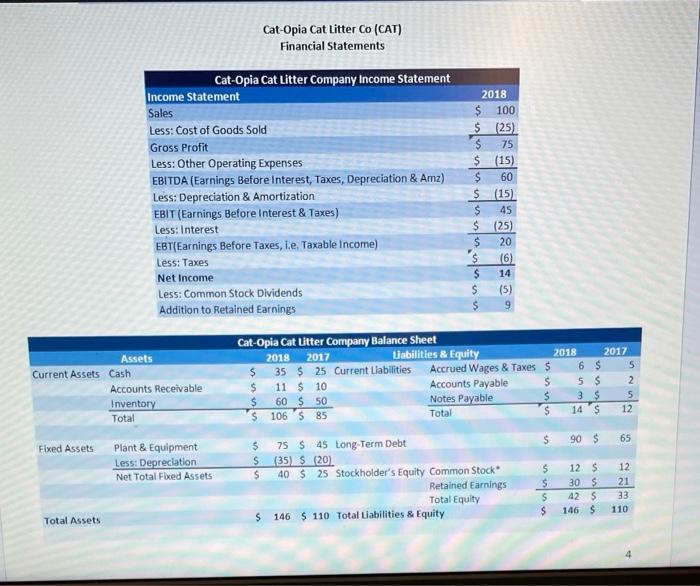

Short Computations (4 points each) General Instructions: The financial statements for CAT and CRE are all in millions Any of your answers that are to be in millions", such as FOF Statements, means that $1,250,000 is input 1.25 and not 1,250,000. Any answers that are compute to two decimal places", should be input as a whole number ( 10.158 input as 10.15, not 0.1015) Any answers that are negative, then make sure to include the negative sign to the answer. Si input in Canvas as -5) You are a financial analyst reviewing a pet supply business, the Cat-Opis Cat Litter Company (NYSE Ticker: CAT. While their financial statements are in the Appendix, for questions 11-13 ignore the income Statement and assume CAT earned $12 mil in 2019 Ele Taxable income). Answer questions 11-13 using this assumption What would be the Tax Liability : what do they owe intares) in millions, to two decimal places)? What is the Elfective Tax Rate (to two decimals)? 1 What is the Marginal Tax Rate to two decimais? 11 12 VA Previous F o hp DV 96 5 o 9 7 6 00 j O E . R G H F K D B N V C M M alt Ctrl Cat-Opia Cat Litter Co (CAT) Financial Statements Cat-Opia Cat Litter Company Income Statement Income Statement Sales Less: Cost of Goods Sold Gross Profit Less: Other Operating Expenses EBITDA (Earnings Before Interest, Taxes, Depreciation & Amz) Less: Depreciation & Amortization EBIT (Earnings Before Interest & Taxes) Less: Interest EBT(Earnings Before Taxes, Le Taxable income) Less: Taxes Net Income Less: Common Stock Dividends Addition to Retained Earnings ununu 2018 $ 100 $ (25) $ 75 $ (15) $ 60 $ (15) $ 45 $ (25) 20 (6) $ 14 (5) 9 Assets Current Assets Cash Accounts Receivable Inventory Total Cat-Opia Cat Litter Company Balance Sheet 2018 2017 Liabilities & Equity 2018 2017 $ 35 $ 25 Current Liabilities Accrued Wages & Taxes $ 5 6 S $ 11 $ 10 Accounts Payable 5 $ 2 $ 60 $ 50 Notes Payable 3 $ 5 $ 106 $ 85 Total $ 14 S 12 un $ 90 $ 65 Fixed Assets Plant & Equipment Less: Depreciation Net Total Fixed Assets $ 75 S 45 Long Term Debt $ (35) $ (20) $ 40 S 25 Stockholder's Equity Common Stock Retained Earnings Total Equity $ 146 $ 110 Total Liabilities & Equity uu 12 S 30$ 425 146 $ 12 21 33 110 $ $ Total Assets Short Computations (4 points each) General Instructions: The financial statements for CAT and CRE are all in millions Any of your answers that are to be in millions", such as FOF Statements, means that $1,250,000 is input 1.25 and not 1,250,000. Any answers that are compute to two decimal places", should be input as a whole number ( 10.158 input as 10.15, not 0.1015) Any answers that are negative, then make sure to include the negative sign to the answer. Si input in Canvas as -5) You are a financial analyst reviewing a pet supply business, the Cat-Opis Cat Litter Company (NYSE Ticker: CAT. While their financial statements are in the Appendix, for questions 11-13 ignore the income Statement and assume CAT earned $12 mil in 2019 Ele Taxable income). Answer questions 11-13 using this assumption What would be the Tax Liability : what do they owe intares) in millions, to two decimal places)? What is the Elfective Tax Rate (to two decimals)? 1 What is the Marginal Tax Rate to two decimais? 11 12 VA Previous F o hp DV 96 5 o 9 7 6 00 j O E . R G H F K D B N V C M M alt Ctrl Cat-Opia Cat Litter Co (CAT) Financial Statements Cat-Opia Cat Litter Company Income Statement Income Statement Sales Less: Cost of Goods Sold Gross Profit Less: Other Operating Expenses EBITDA (Earnings Before Interest, Taxes, Depreciation & Amz) Less: Depreciation & Amortization EBIT (Earnings Before Interest & Taxes) Less: Interest EBT(Earnings Before Taxes, Le Taxable income) Less: Taxes Net Income Less: Common Stock Dividends Addition to Retained Earnings ununu 2018 $ 100 $ (25) $ 75 $ (15) $ 60 $ (15) $ 45 $ (25) 20 (6) $ 14 (5) 9 Assets Current Assets Cash Accounts Receivable Inventory Total Cat-Opia Cat Litter Company Balance Sheet 2018 2017 Liabilities & Equity 2018 2017 $ 35 $ 25 Current Liabilities Accrued Wages & Taxes $ 5 6 S $ 11 $ 10 Accounts Payable 5 $ 2 $ 60 $ 50 Notes Payable 3 $ 5 $ 106 $ 85 Total $ 14 S 12 un $ 90 $ 65 Fixed Assets Plant & Equipment Less: Depreciation Net Total Fixed Assets $ 75 S 45 Long Term Debt $ (35) $ (20) $ 40 S 25 Stockholder's Equity Common Stock Retained Earnings Total Equity $ 146 $ 110 Total Liabilities & Equity uu 12 S 30$ 425 146 $ 12 21 33 110 $ $ Total Assets