Answered step by step

Verified Expert Solution

Question

1 Approved Answer

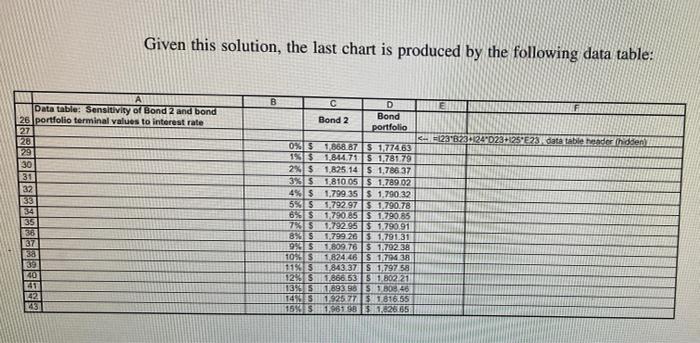

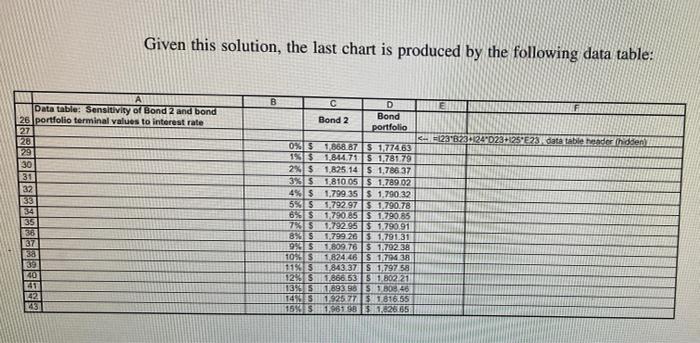

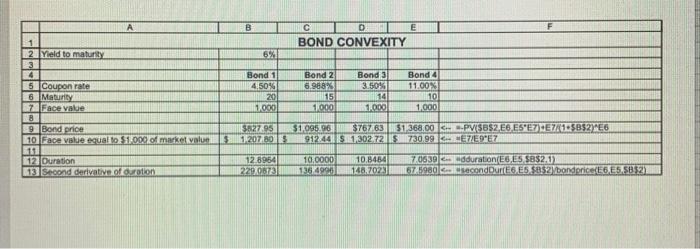

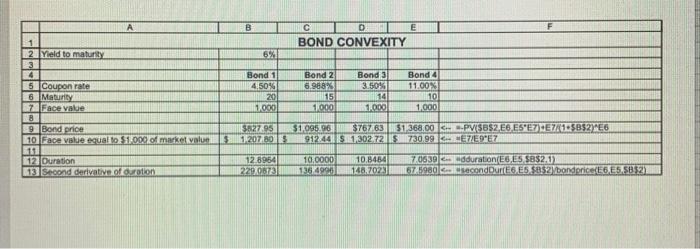

Please ans question 3 Please refer this table for question 3. Given this solution, the last chart is produced by the following data table: B

Please ans question 3

Please refer this table for question 3.

