Please answer #1 only

- Prepare a quarterly master budget for Happy Place for the year ended December 31, 2020, including the following schedules:

Sales Budget & Schedule of Cash Collections (Receipts)

Production Budget

Direct Materials Budget & Schedule of Cash Disbursements for Materials

Direct Labour Budget

Manufacturing Overhead Budget

Ending Finished Goods Inventory Budget

Selling and Administrative Expense Budget

Cash Budget

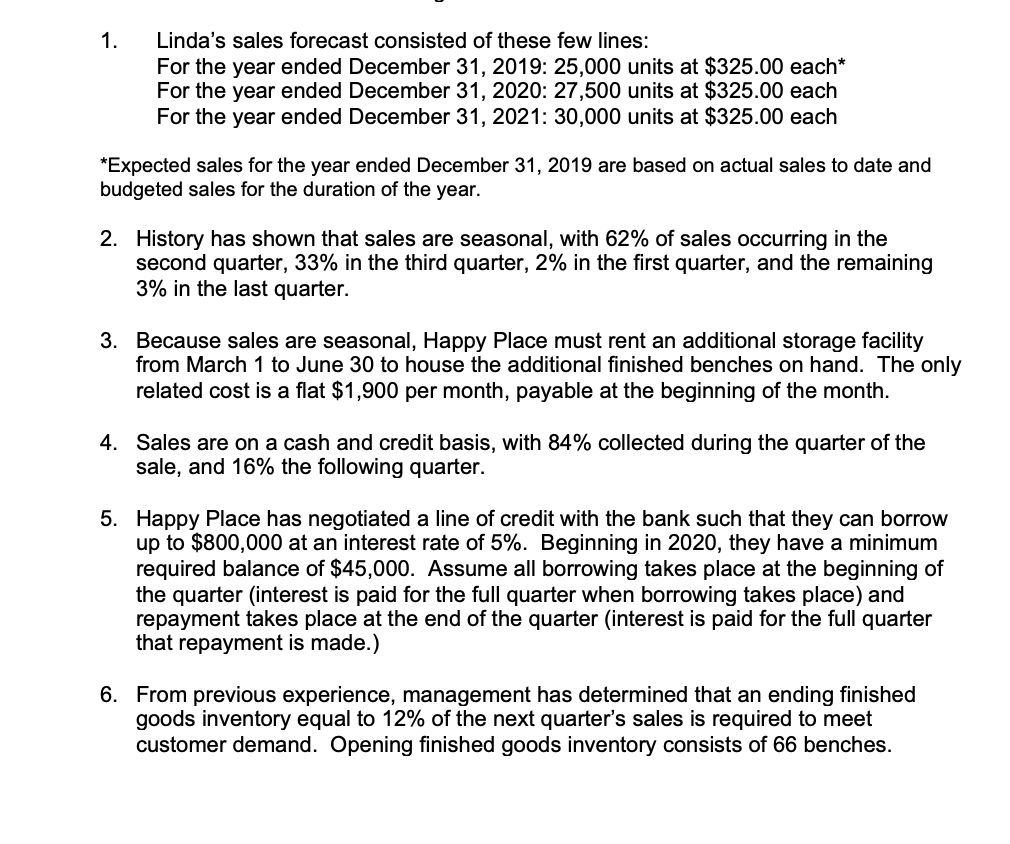

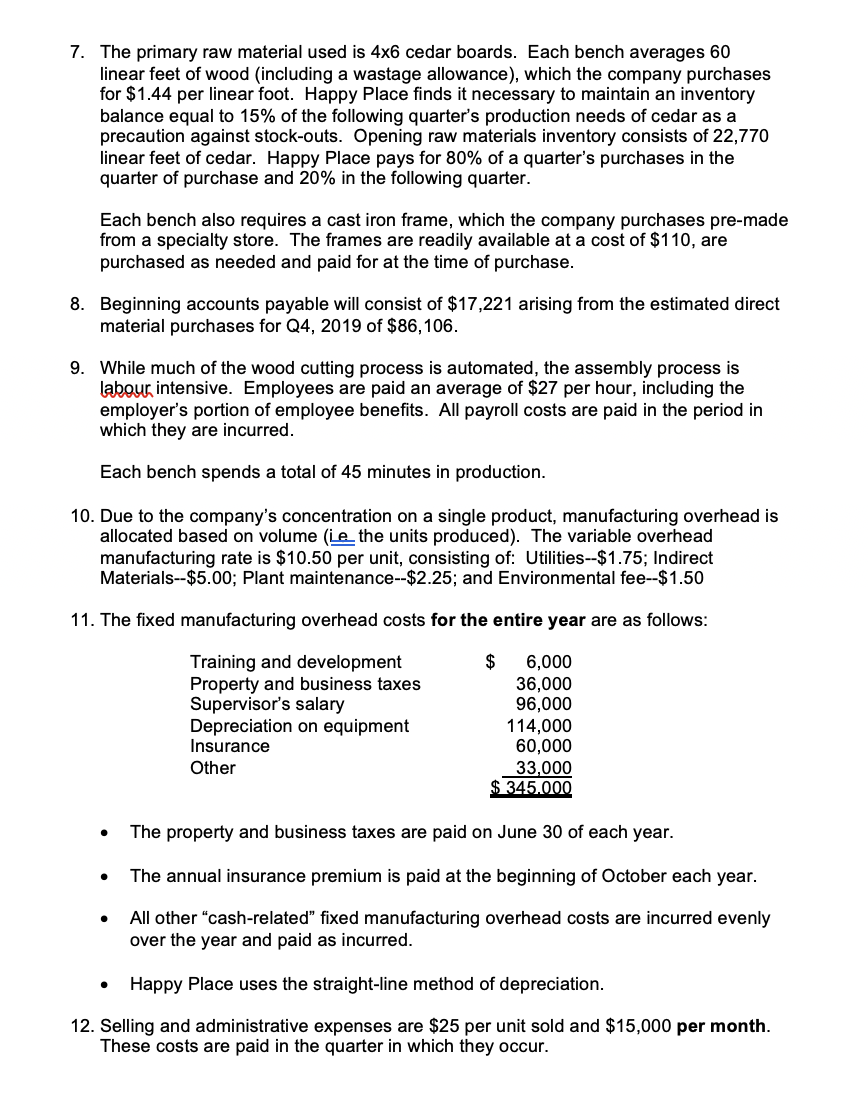

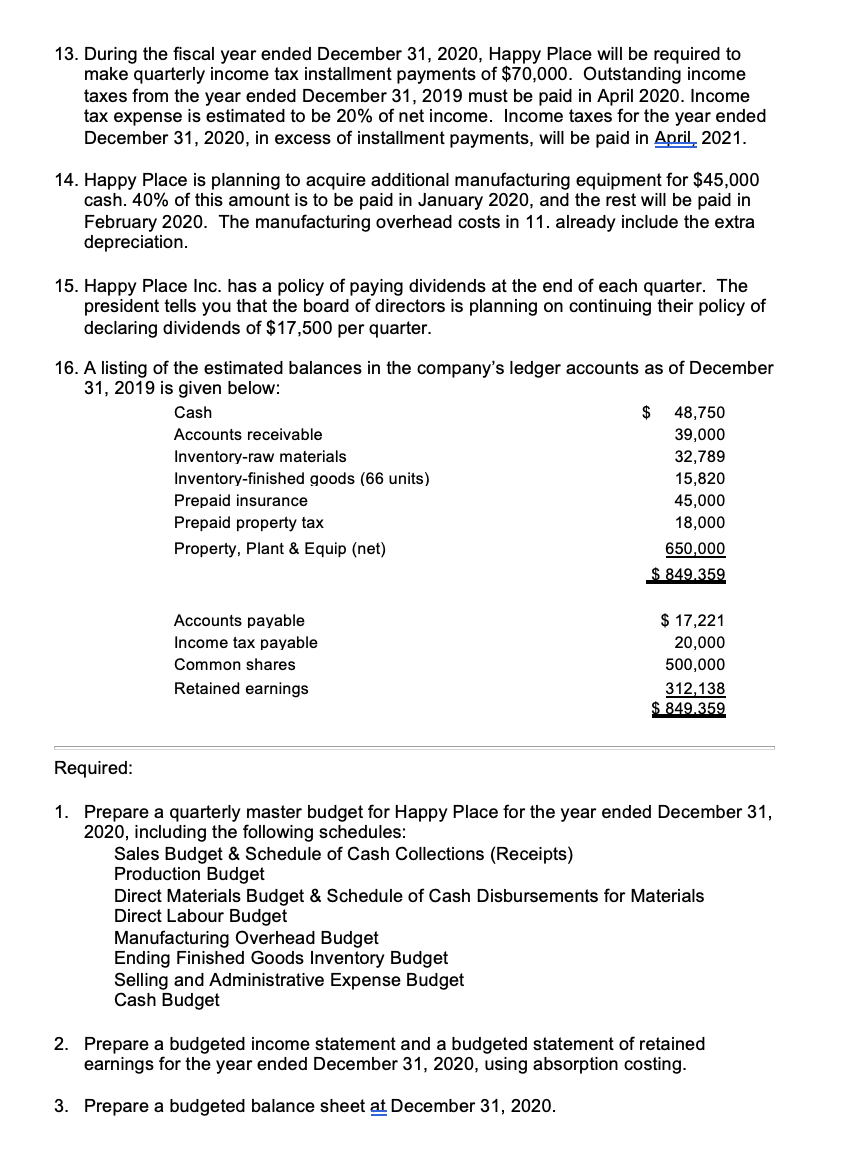

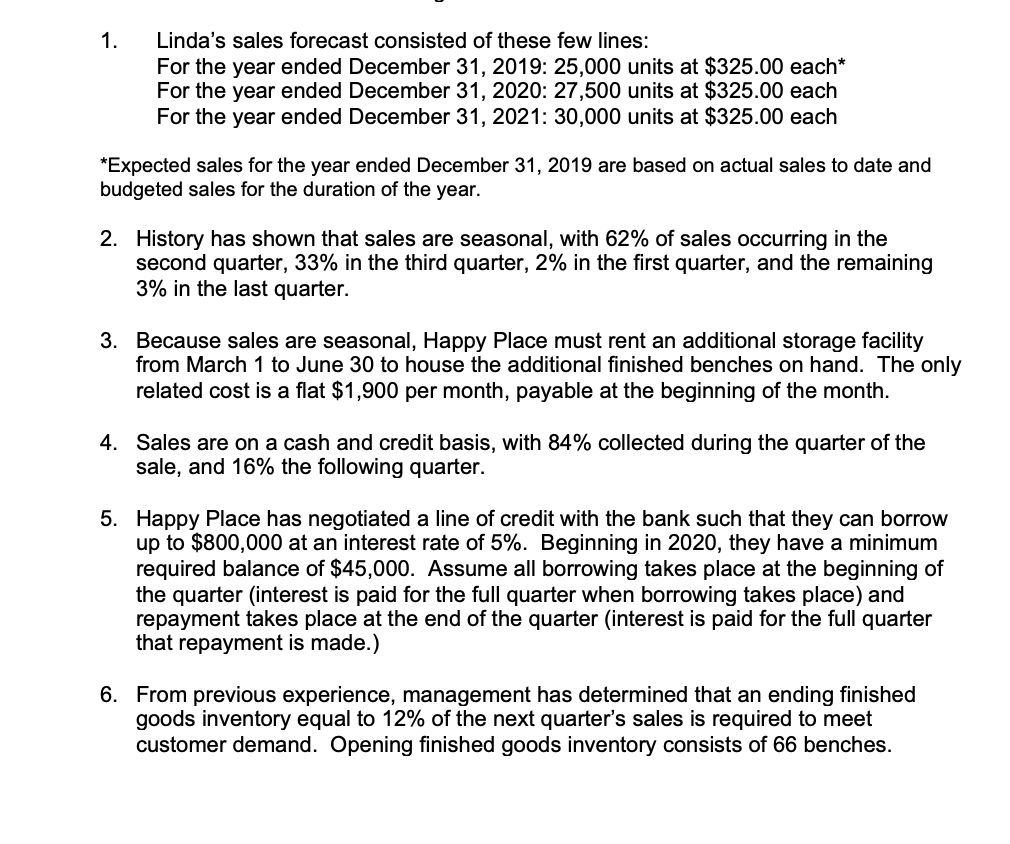

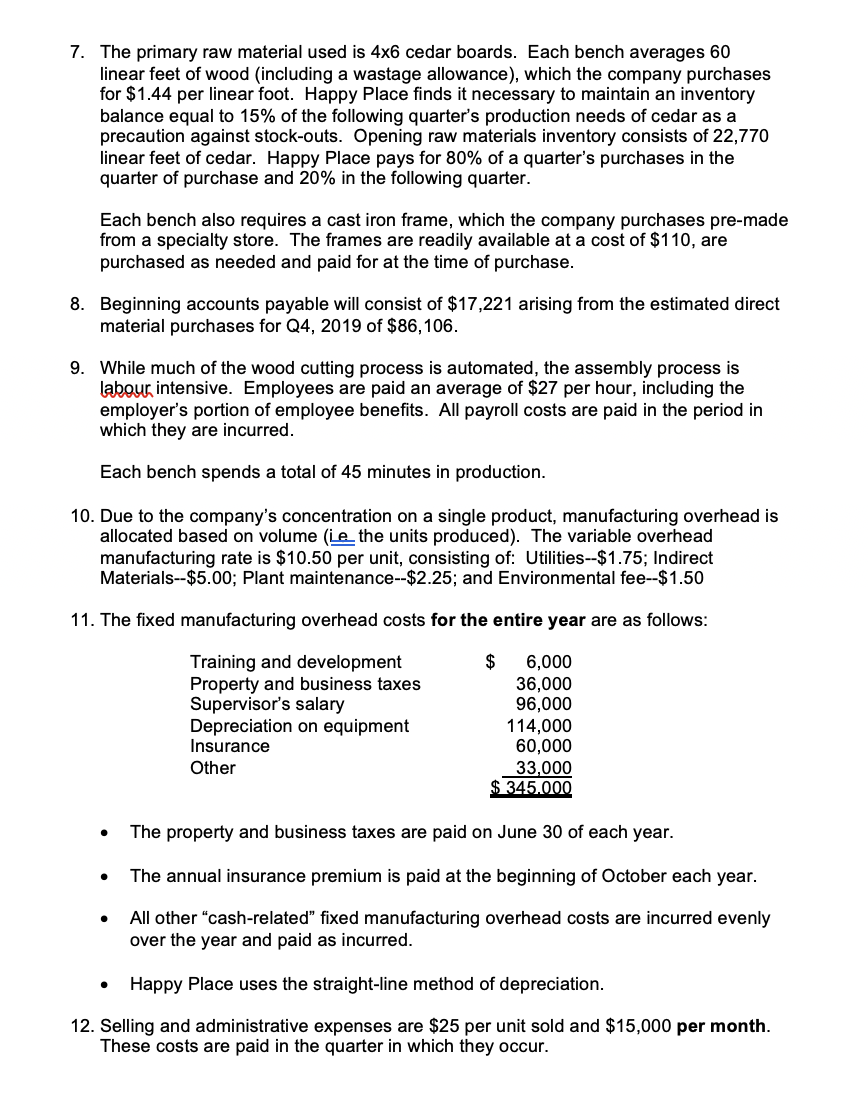

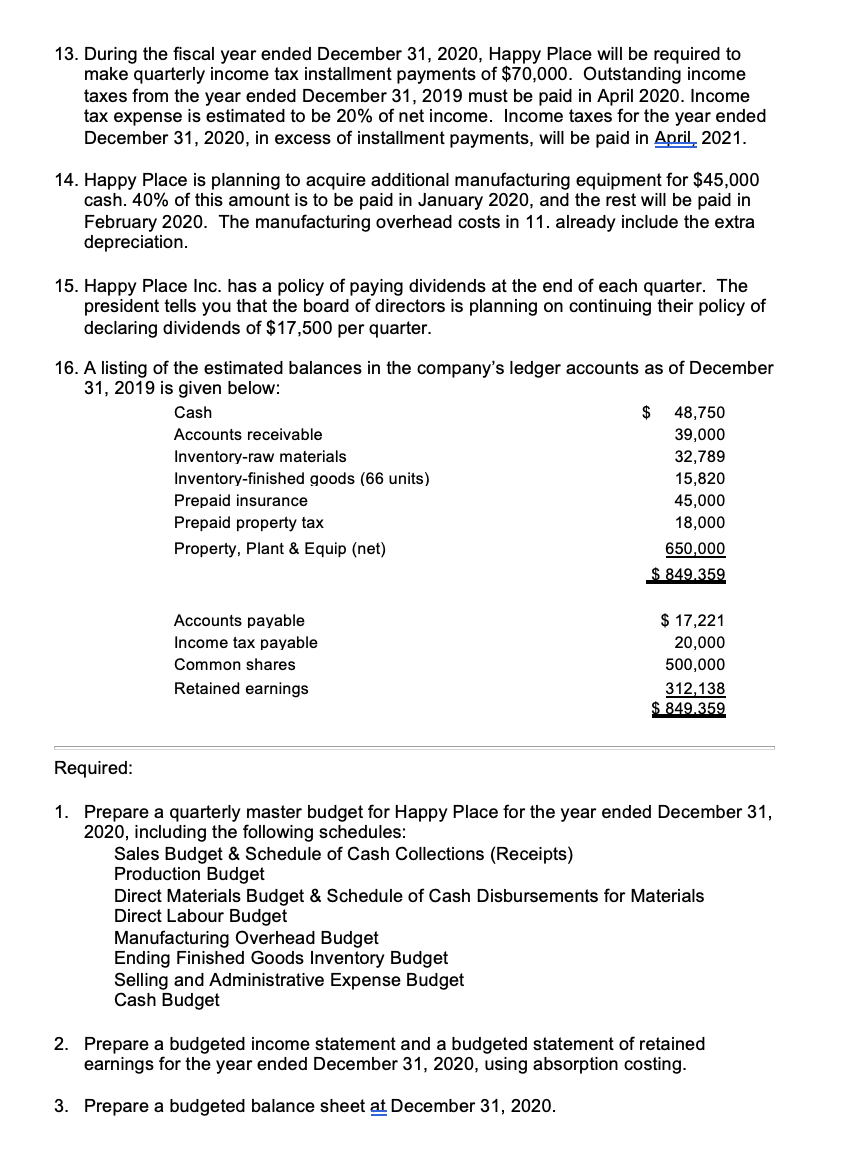

1. Linda's sales forecast consisted of these few lines: For the year ended December 31, 2019: 25,000 units at $325.00 each* For the year ended December 31, 2020: 27,500 units at $325.00 each For the year ended December 31, 2021: 30,000 units at $325.00 each *Expected sales for the year ended December 31, 2019 are based on actual sales to date and budgeted sales for the duration of the year. 2. History has shown that sales are seasonal, with 62% of sales occurring in the second quarter, 33% in the third quarter, 2% in the first quarter, and the remaining 3% in the last quarter. 3. Because sales are seasonal, Happy Place must rent an additional storage facility from March 1 to June 30 to house the additional finished benches on hand. The only related cost is a flat $1,900 per month, payable at the beginning of the month. 4. Sales are on a cash and credit basis, with 84% collected during the quarter of the sale, and 16% the following quarter. 