Please answer 15-29

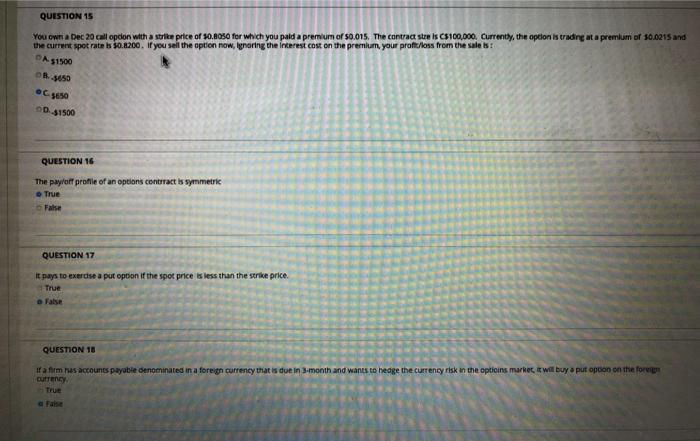

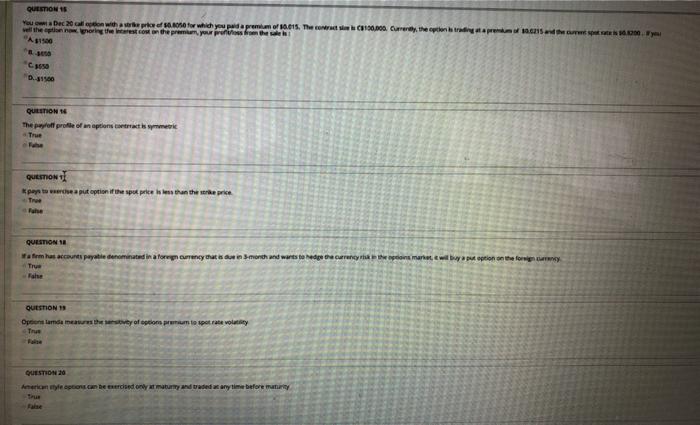

QUESTION 15 You Dec 20 on with a power for which you daremum of 10.015. The 100,000. Currently, the contra noring the best cow on the premium, you prethe A110 Nya *Case QUITION 1 The ploff prole of an options is mere True QUESTION perto deput option if the spot price is less than the pre Tree Fahe QUESTION 1 wa firm has accurate denominated in a forurency that is in 5 month and wants to her career met buy put options for Try he QUESTION Openlamdaman af to put spot rate volte The QUESTION 20 Ameriyle Derecedony matury and traded any time before many QUEEON 15 You won with the pres0.056 for which you premium/10.015. The contract 100,000. Currently, the option optionem the rest on the premier, your profits from the A350 1458 prumum of an und EUR 300 0.31500 QUESTION 16 The payoff profile of an option contract is True QUESTION 17 pays to exercise put option in the spot price is less than the strike price True QUESTION 1 a firm has accounts payable denominated in a foreign currency that is due in 3 month and wants to hedge the curreny risk in the option market will buy a put option on the foreign currency True QUESTION 19 Options and measures the sentity of options premto spot rate volatility QUESTION 15 You Dec 20 on with a power for which you daremum of 10.015. The 100,000. Currently, the contra noring the best cow on the premium, you prethe A110 Nya *Case QUITION 1 The ploff prole of an options is mere True QUESTION perto deput option if the spot price is less than the pre Tree Fahe QUESTION 1 wa firm has accurate denominated in a forurency that is in 5 month and wants to her career met buy put options for Try he QUESTION Openlamdaman af to put spot rate volte The QUESTION 20 Ameriyle Derecedony matury and traded any time before many QUEEON 15 You won with the pres0.056 for which you premium/10.015. The contract 100,000. Currently, the option optionem the rest on the premier, your profits from the A350 1458 prumum of an und EUR 300 0.31500 QUESTION 16 The payoff profile of an option contract is True QUESTION 17 pays to exercise put option in the spot price is less than the strike price True QUESTION 1 a firm has accounts payable denominated in a foreign currency that is due in 3 month and wants to hedge the curreny risk in the option market will buy a put option on the foreign currency True QUESTION 19 Options and measures the sentity of options premto spot rate volatility