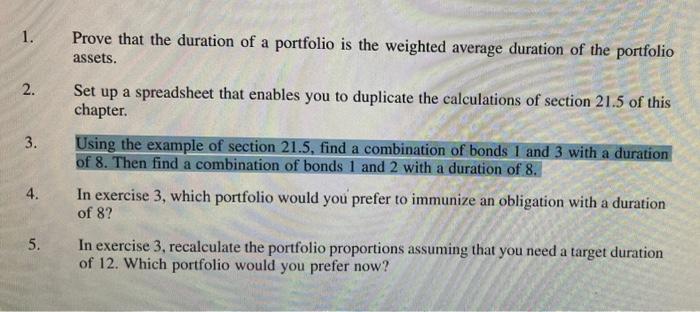

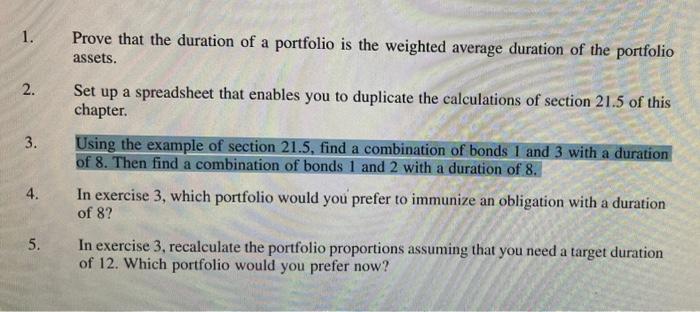

Given this solution, the last chart is produced by the following data table: B A Data table: Sensitivity of Bond 2 and bond 26 portfolio terminal values to interest rate 27 28 29 30 31 32 1133 34 35 38 137 38 39 40 41 42 43 C D HIE F Bond 2 Bond portfolio 1231823-1241023-125 E 23 data table tender hidden 0% 1868.87 S 177463 1931.844.715 1781.79 2$ 1.825.14 $ 1.786 37 3% 1.810 05 $ 1.789 02 4% $ 1.799.35 $ 1.790.32 5% 5 5.792 975 1,790.78 6%S 1,790 85 $ 1.790.85 781.79295 $ 1.790 91 895 1.799.26 $ 1.791,31 9% 51,809.76 $ 1.79238 1091.82446 $ 1.794 38 1191,843.37 S 1,797 58 12% 1.866.5351 802 21 139 S 893 98 1046 143 S12577A1 B 1816.55 15% 519619B 3.1,826,65 1. Prove that the duration of a portfolio is the weighted average duration of the portfolio assets. 2. 3 . Set up a spreadsheet that enables you to duplicate the calculations of section 21.5 of this chapter Using the example of section 21.5, find a combination of bonds 1 and 3 with a duration of 8. Then find a combination of bonds 1 and 2 with a duration of 8. In exercise 3, which portfolio would you prefer to immunize an obligation with a duration of 8? 4. 5. In exercise 3, recalculate the portfolio proportions assuming that you need a target duration of 12. Which portfolio would you prefer now? B D E BOND CONVEXITY 6% 1 2 Yield to matury 3 4 5 Coupon rate 6 May 7. Face value B 9 Bond price 10 Face value equal to $100 of market value Bond 1 4.50% 20 1.000 Bond 2 6.988% 15 Bond 3 3.50% 141 1.000 Bond 4 11.00% 10 1.000 1000 5827.95 1207.80 $1.095,96 $7676351368.00 .PVSBS2E6 ES'EXE7A1:5B$26 912.441151,302.721730.99MZEE7 12 Duration 13 Second derivative of duration 12.8964 229.0673 10,0000 136 4990 10.8484 148,7023 7.0639 duration ED ES $882.3 67,5980 second DurE6 E5 $852 bondprice(E6E5,5892 Given this solution, the last chart is produced by the following data table: B A Data table: Sensitivity of Bond 2 and bond 26 portfolio terminal values to interest rate 27 28 29 30 31 32 1133 34 35 38 137 38 39 40 41 42 43 C D HIE F Bond 2 Bond portfolio 1231823-1241023-125 E 23 data table tender hidden 0% 1868.87 S 177463 1931.844.715 1781.79 2$ 1.825.14 $ 1.786 37 3% 1.810 05 $ 1.789 02 4% $ 1.799.35 $ 1.790.32 5% 5 5.792 975 1,790.78 6%S 1,790 85 $ 1.790.85 781.79295 $ 1.790 91 895 1.799.26 $ 1.791,31 9% 51,809.76 $ 1.79238 1091.82446 $ 1.794 38 1191,843.37 S 1,797 58 12% 1.866.5351 802 21 139 S 893 98 1046 143 S12577A1 B 1816.55 15% 519619B 3.1,826,65 1. Prove that the duration of a portfolio is the weighted average duration of the portfolio assets. 2. 3 . Set up a spreadsheet that enables you to duplicate the calculations of section 21.5 of this chapter Using the example of section 21.5, find a combination of bonds 1 and 3 with a duration of 8. Then find a combination of bonds 1 and 2 with a duration of 8. In exercise 3, which portfolio would you prefer to immunize an obligation with a duration of 8? 4. 5. In exercise 3, recalculate the portfolio proportions assuming that you need a target duration of 12. Which portfolio would you prefer now? B D E BOND CONVEXITY 6% 1 2 Yield to matury 3 4 5 Coupon rate 6 May 7. Face value B 9 Bond price 10 Face value equal to $100 of market value Bond 1 4.50% 20 1.000 Bond 2 6.988% 15 Bond 3 3.50% 141 1.000 Bond 4 11.00% 10 1.000 1000 5827.95 1207.80 $1.095,96 $7676351368.00 .PVSBS2E6 ES'EXE7A1:5B$26 912.441151,302.721730.99MZEE7 12 Duration 13 Second derivative of duration 12.8964 229.0673 10,0000 136 4990 10.8484 148,7023 7.0639 duration ED ES $882.3 67,5980 second DurE6 E5 $852 bondprice(E6E5,5892

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started