5. Happy Place has negotiated a line of credit with the bank such that they can borrow up to $800,000 at an interest rate of 5%. Beginning in 2020, they have a minimum required balance of $45,000. Assume all borrowing takes place at the beginning of the quarter (interest is paid for the full quarter when borrowing takes place) and repayment takes place at the end of the quarter (interest is paid for the full quarter that repayment is made.) 6. From previous experience, management has determined that an ending finished goods inventory equal to 12% of the next quarter's sales is required to meet customer demand. Opening finished goods inventory consists of 66 benches. 7. The primary raw material used is 4x6 cedar boards. Each bench averages 60 linear feet of wood (including a wastage allowance), which the company purchases for $1.44 per linear foot. Happy Place finds it necessary to maintain an inventory balance equal to 15% of the following quarter's production needs of cedar as a precaution against stock-outs. Opening raw materials inventory consists of 22,770 linear feet of cedar. Happy Place pays for 80% of a quarter's purchases in the quarter of purchase and 20% in the following quarter. Each bench also requires a cast iron frame, which the company purchases pre-made from a specialty store. The frames are readily available at a cost of $110, are purchased as needed and paid for at the time of purchase. 8. Beginning accounts payable will consist of $17,221 arising from the estimated direct material purchases for Q4, 2019 of $86,106. 9. While much of the wood cutting process is automated, the assembly process is labour intensive. Employees are paid an average of $27 per hour, including the employer's portion of employee benefits. All payroll costs are paid in the period in which they are incurred. Each bench spends a total of 45 minutes in production. 