Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please ans this question as soon as possible. Q. 1 Pritha spent much of her childhood learning the art of cookie-making from her grandmother. They

please ans this question as soon as possible.

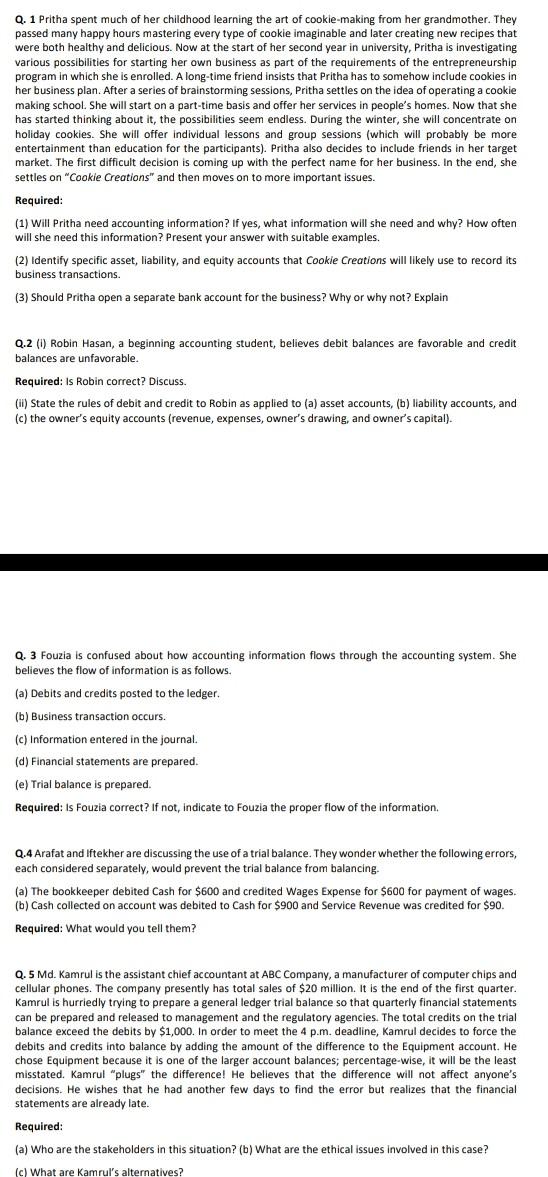

Q. 1 Pritha spent much of her childhood learning the art of cookie-making from her grandmother. They passed many happy hours mastering every type of cookie imaginable and later creating new recipes that were both healthy and delicious. Now at the start of her second year in university, Pritha is investigating various possibilities for starting her own business as part of the requirements of the entrepreneurship program in which she is enrolled. A long-time friend insists that Pritha has to somehow include cookies in her business plan. After a series of brainstorming sessions, Pritha settles on the idea of operating a cookie making school. She will start on a part-time basis and offer her services in people's homes. Now that she has started thinking about it, the possibilities seem endless. During the winter, she will concentrate on holiday cookies. She will offer individual lessons and group sessions (which will probably be more entertainment than education for the participants). Pritha also decides to include friends in her target market. The first difficult decision is coming up with the perfect name for her business. In the end, she settles on "Cookie Creations" and then moves on to more important issues. Required: (1) Will Pritha need accounting Information? If yes, what information will she need and why? How often will she need this information? Present your answer with suitable examples. (2) Identify specific asset, liability, and equity accounts that Cookie Creations will likely use to record its business transactions. (3) Should Pritha open a separate bank account for the business? Why or why not? Explain Q.2 (1) Robin Hasan, beginning accounting student, believes debit balances are favorable and credit balances are unfavorable. Required: Is Robin correct? Discuss. (il) State the rules of debit and credit to Robin as applied to (a) asset accounts, (b) liability accounts, and (c) the owner's equity accounts (revenue, expenses, owner's drawing, and owner's capital). Q. 3 Fouzia is confused about how accounting information flows through the accounting system. She believes the flow of information is as follows. (a) Debits and credits posted to the ledger. (b) Business transaction occurs. (c) Information entered in the journal. (d) Financial statements are prepared. (e) Trial balance is prepared. Required: Is Fouzia correct? If not, indicate to Fouzia the proper flow of the information, Q.4 Arafat and Iftekher are discussing the use of a trial balance. They wonder whether the following errors, each considered separately, would prevent the trial balance from balancing. (a) The bookkeeper debited Cash for $600 and credited Wages Expense for $600 for payment of wages. (b) Cash collected on account was debited to Cash for $900 and Service Revenue was credited for $90. Required: What would you tell them? Q.5 Md. Kamrul is the assistant chief accountant at ABC Company, a manufacturer of computer chips and cellular phones. The company presently has total sales of $20 million. It is the end of the first quarter. Kamrul is hurriedly trying to prepare a general ledger trial balance so that quarterly financial statements can be prepared and released to management and the regulatory agencies. The total credits on the trial balance exceed the debits by $1,000. In order to meet the 4 p.m. deadline, Kamrul decides to force the debits and credits into balance by adding the amount of the difference to the Equipment account. He chose Equipment because it is one of the larger account balances; percentage-wise, it will be the least misstated. Kamrul "plugs" the difference! He believes that the difference will not affect anyone's decisions. He wishes that he had another few days to find the error but realizes that the financial statements are already late. Required: (a) Who are the stakeholders in this situation? (b) What are the ethical issues involved in this case? (c) What are Kamrul's alternativesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started