Answered step by step

Verified Expert Solution

Question

1 Approved Answer

please answer 1-5. Thanks! please answer asap! To explain this as simply as possible, when you buy a home and get a loan to help

please answer 1-5. Thanks!

please answer 1-5. Thanks!

please answer asap!

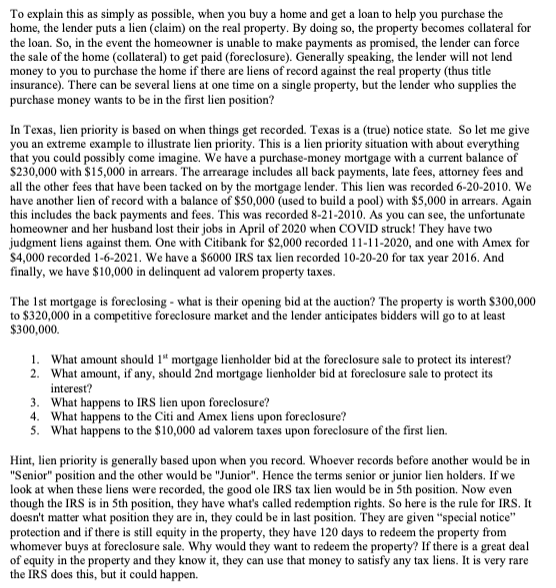

To explain this as simply as possible, when you buy a home and get a loan to help you purchase the home, the lender puts a lien (claim) on the real property. By doing so, the property becomes collateral for the loan. So, in the event the homeowner is unable to make payments as promised, the lender can force the sale of the home (collateral) to get paid (foreclosure). Generally speaking, the lender will not lend money to you to purchase the home if there are liens of record against the real property (thus title insurance). There can be several liens at one time on a single property, but the lender who supplies the purchase money wants to be in the first lien position? In Texas, lien priority is based on when things get recorded. Texas is a (true) notice state. So let me give you an extreme example to illustrate lien priority. This is a lien priority situation with about everything that you could possibly come imagine. We have a purchase-money mortgage with a current balance of $230,000 with $15,000 in arrears. The arrearage includes all back payments, late fees, attorney fees and all the other fees that have been tacked on by the mortgage lender. This lien was recorded 6-20-2010. We have another lien of record with a balance of $50,000 (used to build a pool) with $5,000 in arrears. Again this includes the back payments and fees. This was recorded 8-21-2010. As you can see, the unfortunate homeowner and her husband lost their jobs in April of 2020 when COVID struck! They have two judgment liens against them. One with Citibank for $2,000 recorded 11-11-2020, and one with Amex for $4,000 recorded 1-6-2021. We have a $6000 IRS tax lien recorded 10-20-20 for tax year 2016. And finally, we have $10,000 in delinquent ad valorem property taxes. The 1st mortgage is foreclosing - what is their opening bid at the auction? The property is worth $300,000 to $320,000 in a competitive foreclosure market and the lender anticipates bidders will go to at least $300,000 1. What amount should 1" mortgage lienholder bid at the foreclosure sale to protect its interest? 2. What amount, if any, should 2nd mortgage lienholder bid at foreclosure sale to protect its interest? 3. What happens to IRS lien upon foreclosure? 4. What happens to the Citi and Amex liens upon foreclosure? 5. What happens to the $10,000 ad valorem taxes upon foreclosure of the first lien. Hint, lien priority is generally based upon when you record. Whoever records before another would be in "Senior" position and the other would be "Junior". Hence the terms senior or junior lien holders. If we look at when these liens were recorded, the good ole IRS tax lien would be in 5th position. Now even though the IRS is in 5th position, they have what's called redemption rights. So here is the rule for IRS. It doesn't matter what position they are in, they could be in last position. They are given "special notice" protection and if there is still equity in the property, they have 120 days to redeem the property from whomever buys at foreclosure sale. Why would they want to redeem the property? If there is a great deal of equity in the property and they know it, they can use that money to satisfy any tax liens. It is very rare the IRS does this, but it could happen. To explain this as simply as possible, when you buy a home and get a loan to help you purchase the home, the lender puts a lien (claim) on the real property. By doing so, the property becomes collateral for the loan. So, in the event the homeowner is unable to make payments as promised, the lender can force the sale of the home (collateral) to get paid (foreclosure). Generally speaking, the lender will not lend money to you to purchase the home if there are liens of record against the real property (thus title insurance). There can be several liens at one time on a single property, but the lender who supplies the purchase money wants to be in the first lien position? In Texas, lien priority is based on when things get recorded. Texas is a (true) notice state. So let me give you an extreme example to illustrate lien priority. This is a lien priority situation with about everything that you could possibly come imagine. We have a purchase-money mortgage with a current balance of $230,000 with $15,000 in arrears. The arrearage includes all back payments, late fees, attorney fees and all the other fees that have been tacked on by the mortgage lender. This lien was recorded 6-20-2010. We have another lien of record with a balance of $50,000 (used to build a pool) with $5,000 in arrears. Again this includes the back payments and fees. This was recorded 8-21-2010. As you can see, the unfortunate homeowner and her husband lost their jobs in April of 2020 when COVID struck! They have two judgment liens against them. One with Citibank for $2,000 recorded 11-11-2020, and one with Amex for $4,000 recorded 1-6-2021. We have a $6000 IRS tax lien recorded 10-20-20 for tax year 2016. And finally, we have $10,000 in delinquent ad valorem property taxes. The 1st mortgage is foreclosing - what is their opening bid at the auction? The property is worth $300,000 to $320,000 in a competitive foreclosure market and the lender anticipates bidders will go to at least $300,000 1. What amount should 1" mortgage lienholder bid at the foreclosure sale to protect its interest? 2. What amount, if any, should 2nd mortgage lienholder bid at foreclosure sale to protect its interest? 3. What happens to IRS lien upon foreclosure? 4. What happens to the Citi and Amex liens upon foreclosure? 5. What happens to the $10,000 ad valorem taxes upon foreclosure of the first lien. Hint, lien priority is generally based upon when you record. Whoever records before another would be in "Senior" position and the other would be "Junior". Hence the terms senior or junior lien holders. If we look at when these liens were recorded, the good ole IRS tax lien would be in 5th position. Now even though the IRS is in 5th position, they have what's called redemption rights. So here is the rule for IRS. It doesn't matter what position they are in, they could be in last position. They are given "special notice" protection and if there is still equity in the property, they have 120 days to redeem the property from whomever buys at foreclosure sale. Why would they want to redeem the property? If there is a great deal of equity in the property and they know it, they can use that money to satisfy any tax liens. It is very rare the IRS does this, but it could happen Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started