10. Due to the company's concentration on a single product, manufacturing overhead is allocated based on volume (Le the units produced). The variable overhead manufacturing rate is $10.50 per unit, consisting of: Utilities--$1.75; Indirect Materials--$5.00; Plant maintenance--$2.25; and Environmental fee--$1.50 11. The fixed manufacturing overhead costs for the entire year are as follows: Training and development Property and business taxes Supervisor's salary Depreciation on equipment Insurance Other $ 6,000 36,000 96,000 114,000 60,000 33,000 $ 345.000 . The property and business taxes are paid on June 30 of each year. The annual insurance premium is paid at the beginning of October each year. All other "cash-related" fixed manufacturing overhead costs are incurred evenly over the year and paid as incurred. Happy Place uses the straight-line method of depreciation. 12. Selling and administrative expenses are $25 per unit sold and $15,000 per month. These costs are paid in the quarter in which they occur. 13. During the fiscal year ended December 31, 2020, Happy Place will be required to make quarterly income tax installment payments of $70,000. Outstanding income taxes from the year ended December 31, 2019 must be paid in April 2020. Income tax expense is estimated to be 20% of net income. Income taxes for the year ended December 31, 2020, in excess of installment payments, will be paid in April, 2021. 14. Happy Place is planning to acquire additional manufacturing equipment for $45,000 cash. 40% of this amount is to be paid in January 2020, and the rest will be paid in February 2020. The manufacturing overhead costs in 11. already include the extra depreciation. 