to investors who believe that common shares are too risky D. To increase the return earned by common shareholders E. All of these 10. . The act of a corporation to call in its shares and issue one new share in the place of more than one share previously outstanding is a A. Share dividend B. Reverse share split C. Liquidating dividend D. Share split E. Cash dividend 11. The amount of income earned by each outstanding common share of a corporation is known as A. Restricted retained earnings B. Income from continuing operations C. Earnings per share D. Dividends payable E. A share dividend 12. Failure to record the declaration and distribution of a share dividend would A. Have no effect on total equity B. Cause the outstanding shares to exceed the equity C. Cause an understatement of equity D. Cause an overstatement of equity E. Cause the balance sheet to be out of balance 13. Residual value is: A. The same as an asset's service life. B. The cost of an asset minus its accumulated depreciation. C. An estimate of the asset's value at the end of its useful life. D. Another name for market value. E. All of these answers are correct. 14. Additional subsequent expenditures that result in future economic benefits and can be reliably measured should be treated as a(n): A. Revenue expenditure. B. Asset expenditure. C. Capital expenditure. D. Contributed capital expenditure. E. Balance sheet expenditure. 15. The receipt of $6,000 in advance ticket sales would be recorded as A. debit Cash, credit Unearned Revenue. B. debit Unearned Revenue, credit Sales. C. debit Sales, credit Unearned Revenue. D. debit Unearned Revenue, credit Cash. E. debit Cash, credit Revenue Payable. 16. Which of the following accounting policy is being observed when we recognize a warranty obligation? A. materiality. B. consistency. C. full disclosure. D. timeliness. E.matching, 17. The accounting principle that requires financial statements to report all contingent liabilities is called A. Relevance B. Evaluation C. Full disclosure D. Materiality E. Matching 18. Goods in transit are included in inventory A. At any time in transit B. When the purchaser is responsible for paying freight charges C. When the supplier pays the freight charges D. When ownership has passed to the purchaser E. When the purchaser is responsible for paying freight charges and when ownership has passed to the purchaser 19. Fees accepted in advance from a client A. are recorded as earned revenues on the income statement B. increase income. C. are recorded as liabilities. D. do not increase assets. E. none of these 20. The pricing of an inventory where the purchase invoice of each item in the ending inventory is identified and used to determine the cost assigned to the inventory is A. Weighted average inventory method B. First-in, first-out method C. Average costing method D. Specific identification method E. Retail method