Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer 1. Clifford Clark is a recent retiree who is interested in investing some of his savings in corporate bonds. His financial planner has

please answer 1.

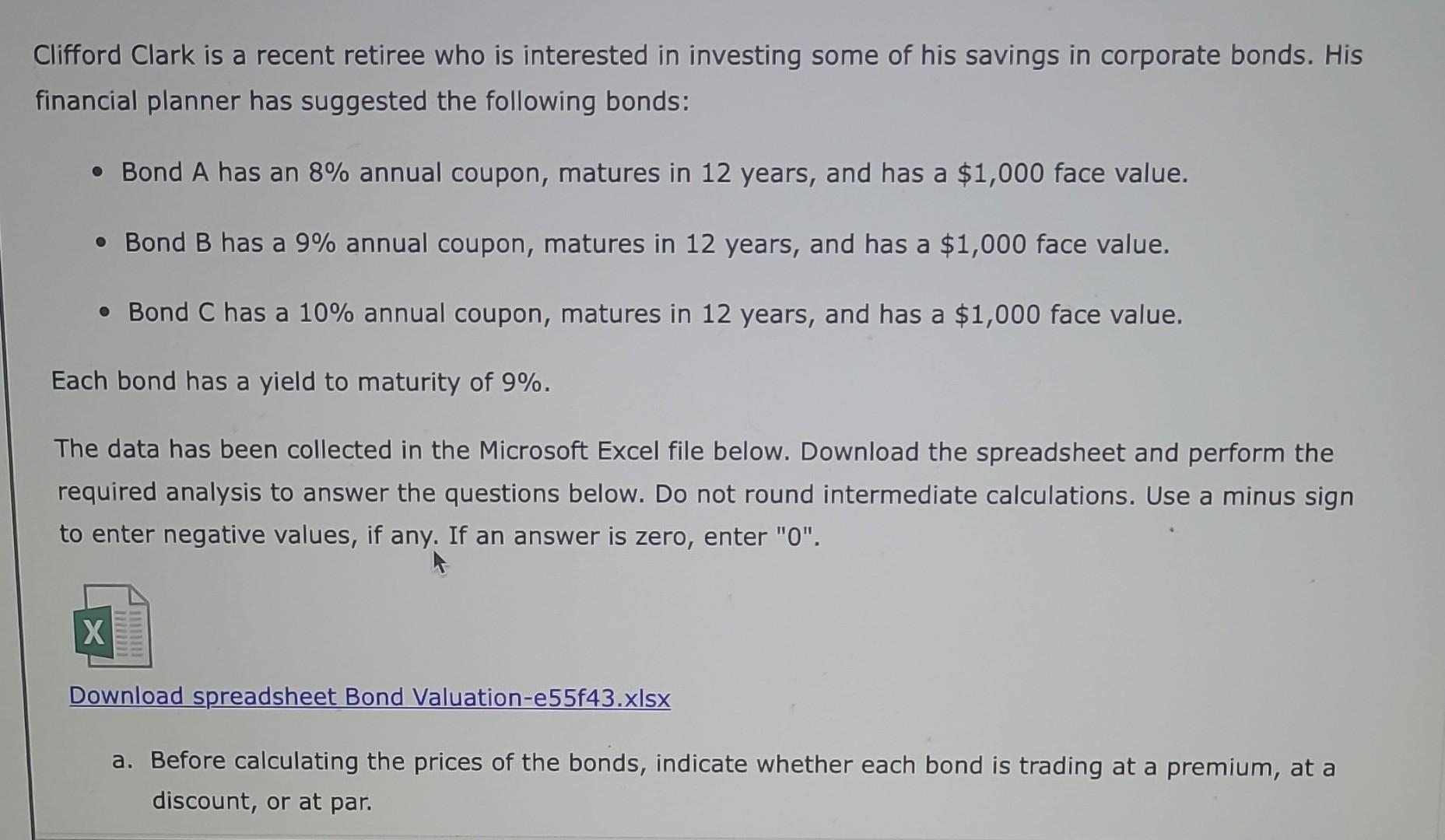

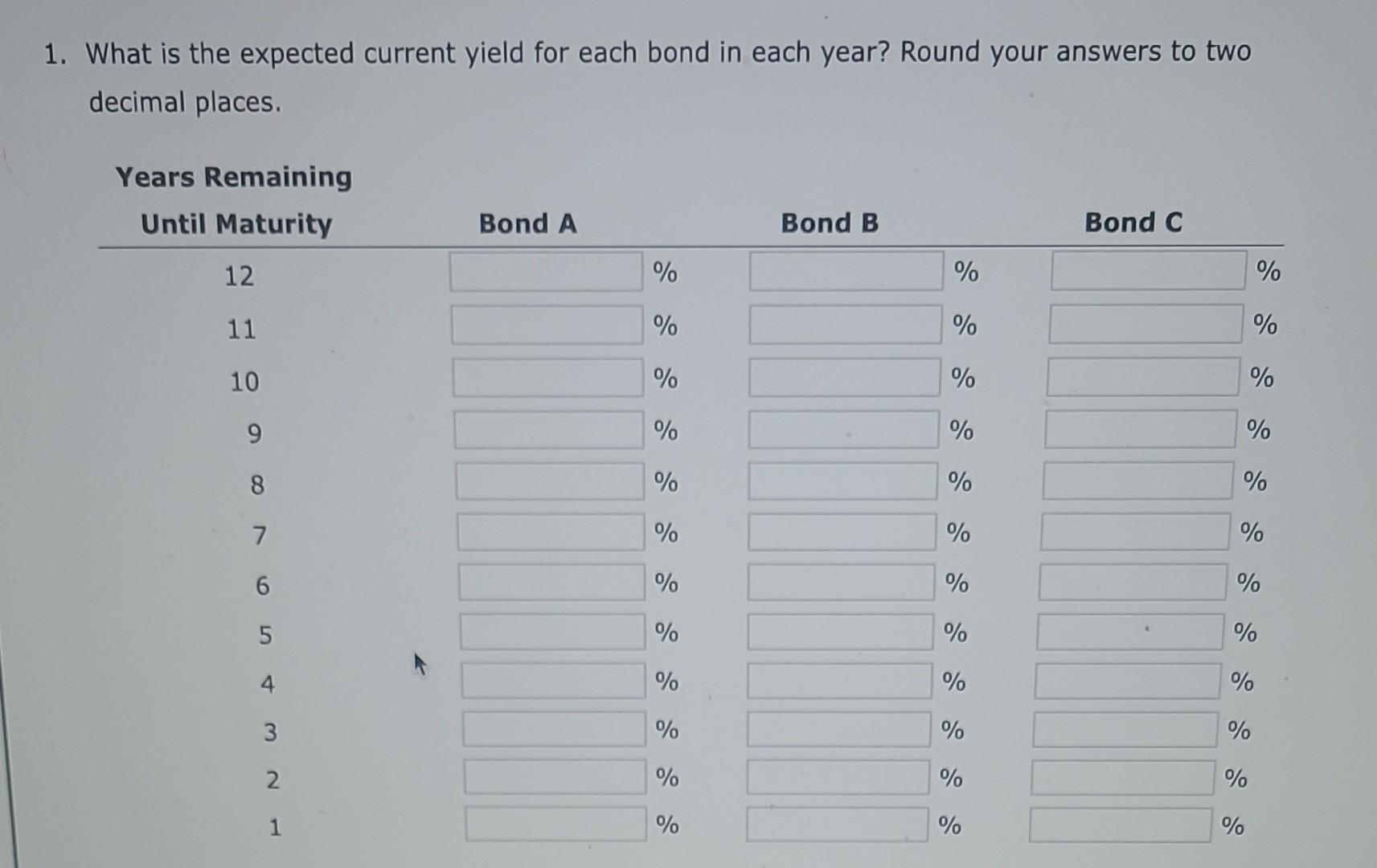

Clifford Clark is a recent retiree who is interested in investing some of his savings in corporate bonds. His financial planner has suggested the following bonds: - Bond A has an 8% annual coupon, matures in 12 years, and has a $1,000 face value. - Bond B has a 9% annual coupon, matures in 12 years, and has a $1,000 face value. - Bond C has a 10% annual coupon, matures in 12 years, and has a $1,000 face value. Each bond has a yield to maturity of 9%. The data has been collected in the Microsoft Excel file below. Download the spreadsheet and perform the required analysis to answer the questions below. Do not round intermediate calculations. Use a minus sign to enter negative values, if any. If an answer is zero, enter " 0 ". Download spreadsheet Bond Valuation-e55f43.xlsx a. Before calculating the prices of the bonds, indicate whether each bond is trading at a premium, at a discount, or at par. What is the expected current yield for each bond in each year? Round your answers to two decimal placesStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started