15. Happy Place Inc. has a policy of paying dividends at the end of each quarter. The president tells you that the board of directors is planning on continuing their policy of declaring dividends of $17,500 per quarter. 16. A listing of the estimated balances in the company's ledger accounts as of December 31, 2019 is given below: Cash $ 48,750 Accounts receivable 39,000 Inventory-raw materials 32,789 Inventory-finished goods (66 units) 15,820 Prepaid insurance 45,000 Prepaid property tax 18,000 Property, Plant & Equip (net) 650,000 $ 849.359 Accounts payable Income tax payable Common shares Retained earnings $ 17,221 20,000 500,000 312,138 849.359 Required: 1. Prepare a quarterly master budget for Happy Place for the year ended December 31, 2020, including the following schedules: Sales Budget & Schedule of Cash Collections (Receipts) Production Budget Direct Materials Budget & Schedule of Cash Disbursements for Materials Direct Labour Budget Manufacturing Overhead Budget Ending Finished Goods Inventory Budget Selling and Administrative Expense Budget Cash Budget 2. Prepare a budgeted income statement and a budgeted statement of retained earnings for the year ended December 31, 2020, using absorption costing. 3. Prepare a budgeted balance sheet at December 31, 2020. 1. Linda's sales forecast consisted of these few lines: For the year ended December 31, 2019: 25,000 units at $325.00 each* For the year ended December 31, 2020: 27,500 units at $325.00 each For the year ended December 31, 2021: 30,000 units at $325.00 each *Expected sales for the year ended December 31, 2019 are based on actual sales to date and budgeted sales for the duration of the year. 2. History has shown that sales are seasonal, with 62% of sales occurring in the second quarter, 33% in the third quarter, 2% in the first quarter, and the remaining 3% in the last quarter. 3. Because sales are seasonal, Happy Place must rent an additional storage facility from March 1 to June 30 to house the additional finished benches on hand. The only related cost is a flat $1,900 per month, payable at the beginning of the month. 4. Sales are on a cash and credit basis, with 84% collected during the quarter of the sale, and 16% the following quarter. 5. Happy Place has negotiated a line of credit with the bank such that they can borrow up to $800,000 at an interest rate of 5%. Beginning in 2020, they have a minimum required balance of $45,000. Assume all borrowing takes place at the beginning of the quarter (interest is paid for the full quarter when borrowing takes place) and repayment takes place at the end of the quarter (interest is paid for the full quarter that repayment is made.) 6. From previous experience, management has determined that an ending finished goods inventory equal to 12% of the next quarter's sales is required to meet customer demand. Opening finished goods inventory consists of 66 benches. 7. The primary raw material used is 4x6 cedar boards. Each bench averages 60 linear feet of wood (including a wastage allowance), which the company purchases for $1.44 per linear foot. Happy Place finds it necessary to maintain an inventory balance equal to 15% of the following quarter's production needs of cedar as a precaution against stock-outs. Opening raw materials inventory consists of 22,770 linear feet of cedar. Happy Place pays for 80% of a quarter's purchases in the quarter of purchase and 20% in the following quarter. Each bench also requires a cast iron frame, which the company purchases pre-made from a specialty store. The frames are readily available at a cost of $110, are purchased as needed and paid for at the time of purchase. 8. Beginning accounts payable will consist of $17,221 arising from the estimated direct material purchases for Q4, 2019 of $86,106. 9. While much of the wood cutting process is automated, the assembly process is labour intensive. Employees are paid an average of $27 per hour, including the employer's portion of employee benefits. All payroll costs are paid in the period in which they are incurred. Each bench spends a total of 45 minutes in production. 10. Due to the company's concentration on a single product, manufacturing overhead is allocated based on volume (Le the units produced). The variable overhead manufacturing rate is $10.50 per unit, consisting of: Utilities--$1.75; Indirect Materials--$5.00; Plant maintenance--$2.25; and Environmental fee--$1.50 11. The fixed manufacturing overhead costs for the entire year are as follows: Training and development Property and business taxes Supervisor's salary Depreciation on equipment Insurance Other $ 6,000 36,000 96,000 114,000 60,000 33,000 $ 345.000 . The property and business taxes are paid on June 30 of each year. The annual insurance premium is paid at the beginning of October each year. All other "cash-related" fixed manufacturing overhead costs are incurred evenly over the year and paid as incurred. Happy Place uses the straight-line method of depreciation. 12. Selling and administrative expenses are $25 per unit sold and $15,000 per month. These costs are paid in the quarter in which they occur. 13. During the fiscal year ended December 31, 2020, Happy Place will be required to make quarterly income tax installment payments of $70,000. Outstanding income taxes from the year ended December 31, 2019 must be paid in April 2020. Income tax expense is estimated to be 20% of net income. Income taxes for the year ended December 31, 2020, in excess of installment payments, will be paid in April, 2021. 14. Happy Place is planning to acquire additional manufacturing equipment for $45,000 cash. 40% of this amount is to be paid in January 2020, and the rest will be paid in February 2020. The manufacturing overhead costs in 11. already include the extra depreciation. 15. Happy Place Inc. has a policy of paying dividends at the end of each quarter. The president tells you that the board of directors is planning on continuing their policy of declaring dividends of $17,500 per quarter. 16. A listing of the estimated balances in the company's ledger accounts as of December 31, 2019 is given below: Cash $ 48,750 Accounts receivable 39,000 Inventory-raw materials 32,789 Inventory-finished goods (66 units) 15,820 Prepaid insurance 45,000 Prepaid property tax 18,000 Property, Plant & Equip (net) 650,000 $ 849.359 Accounts payable Income tax payable Common shares Retained earnings $ 17,221 20,000 500,000 312,138 849.359 Required: 1. Prepare a quarterly master budget for Happy Place for the year ended December 31, 2020, including the following schedules: Sales Budget & Schedule of Cash Collections (Receipts) Production Budget Direct Materials Budget & Schedule of Cash Disbursements for Materials Direct Labour Budget Manufacturing Overhead Budget Ending Finished Goods Inventory Budget Selling and Administrative Expense Budget Cash Budget 2. Prepare a budgeted income statement and a budgeted statement of retained earnings for the year ended December 31, 2020, using absorption costing. 3. Prepare a budgeted balance sheet at December 31, 2020